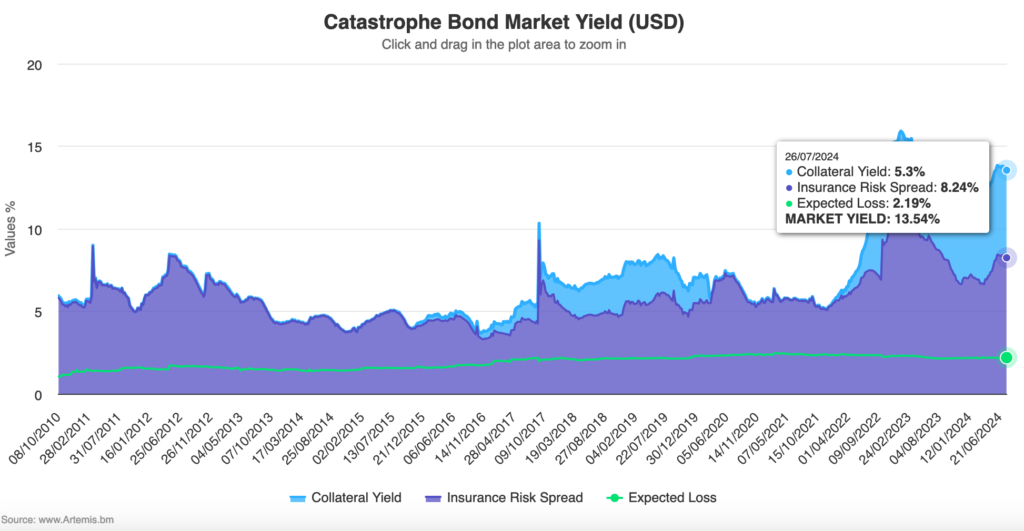

Catastrophe bond market yield shows seasonality, ends July 2024 at 13.54%

Seasonality has started to become visible in the overall yield of the catastrophe bond market, with the figure sliding slightly in the month of July 2024 to end the period at a still historically very high 13.54%.

2024 has seen the catastrophe bond market yield on more of a roller coaster than normal, with spread tightening to begin the year, which drove cat bond spreads and yields down, which was followed by a period of relatively significant spread widening that drove the market yield back up again.

Having reached an all-time high of around 15.91% in early 2023, the cat bond market experienced a spread tightening trend that saw the cat bond market yield bottoming out at just below 12% by the end of March 2024.

A rising contribution from insurance risk spreads then drove the cat bond market yield back up to as high as 13.83% in early June, since when it has slowly tapered off to 13.69% by the end of June and continuing down to 13.54% by the end of July 2024.

The most recent decline is seen as largely due to seasonal effects that are typical with catastrophe bonds as the Atlantic hurricane season ramps up towards its typical peak.

You can analyse these market yield developments in our chart that displays the yield of the catastrophe bond market over time.

As expected, it is the insurance risk spread component that has declined in July, falling from 8.41% at the beginning of the month to end it at 8.24%.

The floating-rate appeal of catastrophe bond investments remains strong, with the average collateral yield slightly down at 5.3%, combining to give the overall cat bond market yield of 13.54% at the end of July.

As we reported yesterday, the rolling twelve-month performance of UCITS catastrophe bond funds as measured by Plenum’s Index, to August 2nd, was 11.74%.

Showing that cat bond funds, on average, are tracking the total market yield potential relatively closely, delivering the elevated returns possible from cat bonds back to their investors.

Specialist catastrophe bond investment fund manager Plenum Investments said that the yield of the catastrophe bond market remains very attractive, even including hedging costs.

The overall yield of the cat bond market sat at 11.90% in Euros and 9.33% in Swiss Francs at the end of July 2024.

Looking back over history, the cat bond market yield remains high, comparatively, which should continue to attract investors through the rest of this year and beyond.

Plenum Investments also noted that, “We expect CAT bond yields to continue to decline as the US hurricane season progresses,” which is their typical seasonal behaviour.

Analyse catastrophe bond market yields over time using this chart.