Cat bonds & ILS dominate Bermuda re/insurance registrations again in 2023

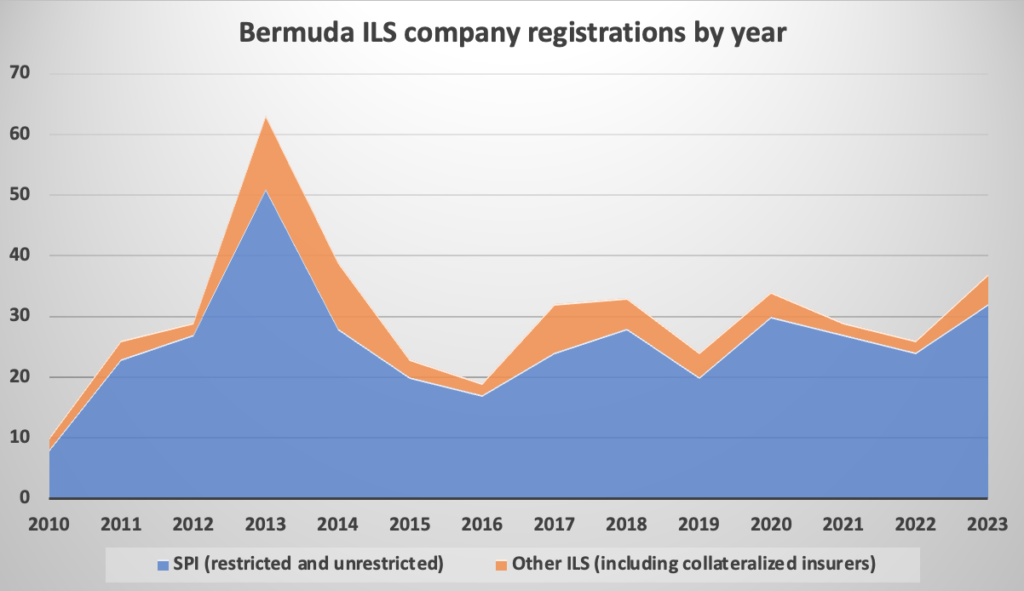

Registrations of new vehicles for catastrophe bond and insurance-linked securities (ILS) purposes have once again dominated the statistics on registrations of new insurance and reinsurance entities in Bermuda for 2023.

Last year saw 29 new restricted special purpose insurers (SPI’s) registered in Bermuda, which are in the main vehicles for issuing catastrophe bonds, according to Bermuda Monetary Authority (BMA) data.

In addition, there were also 3 unrestricted SPI’s registered in Bermuda in 2023, which are structures that can be used for risk transformation and fronting of insurance-linked securities (ILS) capital, as well as other collateralised reinsurance transactions.

In addition, 2023 saw 3 new collateralised insurer class companies registered during the year, plus two other registrations in other classes of company that we can definitely identify as linked to ILS strategies.

The end result was that 2023 was the strongest year for overall cat bond, ILS and collateralized reinsurance company registrations in Bermuda since 2014.

But it was the strongest year since 2013 for special purpose insurer (SPI) registrations in Bermuda, reflecting the very strong levels of activity in the catastrophe bond market last year, according to the data (see chart below).

In total, the Bermuda Monetary Authority (BMA) said that 2023 saw 62 re/insurance companies and 5 intermediaries registered during the year, a decline on the previous year, but closely aligned with years before that.

That compares to 80 re/insurers and 4 intermediaries registered in Bermuda in 2022, 64 re/insurers and 14 intermediaries registered in 2021, and 67 re/insurers and 5 intermediaries in 2020.

As a result, with 37 being ILS related, it’s clear the contribution that this market makes to Bermuda’s overall global re/insurance footprint and influence.

Insurance-linked securities (ILS) related registrations dominated again, as Bermuda benefited from the resurgence in cat bond market activity over recent years, as well as ongoing and now rebuilding interest in broader ILS and collateralized reinsurance investment strategies.

Bermuda’s important position in the catastrophe bond and ILS market is clear with the list of registrations, as it continues to dominate as a domicile for structures used in this industry.

You can read about and view details of many of the Bermuda registered SPI’s and other ILS structures in our catastrophe bond Deal Directory, our mortgage ILS directory and our reinsurance sidecar listings.