Cat bond UCITS funds fall -0.3% in May, first negative month since Oct 2022

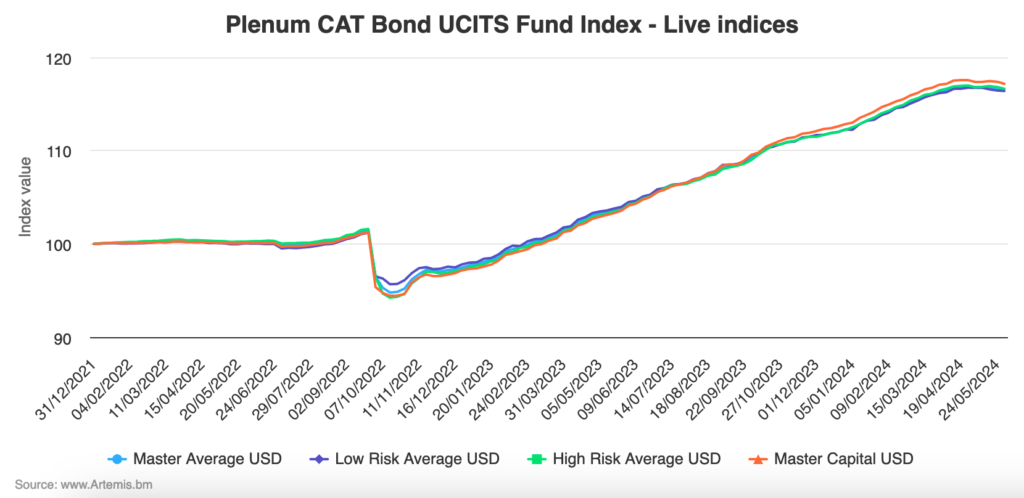

Catastrophe bond funds in the UCITS format have experienced their first negative month of performance since October 2022, with the Plenum CAT Bond UCITS Fund Indices falling -0.30% in May 2024.

The driver is the catastrophe bond spread widening that has been seen through much of April and May.

As we had reported a month ago, the spread widening accelerated into May and ended a 73 week long-run of positive average returns across the tracked UCITS cat bond funds.

Now, the effect of the spread widening is clear for the full month of May and it is the first month where the UCITS cat bond fund index performance was negative since right back in October 2022 when the market was still digesting the potential for losses from hurricane Ian.

The -0.30% decline in the Plenum CAT Bond Fund Index average ends a streak of 18 consecutive months where the UCITS cat bond fund market has delivered positive returns, on average.

Analyse cat bond fund performance using the Plenum CAT Bond UCITS Fund Indices, which tracks the performance of a basket of cat bond funds structured in the UCITS format and provides a broad benchmark for the performance of cat bond investment strategies. Click the chart below for an interactive version and index development by week.

With this negative month, the year-to-date return for the Plenum UCITS Cat Bond Fund Index average is now slightly lower at 3.84% by the end of May.

Which is still a strong start to the year, beaten only by the record returns achieved a year ago in the cat bond asset class.

For May, the capital weighted index of UCITS cat bond funds was down slightly more than the average, at -0.34%.

Both the index of lower risk UCITS cat bond funds and the index of higher risk UCITS cat bond funds fell by the average, at -0.30% for the month.

After May, the average return of the UCITS cat bond fund index reached 3.84% for the first five months of this year.

As we reported last week, the spread development seen in catastrophe bonds actually enhances the forward return potential of cat bond funds, but has resulted in a dent to performance of late.

These kinds of price effects tend to work themselves through and balance-out over time, although this time there are risk-related factors involved, namely a recent risk model update and the influence of active hurricane season forecasts.

How the cat bond spread environment develops through and beyond the hurricane season is going to be interesting to watch.

Analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

Analyse catastrophe bond market yields over time using our new chart.