Cat bond investments post-loss recovery period impressive: Plenum

The relatively short time taken for catastrophe bond investments to recover after loss events and crises affecting global markets has been impressive throughout the sector’s history, with cat bonds exhibiting a tendency to recover from draw-downs much faster than other asset classes.

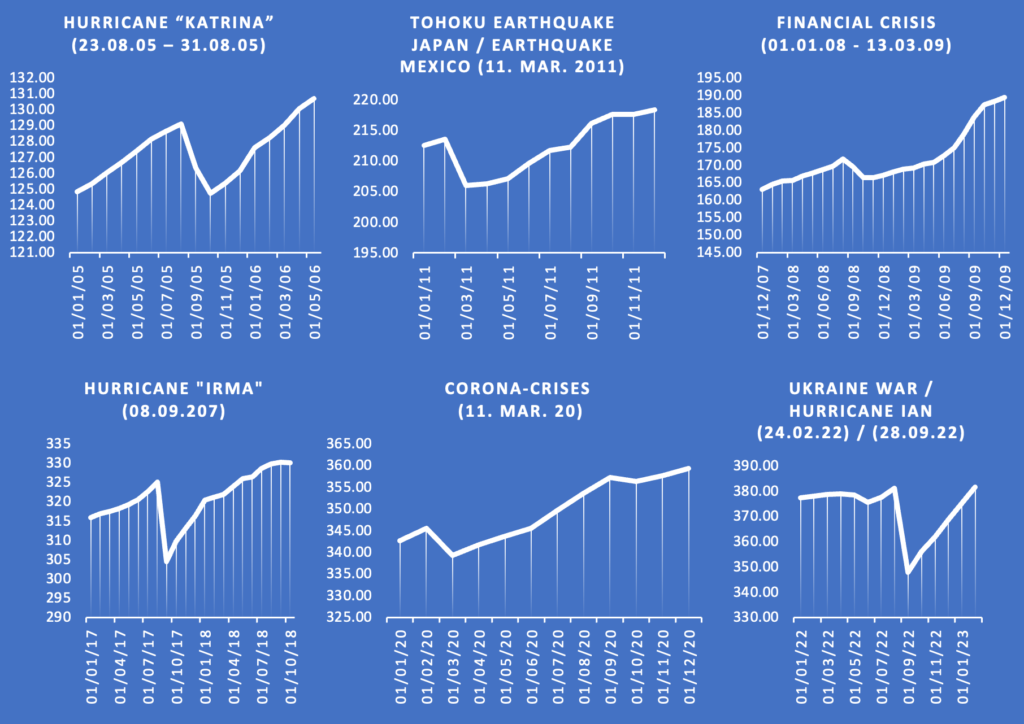

Hurricane Ian is the latest example, where the catastrophe bond market has already recovered all of the decline caused by this major catastrophe loss event, as measured by reinsurance firm Swiss Re’s Global CAT Bond Total Return Index.

In fact, the catastrophe bond market, as measured by Swiss Re’s Index, had dropped by roughly 9% in the wake of hurricane Ian.

But, the market as measured by this Index recovered back to a level above the days prior to hurricane Ian around the end of February this year, so in around six months.

Higher rates have certainly helped that recovery be more speedy, driving the cat bond Index higher.

However, this isn’t the first time that the cat bond market’s recovery has been this impressive though, as for previous major catastrophe events and other crises over its history, the cat bond Index has recovered the decline relatively quickly as well.

Dirk Schmelzer, Managing Partner and Senior Portfolio Manager at catastrophe bond focused investment manager Plenum Investments explained, “The very short post event recovery periods over the past 22 years are impressive and seem to distinguish CAT bond investments from what we see in other asset classes. Of course, it should be borne in mind that the impact of these natural disasters was limited.

“Our own studies show that current risk premium income of CAT Bond Funds is sufficient to recover 12 months aggregate losses from a 1 in 100 year scenario over 4.8 to 7.5 years; but even those numbers compare relatively well to the more frequent and longer periods that other traditional asset classes need to recover from setbacks.”

Plenum Investments kindly shared some data with us, to help in demonstrating the strong recoveries seen over the years in the catastrophe bond market.

As you can see from the above, the time taken for the Swiss Re cat bond Index to recover back above the pre-event highs can be quite fast.

In addition, some of the events included above, particularly the Global Financial Crisis and the Coronavirus pandemic, clearly show that catastrophe bonds as an asset class can deliver significant value in times where other global assets were suffering significant declines.

As we reported already this week, the lower-risk cohort of UCITS catastrophe bond funds have now recovered back to levels last seen just before hurricane Ian, reflecting the strong performance seen since and the ability of the asset class to recover from loss impacts.