‘Chilling effect’ – How did carrier pullouts affect auto and home insurance shopping behavior?

‘Chilling effect’ – How did carrier pullouts affect auto and home insurance shopping behavior? | Insurance Business America

Insurance News

‘Chilling effect’ – How did carrier pullouts affect auto and home insurance shopping behavior?

Consumer habits changed amid rate increases, new data shows

Insurance News

By

Gia Snape

New data has revealed how capacity constraints, made worse by carrier pullouts in auto and home insurance markets in several states, impacted consumer shopping trends last year.

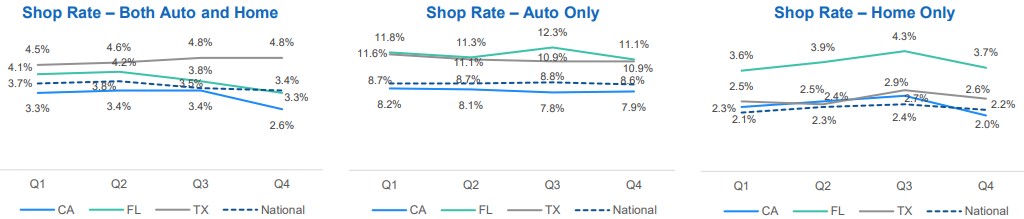

JD Power’s quarterly shopping list report for US property and casualty (P&C) insurance showed that the shopping rate for consumers in Texas, Florida and California dropped in Q4 2023. These states experienced significant rate increases in auto and home insurance over the past year.

The trend likely indicates that shoppers in those markets likely found it too difficult or risky to switch auto and/or home insurance providers.

Stephen Crewdson (pictured), senior director in the global insurance intelligence group at JD Power, detailed the “chilling effect” that shrinking capacity and increasing rates had on insurance shopping behavior.

“In California and Florida, the shop rate for both bundled auto and home insurance came down a fairly significant amount,” said Crewdson.

“The shop rate of people shopping for both auto and home California was flat throughout the year, and in Q4, it tumbled, and we think it’s because home insurers were pulling out of the market.

“So, consumers were hearing from friends and family that it’s hard to find homeowners’ insurance right now, and they may say, ‘I’m going to stick with the insurer I have right now because I’m afraid if I go out there and try to switch, I can’t switch anyway.’”

“Chilling effect” on auto and home insurance shopping

JD Power’s Q4 2023 report showed that the quarterly shopping rate nationwide dropped from 12.3% to 12.0%, with shopping rates falling each month. The rate of auto insurer switching has also slipped despite rate increases accelerating through Q4.

The report also noted the impact of GEICO’s pullback from the market.

“After being the leading destination for at least one insurer’s defectors each quarter of 2021 and 2022, they achieved this in only one quarter in 2023 (Q3, by being the leading destination for USAA defectors),” the JD Power report continued.

“When we look at geographical trends, we see consumers in different states wrestling with state-specific issues aside from the rate-taking that has blanketed the nation.”

When it comes to bundled shoppers (i.e. consumers who shopped for both auto and homeowners policies simultaneously), those in Texas, California and Florida ramped up shopping throughout 2023, according to JD Power’s data.

But as major carriers announced they were pulling back from the California and Florida homeowners markets, shopping among consumers looking for both auto and home insurance fell in these states. Shopping in the same category remained mostly flat in Texas, where capacity was not pressured.

Shopping for monoline auto was higher in Florida and Texas than in California (where auto premium increases are just beginning to approach recent increases in other states). These trends throughout 2023 are mostly flat.

But JD Power suggests non-renewals and media attention on carrier withdrawals in California and Florida also impacted monoline homeowners insurance shoppers, as it has with bundlers, in those markets.

“Because insurers are pulling out in the home side, consumers are thinking, I’m not even going shop home, and I’m certainly not going stop auto and home together because I’m afraid I can’t switch these,” said Crewdson.

What’s the impact on the insurance market?

How do the recent shopping trends impact insurers? According to Crewdson, consumers’ reluctance to shop around might help remaining carriers increase their retention.

“The insurers that are staying in those markets might see elevated retention in 2024 because, at the end of 2023, consumers were backing off from shopping because of the fear of what’s happening in the home market,” Crewdson told Insurance Business.

For new entrants looking to increase their market share, however, it might be a different story.

“It might be a difficult market for a while because consumers are not thinking specifically about new entrants when they shop,” said Crewdson.

“They’re thinking, ‘I need to lower my premium, or I need better coverage, or I just had a bad claim with this carrier, and I want to find a new one.’ [Consumers] may already be turned off from the idea of shopping because of what’s happening in the larger dynamics.”

“If capacity issues are being addressed in those states, then that tide can turn,” he said.

What are your thoughts on JD Power’s new data on auto and home insurance shopping trends? Please share them below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!