Cat bonds in H1 – Records broken, capital raised, discipline evident: Swiss Re

In the first-half of 2023, the catastrophe bond market broke a number of records, as fresh investor flows and successful capital raising by insurance-linked securities (ILS) fund managers helped make the cat bond an attractive alternative to reinsurance and an even better complement, Swiss Re has said.

In the reinsurance firm’s latest catastrophe bond market report, Swiss Re explained that after hurricane Ian last year it had been uncertain whether the ILS and cat bond market would raise significant capital in time for 2023.

“Questions were raised whether capacity could be met in the alternative capital sphere,” Swiss Re explained, going on to say that this led to “a dislocated ILS market” at the start of this year.

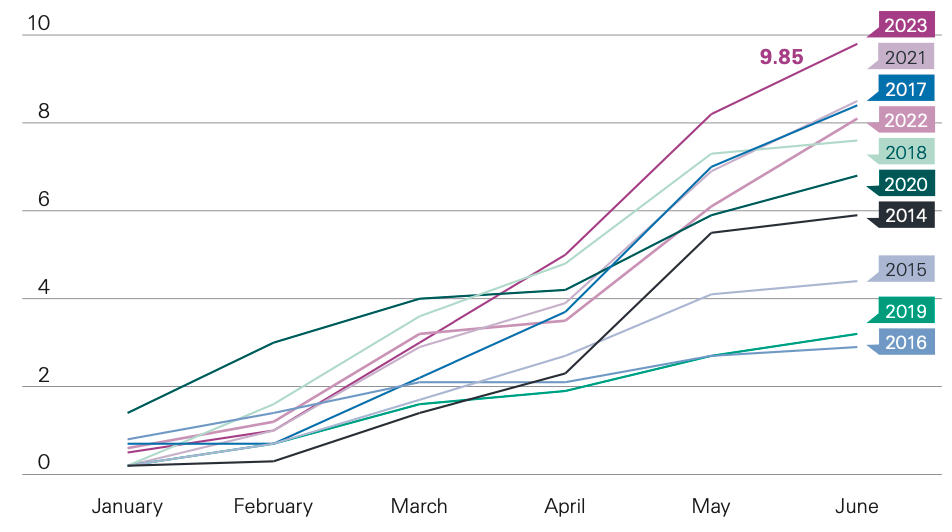

But by the end of the first-half, Swiss Re reports a record level of new catastrophe bond issuance, with almost $9.85 billion of new issuance across 64 tranches of notes, outpacing any other year in cat bond market history.

“This milestone was achieved through a confluence of events including a significant capital raise from most ILS investors already participating in the market,” Swiss Re said.

Adding that, “Investors globally saw an opportunity in the temporarily dislocated ILS market and successfully raised money to support growing demand in the new issuance pipeline.”

With catastrophe bond spreads having widened across all perils the market saw, “a strong relative value play for catastrophe bonds and other liquid forms of ILS,” which attracted investors to it.

Then, of course, the industry loss from hurricane Ian did not develop to the levels originally anticipated, resulting in recovery in value of many positions and additional returns for those that came into the cat bond investment universe at the right time.

So, it has been a strong first-half for cat bond investors, evidenced by the record 10.34% return of the Swiss Re cat bond index, as we reported before.

On the other side, sponsors continued to find strong value in catastrophe bonds as a structure for sourcing reinsurance from the capital markets.

“Sponsors found the cat bond market as a great alternative but an even better complement to a hardening traditional re/insurance market,” Swiss Re explained.

Stating that, “The benefit of the market’s price discovery performed exceptionally during 1H 2023 and attracted new and existing sponsors to issue cat bonds.”

While the cat bond market was flying, with fresh capital having flowed in from investors and sponsors taking advantage of investor appetite in a hard reinsurance market environment, Swiss Re also notes that there was evident discipline in the cat bond market as well.

“The resiliency of the market was demonstrated again in early 2023 when capital was raised at least partly from new investors who saw opportunity to enhance their portfolios with an attractive alternative,” Swiss Re said.

But also added that despite this “record-breaking 6-month stretch of new issuance,” in the catastrophe bond market, “capital appears more disciplined.”

Already in 2023, more risk has been issued in 144a catastrophe bond form than in full-year 2022, by Swiss Re’s figures.

Swiss Re counts the outstanding cat bond market as being roughly $40 billion in size at the half-year, and says this is likely to be sustained and perhaps continue in the second-half.

“With sustained growth through the first half of the year and lower levels of maturities in Q3 and early Q4, 2023 is likely to be another prosperous year of growth,” the reinsurer believes.

View details on every catastrophe bond issued in the Artemis Deal Directory, analyse the catastrophe bond market using our cat bond market charts and visualisations, and download all of our quarterly cat bond market reports.