Cat bond market yield declines again on accelerated seasonality, lower collateral contribution

In the month of September 2024, the overall yield of the catastrophe bond market declined further as the effects of hurricane seasonality accelerated, while also adding to the decline is a gradual reduction in the cat bond market collateral yield, as lower interest rates begin to have an effect.

As we’ve explained before, US hurricane risk seasonality is a key driver of yield spreads in catastrophe bonds every year.

The cat bond market is typically expected to experience spread compression as the peak of the hurricane season approaches, then recovers ground as the US wind season winds down.

This year, the catastrophe bond market yield began to show some seasonality traits back in July, which then accelerated in August.

The overall yield of the catastrophe bond market stood at 13.54% at the end of July, then fell 7.5% to a market yield of 12.52% by the end of August.

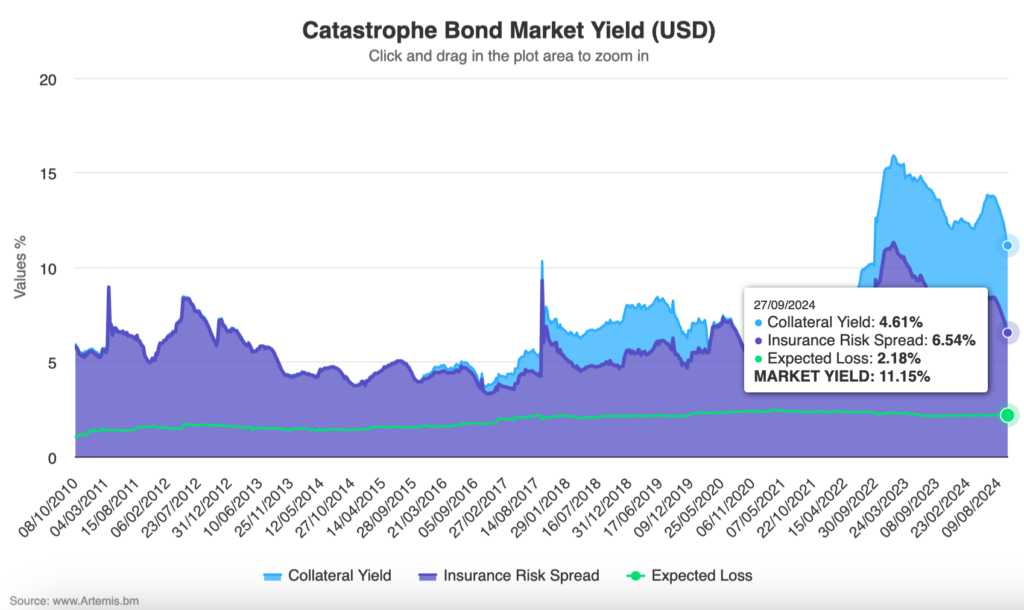

Now, one month further on, by September 29th the cat bond market yield had declined by almost another 11%, to a still historically healthy level of 11.15% at that stage (click the image below for our interactive chart).

It’s important to point out that bond yields declining are not a direct signal of lower returns being ahead. Price and yield are inverse and hurricane seasonality pushes cat bond prices higher (tightening spreads), resulting in a reduction in the observable market yield.

As seasonality peters out, typically through October and into November as the Atlantic hurricane season draws to a close, the yield typically starts recovering as prices fall back once again.

The fact the cat bond market’s yield can move so far during the US wind season is therefore one expression of just how much of the market’s exposure is tied to US hurricane risks.

As our chart on cat bond market yields shows, the overall yield at 11.15% as of the end of September still remains historically very attractive.

One other factor worth pointing out from September, which we alluded to in our last article on the cat bond market yield, is that the collateral yield across the market has declined somewhat.

The collateral yield, measured as a USD Money Market Rate, was as high as 5.39% in June, then declined to 5.12% by the end of August and has now declined further to 4.61% at the end of September.

Given the rate tightening cycle that the United States Treasury has now begun, it seems the effects of this may now be beginning to become evident in the data.

Whether the yield on collateral declines too much further remains to be seen, as there are significant uncertainties over how fast and how far interest rate cuts will go at this time. It seems likely the collateral yield of the cat bond market will remain historically elevated, as few financial commentators or analysts believe we are heading back to a low interest rate environment any time soon.

Seasonal effects will continue to be seen through October and into November, after which we should see a change in trajectory for the yield of the catastrophe bond market.

Of course, it’s also worth noting that as issuance picks up again, once the hurricane season risk declines, there is also the chance of greater capital inflows to the catastrophe bond sector which can also have an influence on spreads and yields. Depending on the volumes of new capital and liquidity entering, this can mask the reversal of seasonal effects to a degree.

Analyse catastrophe bond market yields over time using this chart.