Cat bond market reassumes growth trajectory, but pricing tightens: Aon

The catastrophe bond market has reassumed its growth trajectory during the first-quarter of 2023, with an increase in transaction sizes one of the notable features of issuance, Aon has explained.

This aligns with Artemis’ own catastrophe bond market report, which was released yesterday and in which we reported that the average size of cat bond and related ILS transactions issued during Q1 increased from $141 million in 2022 to $172 million in 2023, the highest average deal size we’ve recorded since 2018.

Aon’s data is only looking at 144a cat bonds and the broker notes that total deal sizes in 2023 to-date have been roughly 67% greater, on average, than those issued during the second-half of 2022.

This is a strong reflection of investor demand for new cat bond issues, as well as of the availability of capital as the cat bond market reassumes its position of expansion.

Notable as well and a trend we’ve been highlighting for weeks as new deals were executed, Aon also comments on the tightening of cat bond pricing as the first-quarter went on.

“While pricing remains elevated from levels achieved in 2021, it has tightened during the first three months of 2023 from peak levels seen at year-end 2022, a development welcomed by both insurers and reinsurers particularly at a time when pricing in the reinsurance and retrocession markets remain heightened relative to the prior decade,” Aon explained.

Adding, “Capital markets investors have taken note of the relative value of the catastrophe bond market compared with other alternative asset classes, especially considering the persistent volatility that continues to pervade the broader financial markets.”

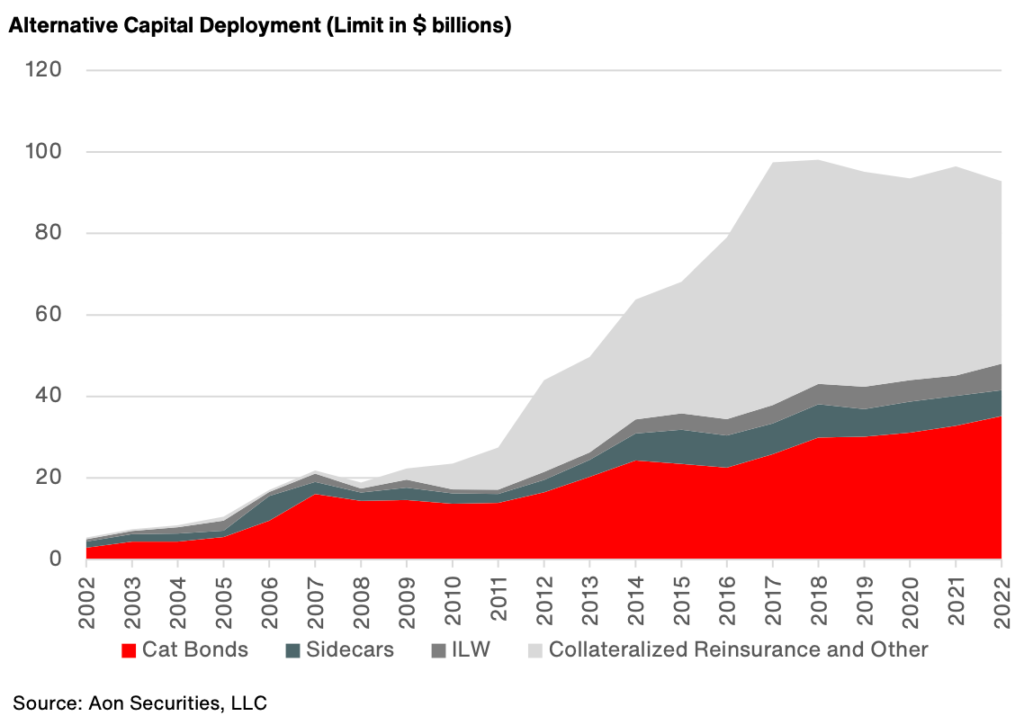

While the cat bond market has been growing, other segments of alternative capital and ILS have been static, or even shrunk further, Aon’s latest data shows.

The chart above shows that any growth in alternative capital is coming from the catastrophe bond segment at this time, with collateralized reinsurance seemingly continuing to contract, while sidecars and industry-loss warranties (ILW’s) remain relatively static.

“Collateralized reinsurance remains somewhat constrained,” Aon reports, but also notes that, “While the sidecar market has not grown substantially, existing investors in the space are committing to existing transactions with meaningfully higher margins.”

But in catastrophe bonds, the performance of the asset class has helped to attract new capital inflows.

As Q1 activity developed, Aon explains, “Investors kept busy, working with their own end-investors to encourage further deployment of capital into the market. Investors were largely successful in their respective capital raises, came to the market eager to deploy freshly raised funds at heightened pricing levels.”

Adding, “Net capital inflows during the first two months of 2023 combined with the relatively quiet start resulted in price tightening of approximately 12 percent during the quarter.

“The sponsors benefited from the improved economics compared to year-end; that said, current margin levels have still proved very attractive to investors.”

Looking ahead, Aon forecasts the catastrophe bond market will continue to be busy through the second-quarter, with the pipeline for new cat bond issues already building nicely.

Noting that there are significant amounts of cat bond risk capital set to mature through Q2 2023, Aon said that investors are keen to see this reinvested.

“Investors are keen to see abundant issuance volume during the second quarter to ensure maturing capital is deployed, but also to put to work newly raised capital from end investors who are seeking to capitalize on the healthy margin environment,” the broker explained.

Aon also notes the higher risk-free returns now also boosting higher cat bond pricing, to deliver much higher risk-interest spreads to investors.

Which bodes well for continued issuance activity and inflows as well.

“While risk more broadly was thoroughly repriced during the past 12 months, catastrophe bond investors are benefiting from higher margins, floating rate returns, relatively short duration, and the diversification benefit of this asset class,” Aon said.

Concluding that for catastrophe bonds, “In light of the above market dynamics, all signs point to continued market growth as we confront the summer months and the North Atlantic hurricane season of 2023.”

You can access our newest catastrophe bond market report here.