Catastrophe bond market yield rose in June, ends month at 13.7%

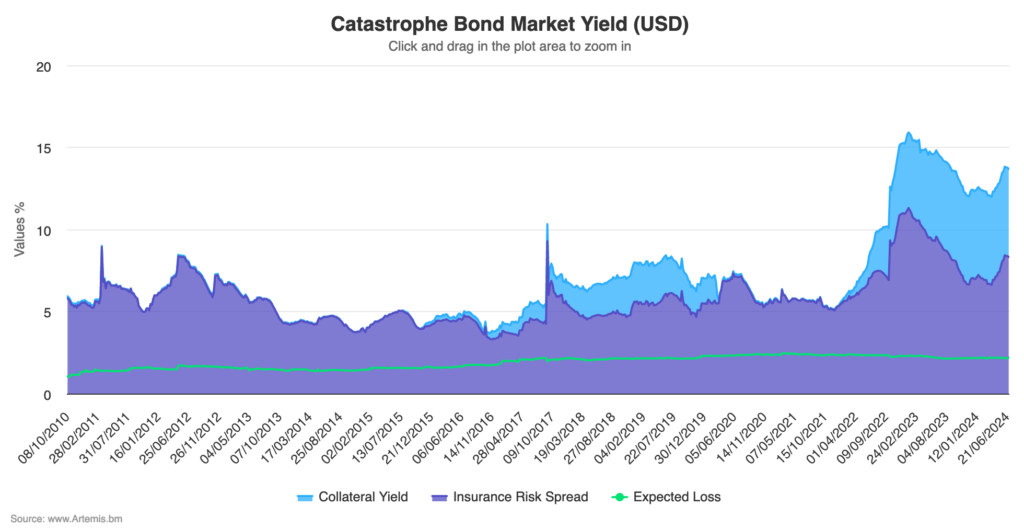

The overall yield of the catastrophe bond market in US dollars rose slightly through June and ended the month at just under 13.7%, reaching levels last seen in August 2023.

A consistent trend of spread tightening in the catastrophe bond market had driven yields down into and through the first-quarter of this year.

That led to the cat bond market yield bottoming out at the end of March 2024 at just under 12%, since when the rising insurance risk spread contribution has been driving the market yield back up.

When we last reported, the recent spread widening seen in the catastrophe bond market had driven the overall market yield in US dollars back up to almost 13.5% again, which was the highest level the return potential of the cat bond market has been at since September 2023.

Now, one month later, a further increase in insurance risk spreads has driven the cat bond market yield higher still, reaching 13.83% in early June, but the dropping slightly to 13.69% at the end of the month.

You can analyse this in our chart that displays the yield of the catastrophe bond market over time.

The insurance risk spread component of the cat bond market yield now stands at 8.33%, up from the 8.13% at the end of May.

But, during June, the risk spread of the cat bond market had peaked at 8.43%, the level it was at last August, since when it has slipped slightly, perhaps as some seasonal effects became evident in June.

The USD money market rate, so return on cat bond collateral, slipped slightly during the month, from 5.41% at the end of May, to 5.36% at the end of June.

It’s important to also consider how the market yield risk-adjusts, as the weekly average expected loss of the cat bond market remained relatively static, moving from 2.18% at the end of May, to 2.19% at the end of June.

Specialist catastrophe bond asset manager Plenum Investments highlighted that the overall yield of the cat bond market sat at 12.50% in Euros and 9.56% in Swiss Francs at the end of June 2024, after hedging costs.

These are also very attractive yield levels, historically speaking and should serve to keep cat bonds attractive to investors over the rest of this year.

Plenum Investments also noted that, “We expect CAT bond prices to bottom beginning of July due to their sea- sonal behavior, only to rise again as the US hurricane season progresses.”

Analyse catastrophe bond market yields over time using this chart.