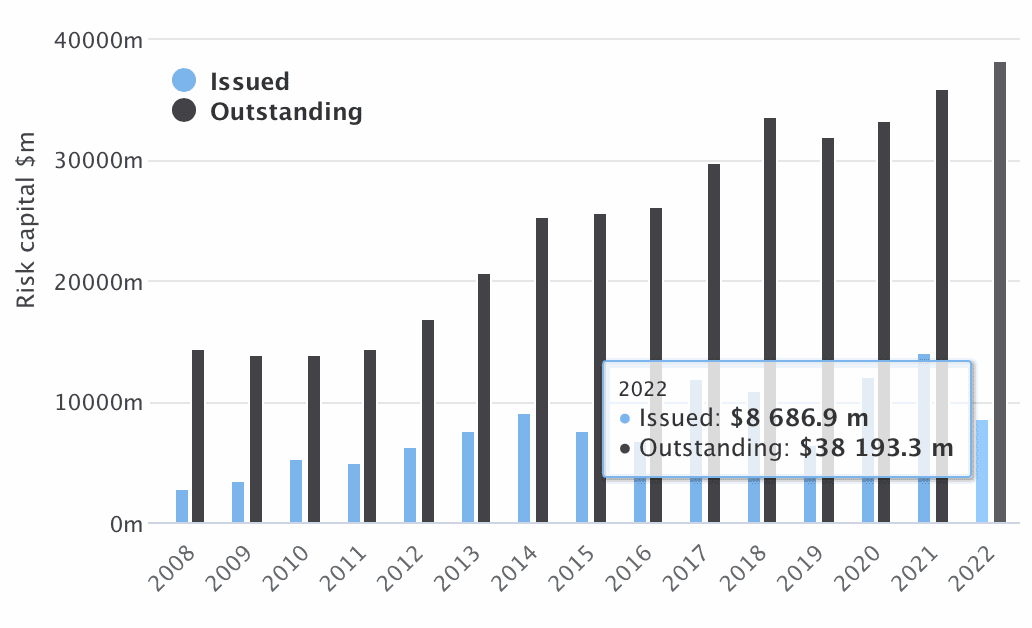

Catastrophe bond market hits new record size of $38.2bn

The global market for catastrophe bonds expanded by almost 2% during the second-quarter of 2022, as demand from sponsors drove strong issuance and helped to grow the outstanding cat bond market to $38.2 billion at June 30th 2022.

Issuance of new catastrophe bonds reached $5.2 billion in the second-quarter of the year. You can download our brand new cat bond market report here, which details issuance trends and breaks down the market activity.

For the third time in the past decade, second-quarter catastrophe bond and ILS issuance surpassed the $5 billion mark, reaching almost $5.2 billion from 27 transactions.

Year-on-year, Q2 issuance did fall by more than $1.2 billion, but was still above the 10-year average for the quarter by around $1.1 billion, according to Artemis data and as detailed in the new report.

A strong Q2 on the back of an above-average start to the year, helped issuance at the half-year stage hit $8.7 billion.

Of this, the large majority, or 92% came from 144A property cat bond deals.

Artemis’ new report reveals that this is one of the strongest H1 periods on record, both for overall issuance and property cat bond issuance.

At the end of Q1 2022, the outstanding market had reached a new high of $37.5 billion, and we said at the time that it would take an above-average Q2 to sustain outright market growth, given the roughly $4 billion of maturities scheduled.

But, issuance of catastrophe bonds in the second-quarter of 2022 exceeded this, taking the outstanding market to a new record high of $38.2 billion, as of the end of June.

Analyse cat bond risk capital issued and outstanding by year in this chart.

This is a strong result for a market that has been dealing with pressures from the macro-environment and its effects on broader capital markets and investor appetite.

Despite wider spreads and effectively much higher rates-on-line for cat bond backed reinsurance and retrocession, the market saw strong demand from existing and new sponsors in the second-quarter.

Over the first-half of 2022, in terms of the number of new cat bond transactions, the 52 issued was up slightly on last year.

But while the number of deals had risen, in terms of risk capital, issuance overall was down, year-on-year, by around $781 million.

This is a reflection of the smaller deals issued this year, when compared with the prior, as the constrained amount of capital available for new cat bonds and the more demanding investor-base meant that some deals were smaller, or could not get completed.

In terms of the dollar-value of catastrophe bonds issued, May was the most active month of 2022 so far, at almost $2.7 billion. This was followed by the $2.2 billion of issuance in March, and almost $2 billion of issuance in June.

All of our catastrophe bond market charts and visualisations are up-to-date, so include this latest quarter of issuance data.

We’ll keep you updated on all catastrophe bond and related ILS transaction issuance as 2022 progresses, as well as evolving trends in the cat bond, insurance-linked securities (ILS) and collateralised reinsurance market.

For full details of first-quarter 2022 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.

For full details of first-quarter 2022 cat bond and related ILS issuance, including a breakdown of deal flow by factors such as perils, triggers, expected loss, and pricing, as well as analysis of the issuance trends seen by month and year.

Download your free copy of Artemis’ Q1 2022 Cat Bond & ILS Market Report here.

For copies of all our catastrophe bond market reports, visit our archive page and download them all.