Catastrophe bond issuance in 2024 hits $12.1bn, running 29% ahead of prior year

Catastrophe bond new issuance continues apace in 2024 and has reached $12.1 billion including the latest deals to hit the market and settle today, which means the pace of issuance is now running 29% ahead of the prior year, according to the latest data from Artemis.

That rate of issuance is particularly notable, especially as last year set a new catastrophe bond market issuance record for the first-half.

In fact, the cat bond market in 2024 is already more than $1.8 billion ahead of the first-half issuance record set a year ago, which was $10.3 billion.

In 2024, the catastrophe bond market has accelerated into the second-quarter, as would normally be expected, but then experienced a slight slowing in recent weeks, because of the spread developments we’ve reported extensively on.

This has slowed some sponsors down in their approach to the cat bond market and even resulted in the cancellation of two issuances, the most recent being the Gateway Re 2024-3 deal and prior to that Ariel Re’s latest cat bond.

But, even with these pricing developments and cancelled issues, the cat bond market remains on-track to break all records for the first-half of the year in 2024.

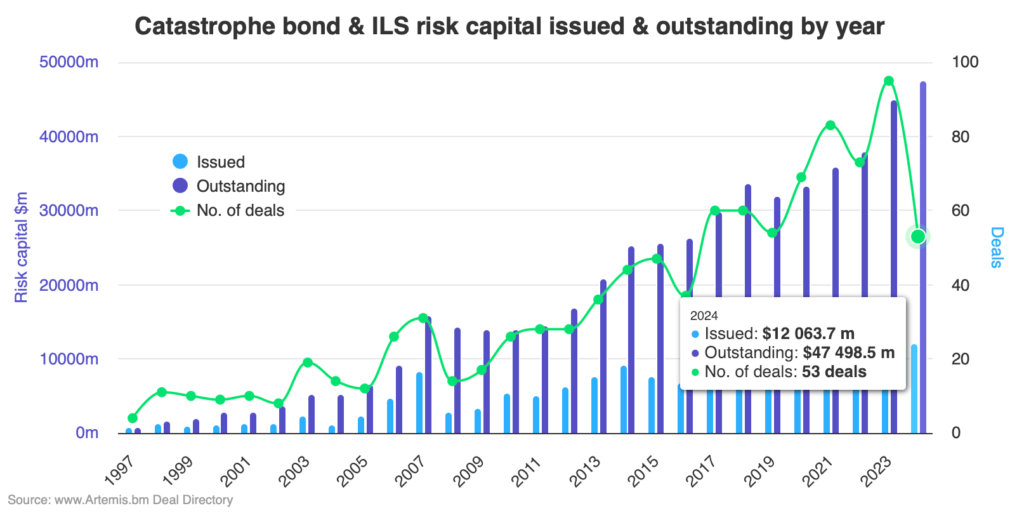

The chart below (available here in interactive form) shows catastrophe bond issuance year-to-date and also market growth:

With almost $12.1 billion of settled new catastrophe bond issuance across 53 deals that we’ve tracked here at Artemis, the pace of issuance is now exactly 29% ahead of where the market sat on June 20th 2023.

It’s worth noting that the pace has slowed since the end of May, as we had reported the cat bond market was running some 38% ahead of the prior year by the end of that month.

But last year, June was a strong month with $1.8 billion of issuance, where as this June 2024 is set to be much slower than that, which we suspect could have something to do with the spread developments seen in the market, at least to a degree.

At this time last year we’d tracked 50 new cat bond issuances in our Deal Directory, while for the full half-year 2023 the total was 56 deals and $10.3 billion of issuance.

By the end of this month, based on what we know of the cat bonds remaining in the market and likely to settle on or before June 3oth, the end of first-half total issuance for 2024 should be around $12.4 billion, from 57 deals tracked.

Which, of course, means the average deal size is set to be considerably higher for the first-half in 2024, helped enormously by a handful of larger issuances this year.

It’s also notable that last year set a record for the second-quarter and it was the biggest single quarter of cat bond issuance ever at $7.1 billion in Q2 2023.

But, in Q2 2024, we’ve already eclipsed that with more than $7.8 billion issued so far this year and another $300 million or more still to settle.

So the catastrophe bond market has already broken the first-half and second-quarter issuance records in 2024 and once we analyse the data in more detail, we’re likely to find other records will break, as 2024 remains on-course to set new highs for catastrophe bond activity on almost every front.

Just a few years ago, $12 billion of catastrophe bond issuance was seen as a healthy full-year figure. Now it’s a new benchmark for a healthy first-half of cat bond issuance and the milestones are set to keep coming, as sponsors continue to find the cat bond market an attractive place to source their reinsurance and retrocession.

Finally, at this stage of the year, the outstanding catastrophe bond market has only grown by roughly 6%, despite the record levels of issuance seen.

There are only $50 million more in maturities scheduled for this month, according to Artemis’ data, but market growth is perhaps slower than might have been anticipated. Which shows there is not a huge amount of room for fresh capital in the space, despite the strong new issuance, with recycling of cash from maturities able to support the vast majority of new deals without any new inflows.

Outright growth of the cat bond market may be a little faster in the second-half, if issuance keeps pace with expectations. More on that in our next quarterly cat bond market report.

The Artemis Deal Directory lists all catastrophe bond and related transactions completed since the market was formed in the late 1990’s. The directory also lists the cat bonds waiting to settle, which are highlighted in green at the top of the list.

Analyse the catastrophe bond market using our charts and visualisations, which are kept up-to-date as every new transaction settles.

Download our free quarterly catastrophe bond market reports.

We track catastrophe bond and related ILS issuance data, the most prolific sponsors in the market, most active structuring and bookrunning banks and brokers, which risk modellers feature in cat bonds most frequently, plus much more.

Find all of our charts and data here, or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.

All of these charts and visualisations are updated as soon as a new cat bond issuance is completed, or as older issuances mature.