Claims paid on Japan Noto Peninsula earthquake near US $415m

Insurance claims paid for the January 1st M7.5 earthquake that hit near the Noto Peninsula in Ishikawa prefecture, Japan, are currently running at almost US $415 million, according to the latest data from the General Insurance Association of Japan.

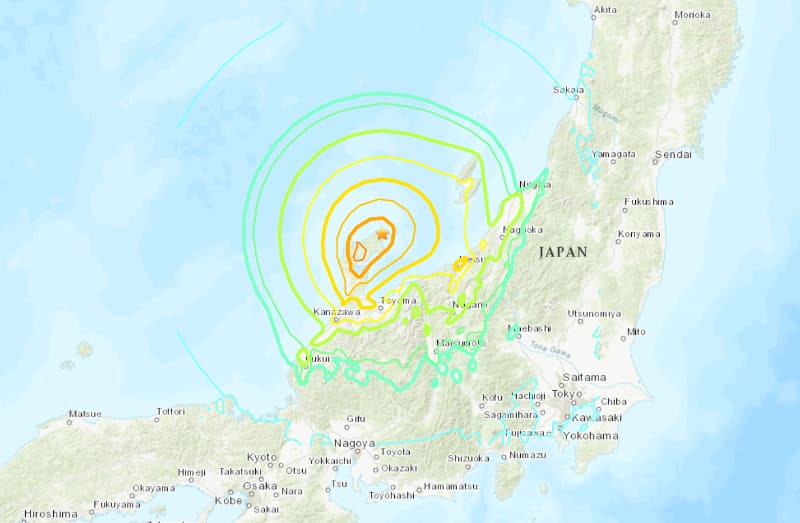

The Peninsula Earthquake on January 1st caused particularly severe impacts to some towns across the four prefectures of Ishikawa, Niigata, Toyama, and Fukui.

Significant property damage was experienced and as the insurance and reinsurance market loss estimates began to come out, it was clear the event was a relatively significant one for the domestic insurance industry, with the potential for some minor global reinsurance effects as well.

Now, we have the first proper view of how the claims payments are flowing, with the General Insurance Association of Japan (GIAJ) explaining that the total has reached over JPY 61 billion as of March 8th 2024.

At that date the figure converted to just under US $415 million, or at today’s date it’s nearer $405 million due to currency fluctuations (note, it would have been over US $430 million at the time the quake occurred).

The GIAJ said that as of March 8th there had been 115,211 accepted insurance claims for damage to houses and household goods, while 95,601 investigations have been made into claims filed so far.

Some 67,413 claims payments have been made, resulting in the more than JPY 61 billion claims payments made to March 8th.

So far, the 2024 Noto Peninsula earthquake loss is the seventh largest insured loss from a Japanese earthquake event so far.

Remember that the figures from the GIAJ are covering member companies of the General Insurance Association of Japan and the Foreign Non-Life Insurance Association of Japan.

As a result, they do not include all losses to global re/insurers operating in Japan, as some may not be members.

Recall that, the first industry loss estimate to be released for this Japanese earthquake was from modelling firm Karen Clark & Company (KCC), which put the insured losses from the quake at an estimated $6.4 billion.

The next to issue an insurance market loss estimate for the Japanese earthquake was CoreLogic, which said it is likely to be below $5 billion.

Then, Verisk’s Extreme Event Solutions business unit put the insurance industry loss at between JPY 260 billion (US $1.8 billion) and JPY 480 billion (US $3.3 billion).

Finally, Moody’s RMS estimated it to be between JPY ¥ 435 Billion to ¥ 870 Billion (US$3 Billion to US$6 Billion).

So, industry loss estimates from the main insurance and reinsurance market risk modelling agencies ranged from as low as US $1.8 billion to as high as US $6 billion and the GIAJ data we now have, after over two months since the earthquake, might suggest the truth is somewhere in the lower-half of that range at least.