Cat bonds and sidecars to see biggest increases in demand over next year: Moody’s

Over the next year, reinsurance buyers have expressed a strong preference for catastrophe bonds when it comes to utilising alternative capital, while sidecars are also expected to see much more elevated demand, the latest survey by Moody’s Ratings shows.

Each year just in advance of the Monte Carlo Rendez-Vous event, Moody’s Ratings surveys reinsurance buyers to identify their outlook for the coming year and their preferences for risk transfer structures and sources.

The alternative capital markets and insurance-linked securities (ILS) funds appear set to experience strong demand, according to the survey results.

“While our survey respondents continue to value long-term and stable relationships with traditional reinsurers, they also seek reinsurance capacity in the alternative capital markets,” the rating agency explained.

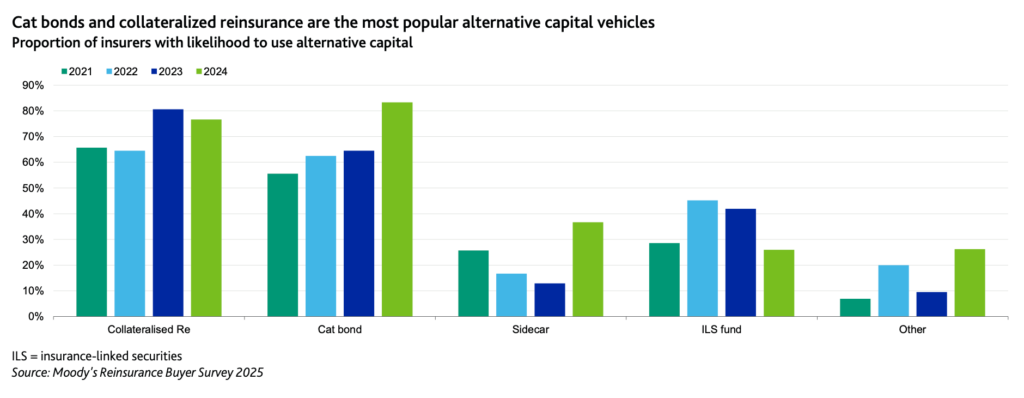

In fact, demand for catastrophe bonds looks particularly high, as Moody’s said, “Over 80% of survey respondents expect to use catastrophe bonds in the year ahead, up from 65% in last year’s survey.”

The rating agency added that, “Collateralized reinsurance also remains attractive to a majority of survey respondents,” but the percentage citing this as their preference is very slightly lower year-on-year.

For cat bonds, the demand according to the survey is at its highest in the last four years. Collateralised reinsurance preference is just slightly lower than in the 2023 survey, but still higher than the two prior years.

Interestingly and perhaps unsurprisingly given recent ILS market activity, the reinsurance sidecar structure is also expected to see much higher demand from protection buyers over the next year.

While, as the graphic above shows, Moody’s survey of reinsurance buyers found a slightly lower preference for ILS funds, with the expected demand growth for cat bonds, still high demand for collateralized reinsurance and rising demand for reinsurance sidecars, it seems it would be unwise to read too much into this data point as many ILS funds will allocate to some or all of these opportunities over the coming year.

Overall though, this survey question implies growing opportunities for capital deployment and perhaps that reinsurance buyers are increasingly motivated to access alternative capital sources, over the coming months, where the price and terms prove attractive.