Cat bond funds average 5.50% return year-to-date in UCITS Index

A particularly strong performance through the month of April 2023 now sees catastrophe bond funds in the UCITS format with an average return for the first four months of the year of 5.50%, with both higher and lower-risk cat bond fund strategies faring particularly well during the period.

A combination of factors have driven this very strong cat bond fund performance through the start of 2023, with the group of UCITS catastrophe bond funds delivering almost 4% in returns, on average, for the first-quarter of 2023.

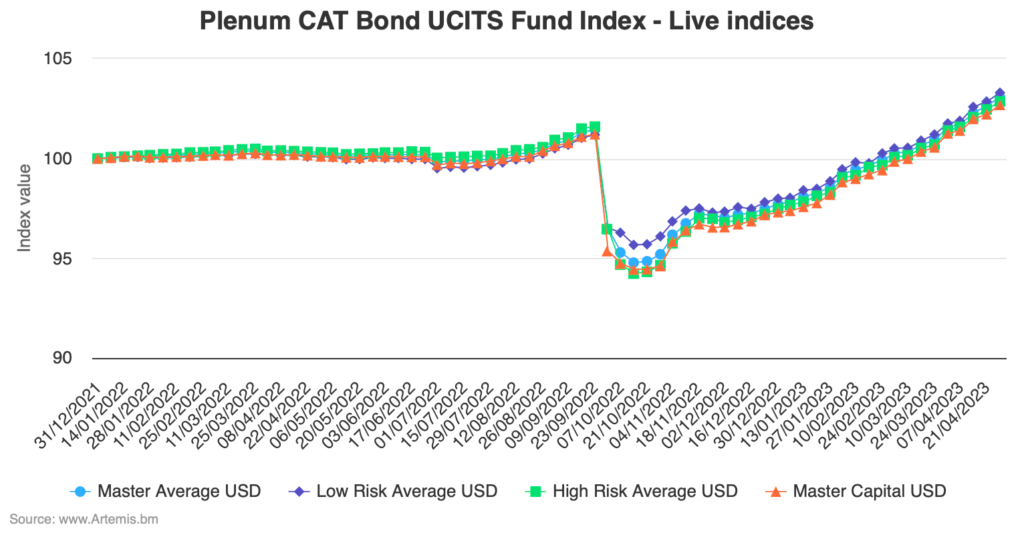

The Plenum CAT Bond UCITS Fund Indices, which tracks the performance of a basket of cat bond funds structured in the UCITS format, provides a broad benchmark for the performance of cat bond investment strategies.

The record pace of returns for this cat bond fund index continues, with the performance across the first four months of the year remaining at a record pace.

The continued recoveries in value of catastrophe bond positions that had been affected by last year’s hurricane Ian and others that had simply experienced spread widening, has been a significant driver of returns this year.

Alongside the recovery in value of some cat bonds that had been marked down, the higher risk-free rate on collateral assets, as well as the improved pricing and so stronger go-forward return potential of new cat bond issues, are also driving cat bond fund returns higher.

The average UCITS cat bond fund return for April 2023, according to Plenum Investment’s Index, was an impressive 1.50%, with lower-risk funds averaging 1.51% and higher-risk 1.44% for the month.

For the first four months of 2023, the average UCITS cat bond fund performance as measured by the Index has now reached 5.50%.

The low-risk group of UCITS cat bond funds averaged 5.42% to the last pricing at the end of April, while the higher-risk grouping averaged 5.51%.

Since this Index hit its lowest level after 2022’s hurricane Ian, the average return has now been a very impressive 8.75%, with lower-risk UCITS cat bond funds delivering 7.98% on average and higher-risk 9.16%.

On a rolling 12-month basis, the Plenum Cat Bond Fund Index average return is now 2.84%, while the lower-risk cat bond fund cohort average 3.21% and higher-risk 2.54%.

All of which clearly demonstrates the attractive returns available in the catastrophe bond market right now and the fact the 12-month returns are now averaging close to 3%, even including the decline caused by hurricane Ian, is a real testament to the way the cat bond market recovers post-catastrophe event.

As we also reported recently, UCITS cat bond funds have been growing in recent months, with inflows and recoveries in values of certain cat bond positions through the first-quarter of 2023 lifting the combined assets of the main UCITS cat bond funds 7% higher to a new record of $9.37 billion.

Also read our recent article that shows the relatively short time taken for catastrophe bond investments to recover after loss events and crises affecting global markets has been impressive throughout the sector’s history.

These catastrophe bond fund indices, calculated by specialist insurance-linked securities (ILS) investment manager Plenum Investments AG, offer a useful source of real cat bond fund return information, focused on the UCITS cat bond fund category, with 14 live cat bond funds currently tracked.

The index provides a broad benchmark for the actual performance of cat bond investment strategies, across the risk-return spectrum.

Analyse interactive charts for this UCITS catastrophe bond fund index.