Cat bond loss multiples unlikely to fall. Capital motivated to stay disciplined: AM Best

On average, catastrophe bond loss multiples are not expected to fall back much further, as the capacity providers in the reinsurance market, including insurance-linked securities (ILS) fund managers and investors, are still motivated to hold onto the gains recently made, according to AM Best.

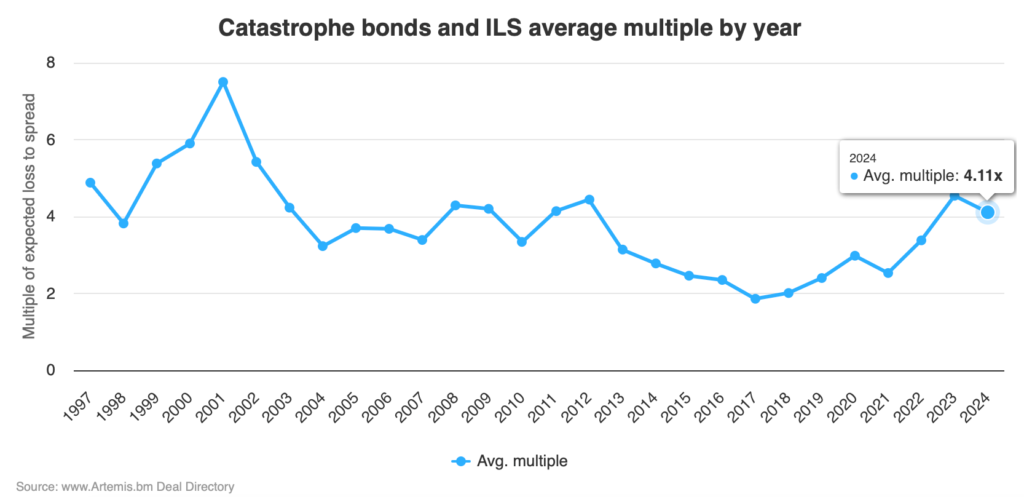

In a recent report the rating agency noted that the loss multiple of catastrophe bond issuance had declined through the second-half of 2023, but picked back up again in the first-half of 2024.

Using Artemis’ data and its own research, AM Best paints a picture of steadily rising loss multiples, with a downward dip in the second-half of last year.

But, while the multiple of cat bonds issued (the multiple of expected loss to spread, that is) declined, particularly in the fourth-quarter, the first-half of 2024 saw an average spread of cat bonds issued at a very healthy multiple of over 4.1 times the expected loss.

For 2024 to-date, the loss multiple of issued catastrophe bonds is tracking at 4.11x, which is still the second highest after 2023 since 2012, and closely compares to others years above 4x from 2008, 2009 and 2011.

You can analyse catastrophe bond loss multiples, by year and quarter of issuance in our interactive chart:

AM Best has an interesting theory, that loss multiples rose higher to attract the capital needed to support the demand for reinsurance protection the catastrophe bond market was seeing.

The rating agency said, “The rebound in the loss multiple can be attributed to a few factors, with supply and demand dynamics perhaps the largest contributor. Cedent demand remained high for reinsurance in the remote layers of risk covered by cat bonds, as reflected in the record issuance volume. Only so much of that demand could be satisfied with capital from prior year deals maturing in first-half 2024.

“The loss multiples had to move higher to pull the roughly USD 3 billion of additional capacity into the cat bond market.”

It’s a bit of a chicken and egg argument. As in, which came first, the need for improved pricing to allow managers to sustainable deploy capital and deliver a return over the cycle, or the need to raise pricing to attract the capital in the first place. We tend to opt for the former, but there is no question the two are intrinsically linked.

AM Best also notes that there is little desire to see loss multiples tumble back to their historical lows.

See our chart tracking catastrophe bond loss multiples at issuance by quarter for a more granular look at the data over the since 2010.

AM Best notes that ILS fund managers are keen to sustain higher loss multiple levels, to ensure capital is being adequately paid for being put at risk.

“ILS managers remain mindful of the need to secure adequate pricing for the capacity being deployed and have not been willing to chase deals down to unacceptable pricing levels. Forecasts for a very active hurricane season and cat model updates also motivated ILS managers to hold the line on pricing,” the rating agency explained.

AM Best continued to say, “Absent a flood of new capital into the cat bond market, the average loss multiple seems unlikely to fall to 2021 levels anytime soon.”

Also noting that, “Some investors, although pleased with the returns made in 2023, have redeemed profits rather than redeploy all of their gains into new transactions.”

In the same report, AM Best discusses an “overall stability in pricing and terms and conditions” which is what the larger investors in the catastrophe bond space want to see.

The rating agency highlights the importance of the reset in reinsurance T&C’s, “Tighter terms and conditions and higher retentions are believed to be even more responsible than price increases for the stellar reinsurance returns in 2023, so appetite to broaden them or to lower retentions appears to be minimal.”

Going on to say that, now in the reinsurance market, whether traditional or alternative, “Capacity providers are negotiating from a position of strength.”

This position of strength means there is some flexibility for capital providers, in terms of having levers they can pull to make their coverage more attractive, across the terms and features of reinsurance and retrocession products.

While this could be deemed a selective-softening, it is also a way for reinsurers and ILS managers to sustain price and returns at higher levels.

AM Best noted, “Not all segments of the reinsurance or ILS markets would soften in the same way. With respect to covered perils, ILS managers believe that the coverage for all-natural perils may return for collateralized reinsurance but may be less likely to return for cat bonds.”

The rating agency believes cedents may have more room to negotiate at the January 2025 reinsurance renewals and through the catastrophe bond issuance period around that and into the new year.

AM Best continued, “However, capacity providers are highly motivated to maintain discipline because the poor returns of recent years are still fresh in their minds. Any material softening is more likely to begin with the traditional reinsurers that are working with a larger (and leveraged) capital base and have more flexibility to use their retained earnings to further expand that base.

“ILS managers, in contrast, may not be able to retain earnings to deploy into new deals because they may need to return money to investors at contract expiry.”