Catastrophe bond market yield dips to 12% on insurance risk spread squeeze

The total yield of the catastrophe bond market in US dollars had declined to 12% by the end of March, down from a high of close to 16% in early January. But the signs are that the cat bond market yield may be stabilising, as demand and supply become more balanced, Plenum Investments believes.

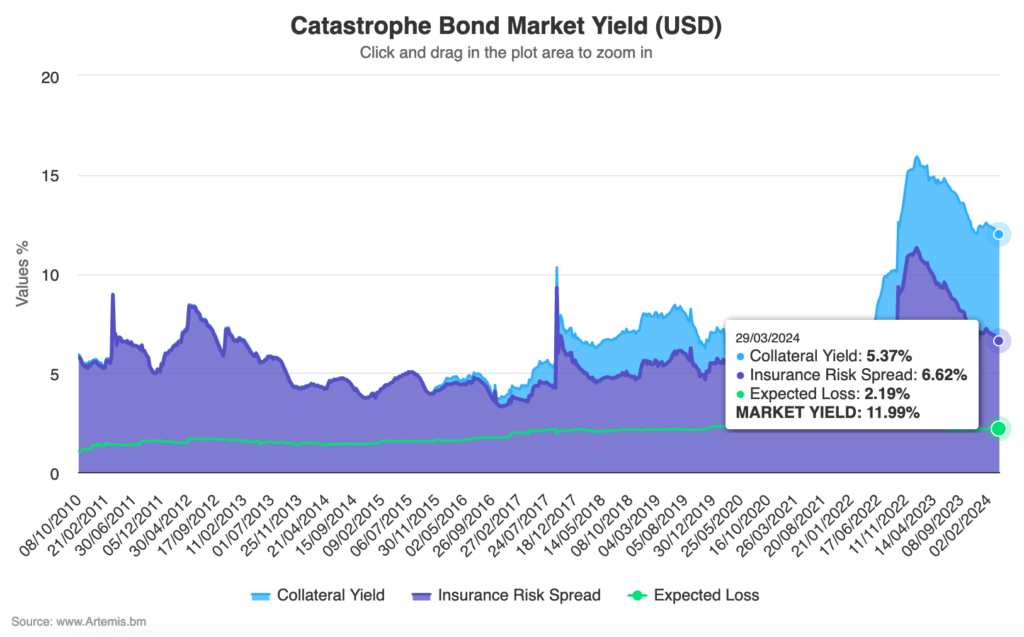

We have launched a new chart that displays the yield of the catastrophe bond market over time, with the help of partner Plenum Investments AG, a specialist insurance-linked securities (ILS) and cat bond investment manager.

The chart also breaks out the total yield of the cat bond market into its constituent parts, of the insurance risk spread and collateral return.

In addition, our new chart of cat bond market yields also displays the expected loss of the market, so the level of risk driving cat bond returns can be analysed over time alongside the two drivers of the cat bond market’s yield.

Analyse the yield of the catastrophe bond market and its constituent parts in Artemis’ new chart (click the image below to access an interactive version):

With our new chart you can click and drag directly on it to zoom in and analyse the yield of the catastrophe bond market over specific time periods.

Cat bond market yields peaked in early January when there was a total yield of 15.91%, driven largely by the very high insurance risk spread of 11.31%.

Now, the total yield of the cat bond market has dipped to 11.99%, but while the return on collateral has risen it is the insurance risk spreads that have plummeted in recent weeks.

The insurance risk spread of the cat bond market at March 29th was down at 6.62%, which is now down 41% from its high.

Falling prices in the catastrophe bond market have been a key driver, as spreads tightened up considerably on the back of higher demand from investors and excess cash in the marketplace.

Plenum Investments notes that, “The total yield in the CAT bond market is still at a very attractive level.”

Noting that, “The USD-yield of the CAT Bond market appears to be stabilizing at around 12%.”

It should be noted that hedging costs reduce the yield for investors in other currencies, such as Euros and Swiss Francs, dropping to as low as 8.2% in CHF at the end of March.

With more of a supply and demand balance having emerged in recent weeks, thanks to the very busy pipeline of new catastrophe bond issuances, Plenum Investments believes this stabilisation can hold.

“Due to the substantial amount of new transactions coming to the primary market in April, we expect a reduction of the excess demand for bonds, which in turn reduces pressure for price increases on outstanding CAT bonds,” the investment manager explained.

What’s important to note is that insurance risk spreads are still 30% to 50% higher than they had fallen to back in the soft market around 2016. In fact, today’s pressured risk spread for the cat bond market, which should bounce back some as prices normalise, is still almost 15% to 20% up on the average seen back in 2021.

It will be interesting to watch how this new catastrophe bond market yields chart develops over the coming months and whether we see evidence on the pressure on spreads releasing somewhat as issuance starts to soak up capital, or whether this new level of overall market yields of around 12% are a level being set for the future.

Remember though, if the collateral yields were to decline to a relatively significant degree, then the compensation on the insurance risk spread side may start to seem too low for some investors in the space. It’s going to be interesting to see how some of the more speculative capital that entered the space over the last year reacts, should that occur.

While record high yields are a thing of the past for the catastrophe bond market, the risk spread of new issuance remains higher than historical deals, which should keep the market yields elevated, compared to the softest periods the market has been through.

Analyse catastrophe bond market yields over time using our new chart.