Catastrophe bond funds deliver stellar August returns: Plenum UCITS Index

The returns of catastrophe bond funds spiked in August 2024 delivering the best monthly performance of the year for many, as seasonal spread tightening delivered strong performance across the market, with the Plenum CAT Bond UCITS Fund Indices averaging a 2.15% return for just slightly over the month.

August was a strong month of performance for the sector and for many catastrophe bond funds their best of the year so far, we understand.

Even lower-risk cat bond fund strategies have generally delivered a 1.85% to 2% return for the month, which is particularly impressive, while some higher-risk strategies have delivered higher performance.

Note: We’re basing this on date for Plenum’s UCITS cat bond fund index from July 26th to August 30th as it is only available by week, so this is very slightly over one months returns.

August is now the strongest month of the year for the majority of catastrophe bond funds, as the market adopted its usual tightening cycle during the hurricane season.

For cat bond fund managers, now we’re in the peak of hurricane season, the next month or two are now critical to their full-year returns, with any major storm potentially the difference between another impressive year, or something lower.

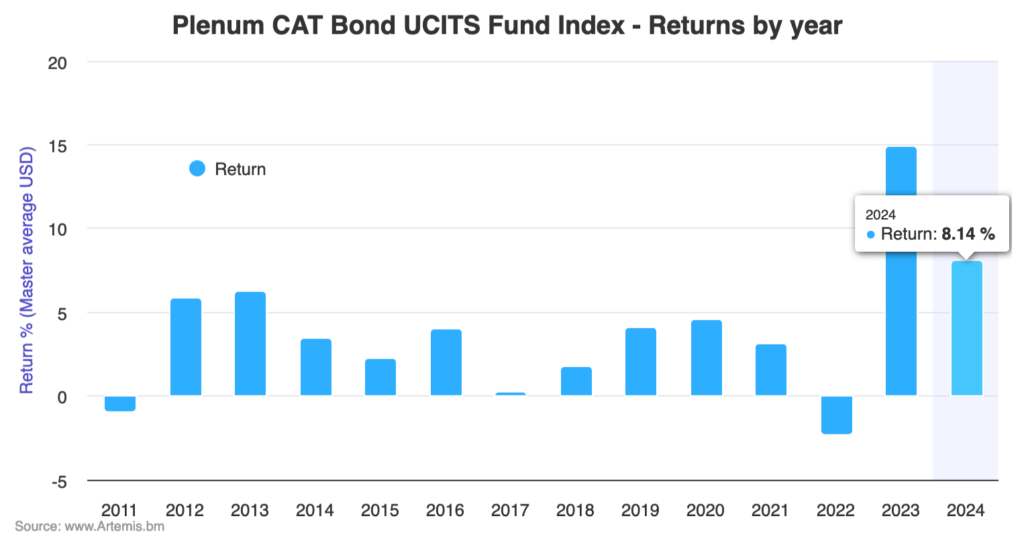

The Plenum CAT Bond UCITS Fund Indices having averaged 2.15% for the period of just over the month of August, has now reached a return of 8.14% by August 30th this year.

That’s impressive and while a little behind the previous year’s pace still, as we explained recently there were factors in 2023’s cat bond fund performance which were never set to be repeated in 2024.

Analyse cat bond fund performance using the Plenum CAT Bond UCITS Fund Indices, which tracks the performance of a basket of cat bond funds structured in the UCITS format and provides a broad benchmark for the performance of cat bond investment strategies.

Click the chart below for an interactive version and index development by week.

August returns were relatively even across the market, without a huge dispersion and Plenum’s cat bond fund index reflects this, as the lower-risk funds averaged 2.17%, while higher-risk averaged 2.13% for the period we are analysing. The capital-weighted version of the index only managed 2.18%.

Year-to-date, the dispersion of returns becomes clearer, as lower-risk UCITS cat bond funds averaged 7.87% to August 30th, while higher-risk cat bond funds averaged 8.30%.

Over the trailing 12-months, to August 30th 2024, the average return of UCITS cat bond funds now stands at 12.40%, which while lower than the full-year 2023 average return of 14.88% is only due to the aforementioned clear reasons.

2024 is the second-best performing year for this Index of UCITS catastrophe bond funds. It will be interesting to watch how the seasonal contribution performs in September, as by the end of that month some cat bond funds may well be in double-digits for the year, as long as the hurricane season plays ball.

Recall that, the catastrophe bond market yield potential still sat around the 13.54% mark as of the end of July.

Analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

Analyse catastrophe bond market yields over time using our new chart.