Catastrophe bond market yield rises to highest level since September 2023

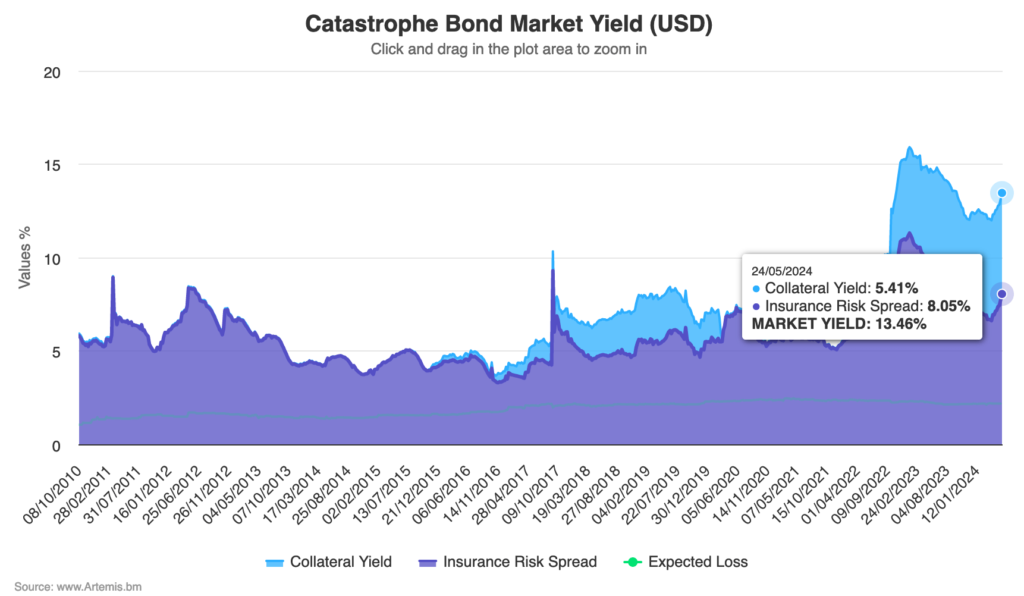

Helped by the recent spread widening seen in the catastrophe bond market, the overall market yield in US dollars has reached almost 13.5% again, which is the highest level the return potential of the cat bond market has been at in over eight months.

Last September 2023, the overall yield of the catastrophe bond market was sitting at just over 13.50%, with insurance risk spreads the main driver.

Then, a consistent trend of spread tightening drove yields down into and through the first-quarter of this year.

Since the cat bond market yield bottomed out at the end of March 2024 at just under 12%, the rising insurance risk spread contribution has helped to drive the overall yield back up by 1.5 percentage points in US dollar terms.

You can analyse this in our chart that displays the yield of the catastrophe bond market over time.

The insurance risk spread had fallen to just 6.62% in March thanks to the inexorable tightening seen into and through the start of this year.

The insurance risk spread component of catastrophe bond market yield is now almost 22% higher, at 8.05%, thanks to the spread widening that has occurred through much of April and into May.

Analyse the yield of the catastrophe bond market and its constituent parts in Artemis’ chart (click the image below to access an interactive version):

The widening of insurance risk spreads and increase to the yield contribution from them is just as dramatic looking in the chart as the tightening was that came before it.

Meanwhile, the collateral yield component is slightly higher at 5.41%, so the overall cat bond market yield has risen from 11.99% at the end of March, to reach 13.46% as of May 24th, an increase of 12.3% in just under two months.

It means that catastrophe bond market yields remain at historically elevated levels, demonstrating how attractive investments into cat bonds remain at this time.

Our chart showing cat bond market yields clearly shows that even based on insurance risk spreads alone, cat bonds are currently very attractive, compared to the market’s history.

As the expected loss of the cat bond market has not changed in the last couple of months, it means the market’s yield above expected loss is also at historically attractive levels at this time.

Then, add in the still high return on collateral and cat bonds remain among the most attractive diversifying investment opportunities available today.

The movement in cat bond market yields is clearly influenced by the factors that have driven the spread widening of recent weeks, so a more balanced supply and demand in the market, as well as the effects that a recent hurricane risk model update has had on investor and manager perception of risk, with a commensurate adjustment to their demand for returns.

Analyse catastrophe bond market yields over time using this chart.