Catastrophe bonds increase in importance again: Fitch

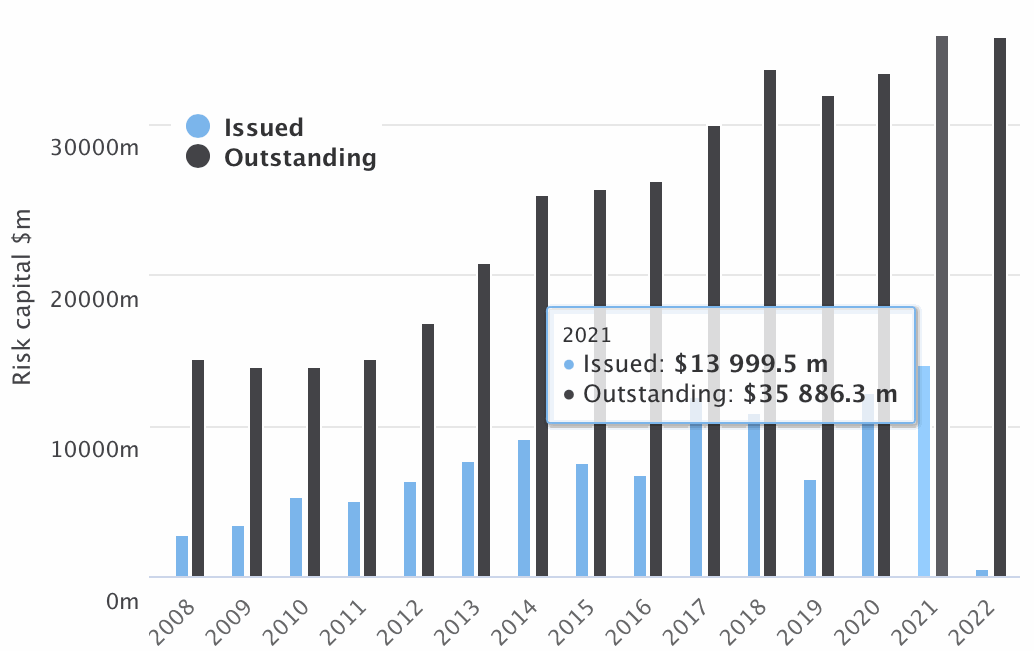

Catastrophe bonds increased in importance for the global reinsurance industry again in 2021, Fitch Ratings has said, as the record levels of issuance seen helped to make cat bonds an even larger pool of risk capital supporting reinsurer businesses.

Momentum in the catastrophe bond market continues to increase, Fitch said in a recent report, highlighting both the record level of issuance seen in 2021, as we detailed in our latest report, but also the fact that the cat bond market keeps growing, so taking an increasing share of global reinsurance program capital.

By our numbers, on the outstanding catastrophe bond market, growth of 4.3% was seen through 2020, but then more than 7.6% in market growth was seen in 2021, expanding the importance of cat bonds within reinsurance programs.

Overall reinsurance capital only grew 2.9% in 2021, according to figures from broker Guy Carpenter and rating agency AM Best.

Overall alternative reinsurance, or insurance-linked securities (ILS), capital only grew by 3.7% over the course of last year.

Meaning that catastrophe bond risk capital grew at twice the pace of overall ILS, so far outpaced private ILS and collateralised reinsurance and grew much faster than traditional reinsurance capital, which only grew at 2.8%, during the last year.

Fitch highlights the continued inflows into catastrophe bonds seen in 2021. We documented that in our chart on UCITS cat bond fund flows here.

In 2021, “Catastrophe bonds gained in importance at the expense of collateralised reinsurance programmes and sidecars, continuing a trend that started in 2019,” Fitch Ratings explained.

Adding that, “Investors stuck to their preferences as catastrophe bonds offered higher liquidity and a more clear-cut definition of what perils are covered.”

Looking ahead, the rating agency forecasts that, “Fitch expects that alternative capital in general – and catastrophe bonds in particular – will maintain their role for the reinsurance market in 2022.”

It’s expected that catastrophe bonds will eat more into the domain of traditional reinsurance and retrocessional capital in time, as increasing numbers of new sponsors come to market and as the product itself evolves to provide new layers and kinds of coverage.

If issuance can be streamlined, made more efficient and with costs reduced, the cat bond market could witness a significant expansion. As cost and effort for new sponsors accessing cat bond market remains significant, which can present a blocker for getting new issuers into the marketplace.