Catastrophe bond market yield declines on peak hurricane seasonality

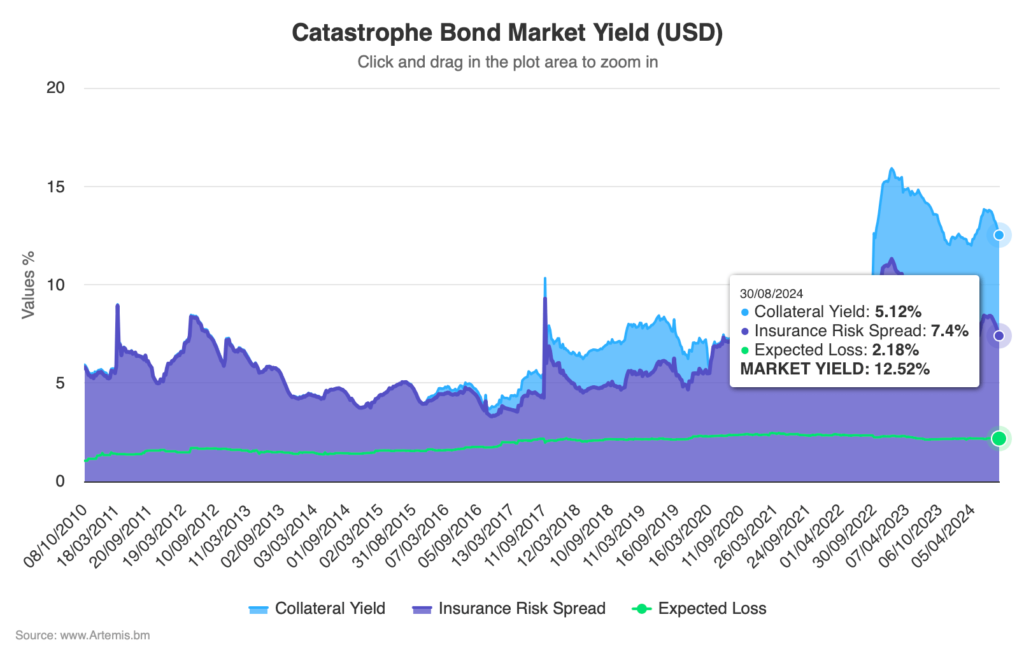

The seasonality effects of the peak of the US hurricane season approaching accelerated a decline in the overall yield of the catastrophe bond market in August, although it still ended the month at a very favourable 12.52%.

US hurricane risk seasonality is a key driver of yield spreads in catastrophe bonds, with the market typically seen to experience spread compression as the peak of the hurricane season approaches, then recover some ground as the season winds down.

When we last reported on the catastrophe bond market yield, we said that seasonality had begun to show itself in July.

The cat bond market yield slid slightly in the month, but still ended July at a still historically very high 13.54%.

One month later and the overall yield of the cat bond market has declined by 7.5%, dropping to 12.52%.

A year ago, the overall yield of the catastrophe bond market at the end of August 2023 sat at 13.56%. But at the same point in 2022 it was just over 10.1%, while in 2021 cat bond market yields sat at just 5.51%.

Which drives home the improved opportunity to invest in catastrophe bonds and as the recent decline is largely seasonal spread movements, at least some of this will be recovered as the peak of hurricane season passes and risk is viewed to be reducing as we move towards the end of the season.

Insurance risk spreads have declined from 8.24% at the end of July to now 7.4%, which is the only component of cat bond market yields that is affected by risk seasonality.

One other notable point is a slight decline seen in the risk-free rate, so the collateral yield.

The collateral yield of the cat bond market sat at 5.3% at the end of July, but has now declined to 5.12%. With a rate tightening cycle anticipated for the United States Treasury, it will be interesting to watch how the contribution comes down over time.

It’s worth noting though that the way interest rate tightening affects collateral yields is typically not even and there can be a lag as well, which can make catastrophe bonds a helpful asset class where higher risk-free rates can be experienced for longer.

As we reported last week, catastrophe bonds funds had a very good August with 2% plus monthly returns in a number of cases.

Over the trailing 12-months, to August 30th 2024, the average return of cat bond funds in the UCITS structure was 12.40%, so still very comparable with market yields.

Strong returns are expected to continue through September, with another 2%+ month again possible for some cat bond funds, helped by the seasonal movements.

Seasonality effects will continue, with the market yield likely to decline further over the rest of peak US hurricane season.

Analyse catastrophe bond market yields over time using this chart.