Cat bond & ILS vehicles lead Bermuda re/insurance registrations in H1 2024

More than half of the insurance and reinsurance entities registered by the Bermuda Monetary Authority (BMA) in the first-half of 2024 were destined for catastrophe bond, collateralized reinsurance, or other insurance-linked securities (ILS) use-cases.

Up to June 30th 2024, Bermuda had seen 14 new restricted special purpose insurers (SPI) vehicles registered by the BMA, predominantly for the issuance of catastrophe bonds.

In addition to this, the island saw the registration of two new collateralized insurers (CI) vehicles during the first-half.

On top of this, we also saw one ILS and third-party reinsurance capital specific manager vehicle registered, which was the recently announced Mt. Logan Capital Management, Ltd.

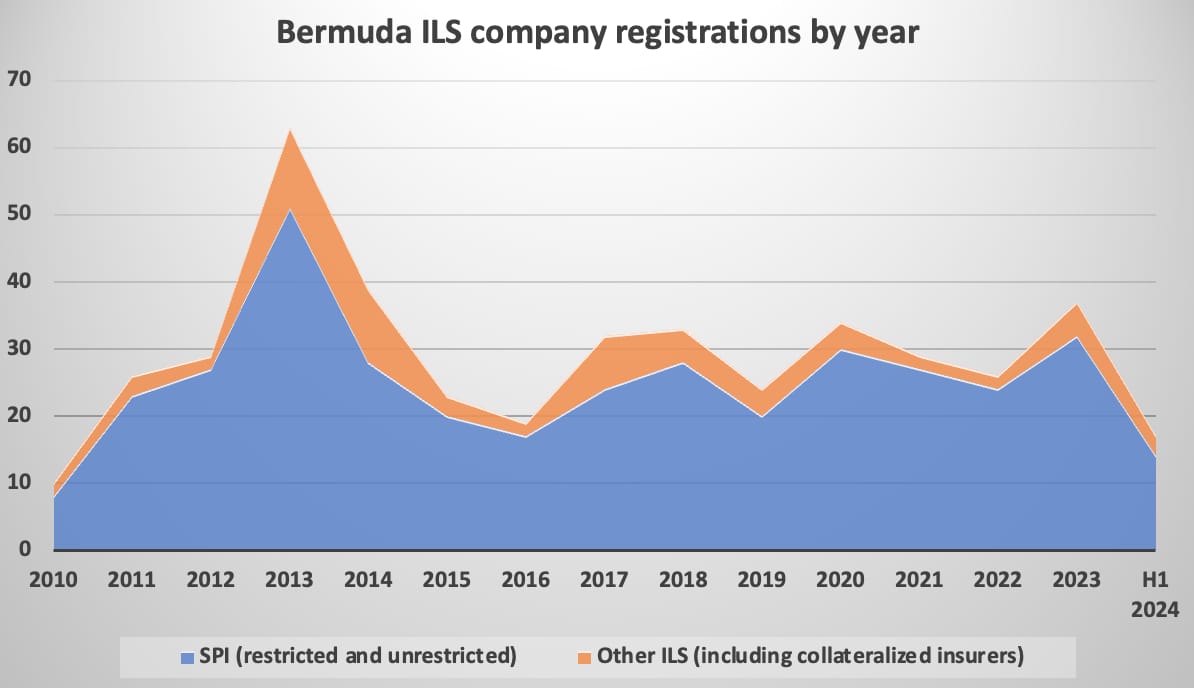

With 17 new cat bond and ILS related entities registered by the BMA in H1 2024, the figure is one behind H1 2023 but above or equal with every other year going back to 2014, reflecting the continued dominance of Bermuda for the establishment of new insurance-linked securities (ILS) entities.

The chart below shows first-half registrations of catastrophe bond and ILS related entities by the BMA.

It puts Bermuda on-course for another strong year of ILS related company registrations, closing in on half the amount seen a year ago and already outpacing a number of other years in the last decade.

It’s worth remembering here that, increasingly, ILS structures are utilised over a period of many years, with catastrophe bond issuance vehicles able to be home to repeat sponsor cat bonds, while the collateralized insurers tend to have an even longer lifespan for their sponsors.

You can see how the first-half of 2024 stacks up against recent full years below.

In total, the Bermuda Monetary Authority (BMA) reports having registered 32 new insurance and reinsurance related companies in the first-half of 2024. So, at 17, the ILS related registrations make up more than half of this activity.

It’s also worth noting that, as well as the registrations that are strictly ILS focused, there were a number of others that are structures used for third-party reinsurance capital uses, such as new Class E entities for life and annuity reinsurance co-investment vehicles, a kind of sidecar.

So the influence of third-party investors on Bermuda re/insurance company registrations remains significant and the island continued to provide a home to the lions share of activity that sees third-party capital being channelled to insurance related risks.

You can read about and view details of many of the Bermuda registered SPI’s and other ILS structures that were established in our catastrophe bond Deal Directory, our mortgage ILS directory and our reinsurance sidecar listings.