Cat bond funds rise 11.81% YTD, on demand, spreads & floating return

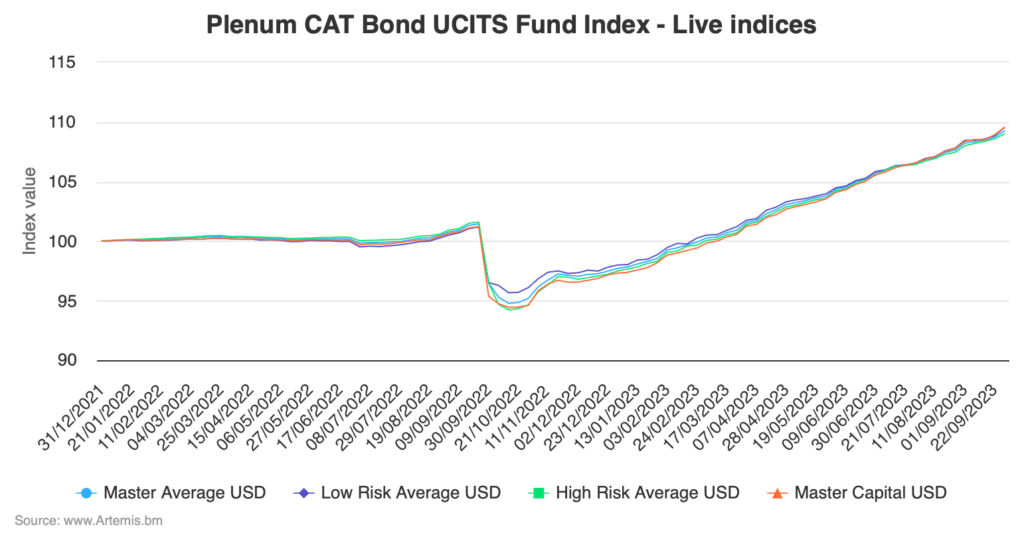

Catastrophe bond funds in the UCITS format delivered an average return of 11.81% across the group according to the Plenum CAT Bond UCITS Fund Indices, with a number of factors continuing to drive returns towards record annual levels.

The average return across the group of UCITS catastrophe bond funds continues apace, with September seeing the majority benefiting from another strong month, with persistent demand in the secondary market for cat bonds one factor that has been assisting.

Of course, the elevated returns are also being driven now by the much higher spreads available from catastrophe bonds that have been issued this year and in the last quarter of 2022.

These spreads are the basis for the strong performance, but prices have continued to tighten and demand is also driving a price response as well.

Topping these factors off is the much higher floating rate returns earned, from the return on invested collateral, with these now adding a mid-single digit percentage annualised boost to catastrophe bond fund performance.

You can analyse the performance of cat bond funds using the Plenum CAT Bond UCITS Fund Indices, which tracks the performance of a basket of cat bond funds structured in the UCITS format, providing a broad benchmark for the performance of cat bond investment strategies.

When we last reported on this Index, using data to to early August, the average return of the group of cat bond funds had reached 9.34%.

A strong rest of August and even stronger September have helped to boost the nine month average performance of the UCITS cat bond funds to a very impressive 11.81%. Click on the chart below to view an interactive version.

What’s perhaps most impressive about cat bond fund performance now, is the fact that on a forward-looking basis returns are now being driven by the performance of the cat bond assets themselves. Where as, in the first-half of 2023 there was still an element of returns being partially driven by the recovery in values after hurricane Ian.

The mark-to-market decline from Ian has been all but recovered, aside from the few bonds impaired or deemed exposed, meaning it is spread prices, demand factors and of course those higher risk-free rates, that are driving the continued strong cat bond fund performance.

The average 12-month return of these cat bond funds has now reached 13.23%, while the return since the lowest point after hurricane Ian struck (which was the pricing on October 14th 2022) has hit 15.23%.

The secondary market for cat bonds was particularly active in August and September, with high demand for cat bond investments continuing, as well as some evidence of more motivated selling occurring (which was always easily absorbed by the market).

Seasonal spread tightening has also been a factor, in continuing to drive price gains on cat bonds.

All of which has resulted in very strong continued cat bond fund performance over the last couple of months.

As the market now eagerly awaits the full reopening of the catastrophe bond issuance pipeline, as the Atlantic hurricane season nears the end of its peak, the appetite among cat bond fund managers and investors remains high, which should help to drive strong execution for those sponsors bringing new cat bond deals to market in the fourth-quarter.

Analyse interactive charts for this UCITS catastrophe bond fund index.