China's robot makers chase Tesla to deliver humanoid workers

China dominates the market for electric vehicles. Now it’s chasing Tesla in the race to build battery-powered humanoids expected to replace human workers building EVs on assembly lines.

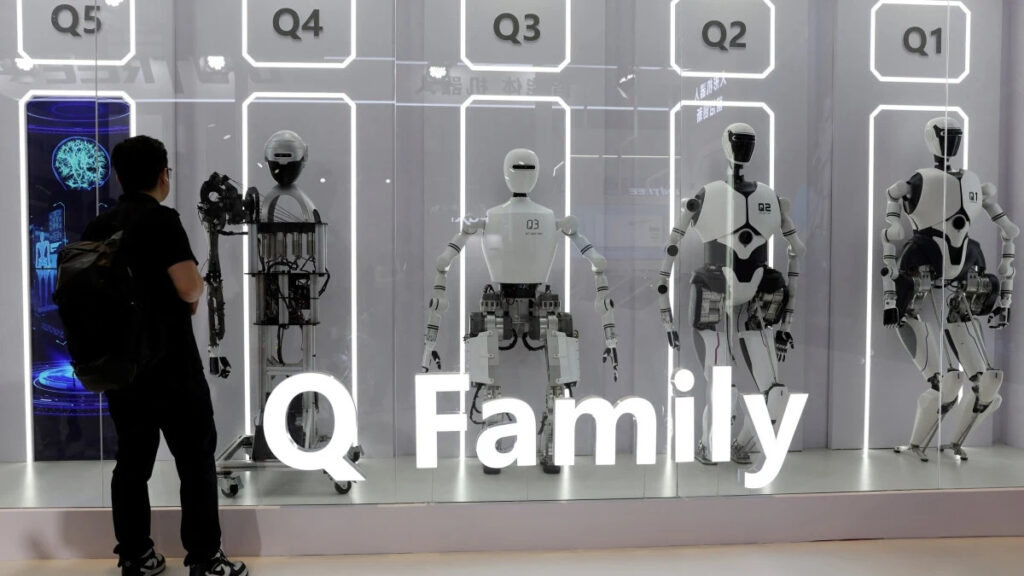

At the World Robot Conference this week in Beijing, over two dozen Chinese companies showed off humanoid robots designed to work in factories and warehouses, with even more displaying the made-in-China precision parts needed to build them.

China’s push into the emerging industry draws from the formula behind its initial EV drive more than a decade ago: government support, ruthless price competition from a wide field of new entrants and a deep supply chain.

“China’s humanoid robot industry demonstrates clear advantages in supply-chain integration (and) mass production capabilities,” said Arjen Rao, analyst at China-based LeadLeo Research Institute.

The robotics effort is backed by President Xi Jinping’s policy of developing “new productive forces” in technology — a point made in brochures for this week’s event.

The city of Beijing launched a $1.4 billion state-backed fund for robotics in January, while Shanghai announced in July plans to set up a $1.4 billion humanoid industry fund.

The robots on display this week draw from some of the same domestic suppliers that rode the EV wave, including battery and sensor manufacturers.

Goldman Sachs forecast in January the annual global market for humanoid robots would reach $38 billion by 2035, with nearly 1.4 million shipments for consumer and industrial applications. It estimated the cost of materials to build them had fallen to about $150,000 each in 2023, excluding research and development costs.

“There is big room to squeeze the cost down,” said Hu Debo, CEO of Shanghai Kepler Exploration Robotics, a company he co-founded last year inspired by Tesla’s humanoid robot Optimus. “China specialises in fast iteration and production.”

Hu’s company is working on its fifth version of a worker robot to trial in factories. He expects the sales price to be less than $30,000.

‘Catfish effect’

When Tesla opened its Shanghai factory in 2019, Chinese officials said they expected the EV pioneer would have a “catfish effect” on China’s industry: introducing a large competitor that would make Chinese rivals swim faster.

Tesla’s Optimus robot has had a similar effect, Hu said.

The US automaker first introduced Optimus in 2021, which CEO Elon Musk then touted as potentially “more significant than the vehicle business over time”.

A child looks up a humanoid robot from Tesla at the World Robot Conference held in Beijing, Wednesday, Aug. 21, 2024. (AP Photo/Ng Han Guan)

Musk’s company is using an artificial intelligence approach for Optimus modelled on its “Full Self-Driving” software for EVs. Chinese rivals and analysts say Tesla has an early lead in AI, but China has the ability to drive down the price of production.

Tesla showed off Optimus, mannequin-like, standing in a plexiglass box next to a Cybertruck at an exhibition alongside the conference in Beijing this week.

Optimus was outdone by many Chinese humanoids that were waving, walking or even shrugging, but it was still one of the most popular exhibits and thronged with people taking photos.

“Next year there will be more than 1,000 of my compatriots in the factory,” a sign next to Optimus said.

Tesla, in a statement, reiterated it expected to move beyond prototypes to start producing Optimus in small volumes next year.

Robots on the assembly line

Hong Kong-listed UBTECH Robotics has also been testing its robots in car factories. It started with Geely and announced a deal on Thursday to test them at an Audi plant in China.

“By next year our goal is going to mass manufacturing,” said Sotirios Stasinopoulos, UBTECH’s project manager.

That would mean up to 1,000 robots working in factories, he said. “It is the first milestone towards a large-scale deployment.”

UBTECH uses Nvidia chips in its robots, but more than 90% of components are from China.

The current generation of production robots — massive arms capable of welding and other tasks – has been led mostly by companies outside China, including Japan’s Fanuc, Swiss engineering group ABB and Germany’s Kuka, owned by Chinese home appliance manufacturer Midea.

China leads the world with factory-installed production robots, more than triple the number in North America, according to the International Federation of Robotics.

Xin Guobin, China’s vice-minister for industry and information technology, said at the opening of the Beijing event that his ministry had been implementing Xi’s guidance and had made China “an important force in the global robot industry.”

The country last November called for mass production of humanoid robots by 2025, but that will start on a much smaller scale than is needed to transform EV production.

“I believe that it is likely to be at least 20 to 30 years before humanoid robots can achieve large-scale commercial application,” said LeadLeo Research Institute’s Rao.