Catastrophe bond market exposure to aggregate covers shrinking fast

Over the second-half of 2023, the catastrophe bond market has continued in its shift away from providing aggregate cat bond coverage, with the percentage of the outstanding cat bond market that aggregate deals contribute falling below 42% for the first time in years.

Using Artemis’ extensive catastrophe bond database, we can visualise this shift away from aggregate reinsurance and retrocessional risks in cat bond form.

As recently as the mid-point of 2021, aggregate deals made up the largest share of the outstanding catastrophe bond market. Since when aggregate deals as a percentage of risk capital outstanding has been falling steadily.

Using Artemis’ range of catastrophe bond and insurance-linked securities (ILS) charts and visualisations, we can clearly watch this trend developing.

Back in June this year, we analysed these trends, finding that as recently as March 2019, the outstanding cat bond market was more than 58% comprised of cat bonds covering reinsurance and retrocessional exposures on an aggregate basis.

Over the next two years, the percentage of the market made up by aggregate cat bond notes had slipped to 51%, as of June 2021, then it fell below 50% for the first time by November of that year.

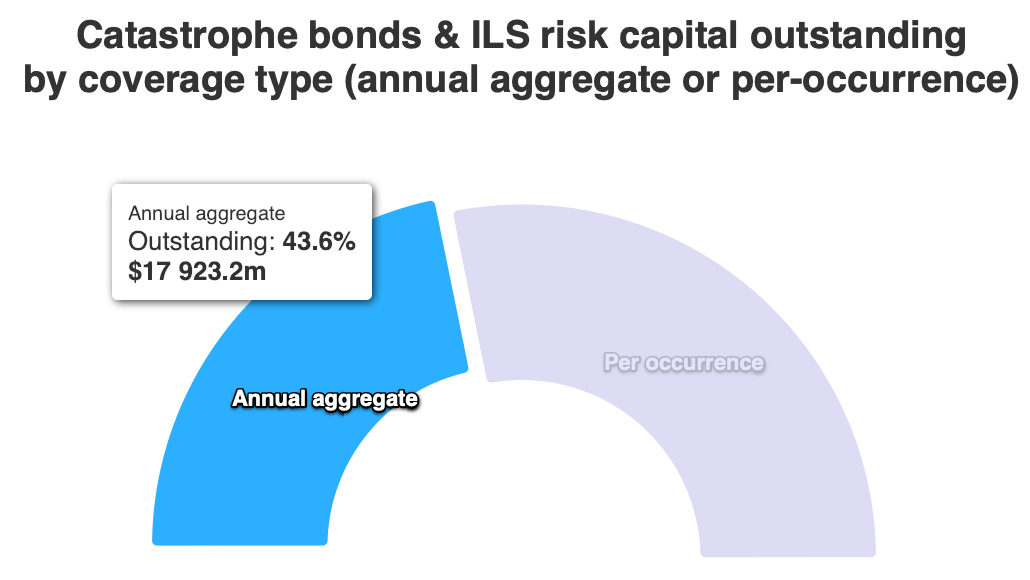

The shift continued and, as of June 2023 when we last analysed our data on this, aggregate cat bonds made up only 47.4% of total risk capital outstanding.

Artemis’ data shows that this shift, from aggregate to occurrence exposure, has accelerated in the second-half of 2023.

In fact, the vast majority of new catastrophe bond limit issued through the recent very busy period has been structured to provide per-occurrence reinsurance or retrocession and it’s clear that far fewer new cat bonds feature aggregate reinsurance or retrocessional cover these days .

At the same time, older aggregate deals have been maturing and moving off-risk, as a result of which the percentage share of the outstanding cat bond market these aggregate structures contributed has now fallen even further.

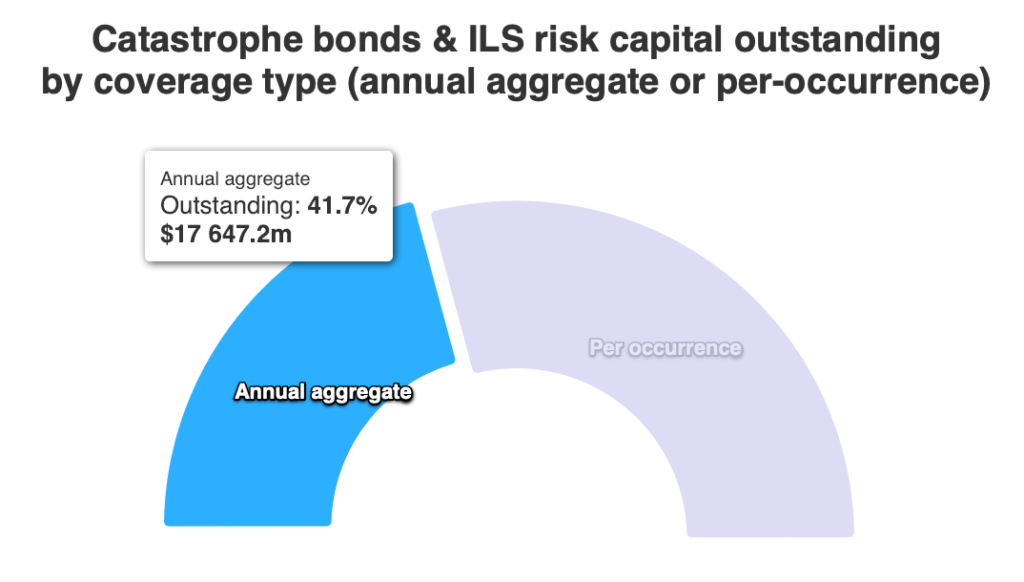

In fact, as of and including all cat bonds that have settled by December 22nd 2023, Artemis’ data on the aggregate and occurrence split of the cat bond market, shows that aggregate deals make up only 41.7% of the market’s risk capital outstanding.

Aggregate limit on-risk in the 144A catastrophe bond market has now shrunk, despite the cat bond market’s outright trajectory of rapid growth this year, with just under $17.65 billion of risk capital now outstanding that is structured to provide aggregate protection.

Based on the deal pipeline, recent cat bond issuance trends and cat bond investor preferences at this time, it seems likely the shrinking of the aggregate part of the market will continue as we move into 2024.

The flip-side to this, as it might be seen as a positive development in some circles, is that this provides another data point showing how cedents are now often lacking access to frequency reinsurance and retrocession covers, especially as many traditional reinsurers have followed a similar retrenchment away from aggregate or frequency protection over the last year.

We’ve discussed the evident protection gaps in reinsurance and retro, in relation to frequency covers and lower-layers, and this shift in the cat bond market pushes more onus on traditional and collateralized providers to satisfy cedent needs.

The shift, from aggregate towards occurrence coverage in the cat bond market, has reached over 18% since late 2019.

At that time, the cat bond market consisted of roughly 60% aggregate and 40% occurrence notes, while today it is just 41.7% aggregate and 58.3% occurrence.

The cat bond and broader insurance-linked securities (ILS) market has been finding a balance of sorts, in terms of its appetite for frequency exposure.

We do expect that, over time, the number of aggregate deals that get issued may increase again, given the evident reinsurance protection gaps there are to fill.

Sponsors clearly want that type of coverage still and the cat bond market is a viable source for it, but the terms now need to be right to get the investors onboard.

There is evidence of some structural innovations coming into play, that can help sponsors secure aggregate cover more readily and these are likely to become increasingly broadly adopted over time.

But, with occurrence cat bond issuance likely to also remain higher given the market’s velocity of late, we may not find it reverts back to one more evenly split.

So per-occurrence deals are likely to stay the majority of the catastrophe bond market, at least for the time being.

The data supporting our charts has been collected by Artemis over the more than 25 year period the catastrophe bond market has existed and is now supported by data on more than $161 billion of issuance, all of which is detailed in the Artemis Deal Directory.

You can access all of Artemis’ catastrophe bond market reports here and analyse our data using the charts and visualisations you can find here.