Cat bond yields still 7.1x higher than 2016, despite some softening: Twelve

The catastrophe bond investment opportunity remains very attractive, even after considering the recent moderation in pricing that has been seen, with the risk-adjusted yield of the cat bond market remaining significantly higher than in the past, according to Twelve Capital.

Specialist insurance-linked securities (ILS) and reinsurance investment manager Twelve Capital continues to believe that catastrophe bond market conditions present one of the best investment environments for the ILS asset class in 2023.

While there has been some moderation in prices since the latter stages of the first-quarter of the year, overall cat bond market yields remain very high and, in fact, the slightly lower prices are seen as a positive that can encourage more sponsors to tap the market for protection, Twelve Capital told us recently.

Based on the latest risk-adjusted assessment of the cat bond market’s yield potential from the investment manager, 2023 continues to present a strong entry and allocation increase point for investors, Twelve Capital believes.

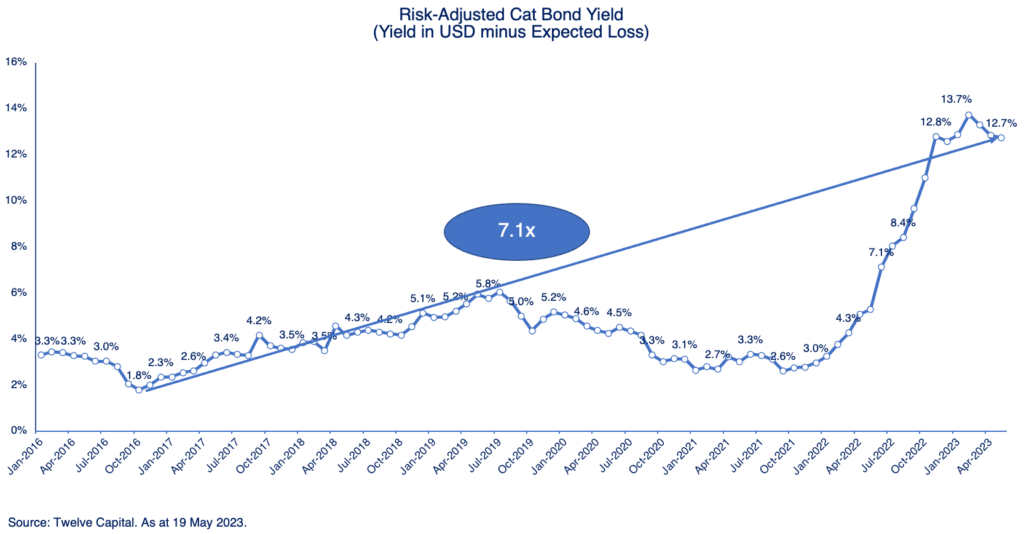

In fact, Twelve Capital’s data shows that the risk-adjusted yield of the catastrophe bond market remains some 7.1 times higher than its low point back in 2016.

As of May 19th, the risk-adjusted cat bond yield in USD, minus expected loss, was running at 12.7%.

The moderation in pricing is evident, being now one percentage point down from a 13.7% peak in risk-adjusted yields, but the chart above clearly shows a very attractive investment opportunity in cat bonds right now.

Florian Steiger, Head of Cat Bonds at Twelve Capital, provided his view on the market opportunity.

“Cat bond yields have normalised somewhat, but are still close to historical highs with risk-adjusted yields of above 12% in USD,” Steiger explained.

Adding that, “The recent increase in cat bond yields has attracted significant interest into the cat bond space, with institutional investors around the globe providing new or additional capital.”

These positive inflows of capital to catastrophe bond funds are evident in Artemis’ data tracking UCITS cat bond segment assets under management.

Steiger further explained that the softening in pricing and so reduction in yields seen can be viewed as healthy for the market.

“The slight decrease in cat bond yields we have witnessed is healthy and is expected to help the market to grow further,” Steiger said.

“The recent peak towards the end of last year had resulted in a locked market, where cedents reduced cat bond issuance, as the cost of protection in some cases had reached or even surpassed the cost of regulatory capital when keeping the risk on balance sheet.

“As such, the recent normalisation in spreads has helped to spark a wave of new issuance, which gives investors plenty of possibilities to deploy capital,” Steiger explained to us.

Track catastrophe bond pricing using Artemis’ charts on cat bond expected losses, coupons and spreads, as well as multiples-at-market of new cat bond issuance.