Choosing a Business Structure

Congratulations! You have made the decision to start your own business! One of your first decisions is to choose your business structure. The business structure you choose influences everything from day-to-day operations to taxes and how much of your personal assets are at risk. You should choose a business structure that gives you the right balance of legal protections and benefits.

Any time you are making this choice you should work with your trusted lawyers, and accountants to find the right business structure for you.

Why Does Business Structure Matter?

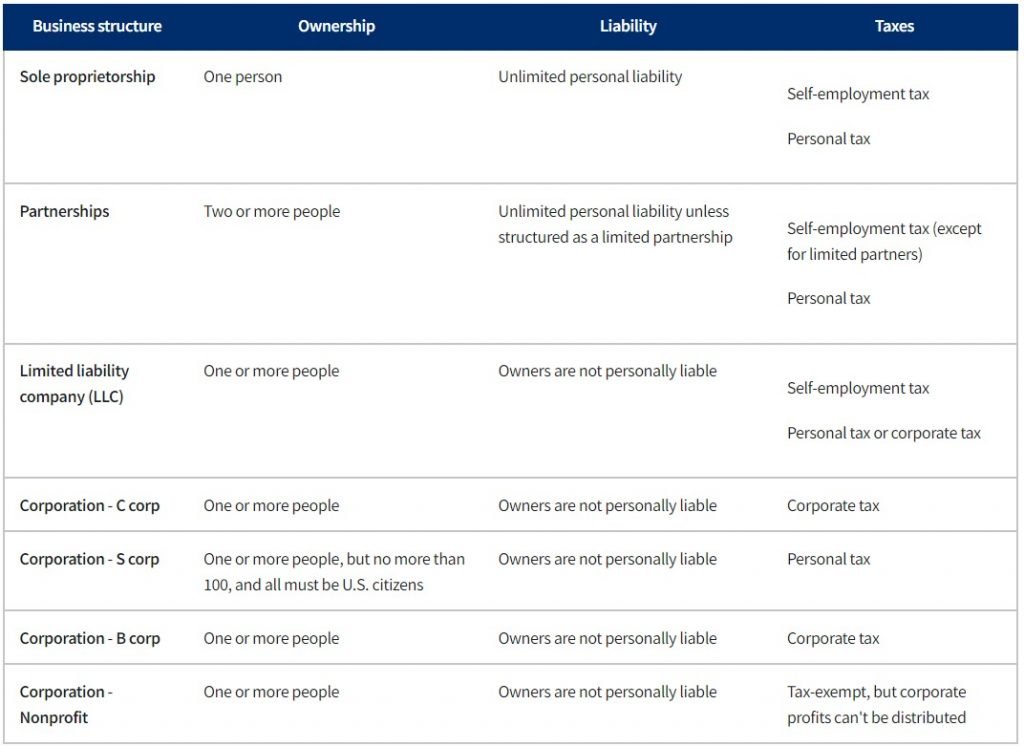

Photo Credit: US Small Business Administration

Sole Proprietorship – Easy to set up, one person in the business, easy taxes, BUT you have unlimited personal liability. Meaning if someone files a lawsuit against your business your personal assets can be used to pay for the damages. Those assets include your business, home, land or savings accounts could be cleaned out. If you are the sole owner operator of your business, you should also think about life insurance. Life insurance can be important to your family to pay off loans, mortgages, or even help fund your kids’ education in the event your income is lost due to an untimely death.

Partnership – Two or more people working together as a team can make the dream work or be a nightmare. Similar to picking a life partner picking a business partner can be just as tricky. Make sure to write your partnership with provisions on what happens in the event the partnership disbands and how the business with be divided or bought out. Depending on how the partnership is written you can be personally liable, meaning your personal assets can be a risk in the event of a lawsuit. Again, you and your partner should also think of life insurance on each other. This will give the surviving partner enough money to buy a deceased partner out of their share of the company allowing the money from the sale to benefit the deceased partners dependents.

Limited Liaility Company, C corp, S corp, B corp, Nonproift – The benefit of these types of company structures from an insurance point of view is when you become an LLC your business becomes a separate legal entity, and an LLC member is normally not personally liable for the LLC’s debts or legal liabilities. As an LLC owner, you are mainly putting your financial contribution to your LLC, not your other personal assets, on the line. The types of business structures above put a wall between your personal assets and the business assets.

Each type of structure above has different pros and con’s check out the chart below for a quick overview.

Photo Credit: US Small Business Administration

Photo Credit: US Small Business Administration

Why does my business structure matter for insurance?

Your insurance policy will give protections and coverages to the Named Insured listed on the insurance policy. So, if you put yourself as the named insured instead of your partnership or LLC you have no coverage for the business you are trying to protect.

WHO IS AN INSURED?

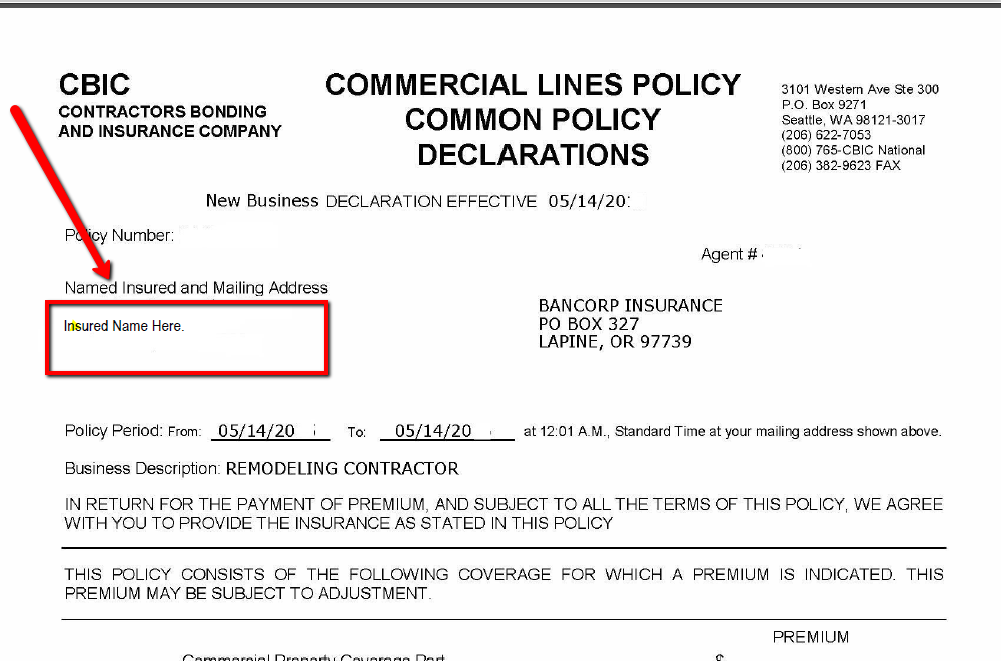

Your General Liability Insurance Policy has a definition of who is insured. The who is covered must be clearly stated on the Declaration Page of your General Liability Policy. Below is an example of a Declaration Page.

Photo Credit: US Small Business Administration

Photo Credit: US Small Business Administration

Do you need business insurance?

Contact Us, We will put together a customized quote to suit your unique needs.

WHAT CHANGES WHEN MOVING MY BUSINESS STRUCTURE FROM A SOLE PROPRIETORSHIP TO AN LLC?

One of the reasons your lawyer or tax accountant told you to become an LLC is it changes your Personal Liability exposure. When you are a sole proprietor, you and your business are viewed as one in the same. Therefore, you have unlimited personal liability for all of the debts and legal liabilities of your sole proprietor business. Your personal assets, such as your home or personal bank account, could be at risk to satisfy unpaid debts, legal judgments, and other legal obligations of your start-up.

When you become an LLC your business becomes a separate legal entity, and an LLC member is normally not personally liable for the LLC’s debts or legal liabilities. As an LLC owner, you are mainly putting your financial contribution to your LLC, not your other personal assets, on the line. However, as an LLC owner, you may still be personally liable for your own conduct or LLC loans in some cases. For example, you may still be responsible if you personally guaranteed repayment of an LLC loan or if your own acts cause harm to a third party or to your LLC.

When you change your business name from John Smith Construction (sole proprietor) to John Smith Construction LLC (corporation) you have changed “Who Is Insured”. The “Who Is Insured” must match your corporate name on all your business insurance policies, the General Liability, Business Auto, Worker Compensation, and your Bond. You do not want a claim denied because the insurance company thought they were insuring you and not your corporation. Call us and we will be happy to make this change for you.

Bancorp’s insurance experts are available to provide you with a free review and consultation. Contact Us – Bancorp Insurance Call 800-452-6826

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our agents.