Car insurance policy checklist: How to find the right coverage

Car insurance policy checklist: How to find the right coverage | Insurance Business America

Guides

Car insurance policy checklist: How to find the right coverage

With the vast number of coverages to choose from, how do you find the right car insurance policy for your unique needs? This guide provides a checklist

Each driver comes with a unique profile and personal circumstances. Because of this, no two auto insurance policies are exactly alike. To ensure that you’re getting the right coverage, there are several elements that go into your car insurance policy that you need to consider.

Insurance Business gives you a rundown of these crucial factors in this article. We will also provide you with a checklist of the essential details to keep an eye on to get the protection that matches your needs. Read on and find out what makes a good car insurance policy in this guide.

Auto insurance is a highly individualized form of coverage. A car insurance policy that works for you may not yield the same results for others. That’s why it’s important to get down to the nitty-gritty if you want to find the right plan. Here’s a checklist of the most essential elements you need to tick off when searching for the best protection.

1. Type of coverage

A car insurance policy consists of several types of coverage designed to provide you with financial protection when accidents or theft happens. Each state imposes its own minimum requirements when it comes to auto coverage. But regardless of where you live, these are the most common types of policies you can access.

Liability car insurance:

This is designed to provide financial protection if you are found legally responsible for an accident that results in another person’s injury, death, or property damage. Liability car insurance is mandatory in almost all states. It comes in two types:

Bodily injury liability (BI) coverage: This helps pay for medical costs for the injuries another person sustains because of an accident you caused. It also covers their lost wages and funeral expenses, as well as the legal costs you incur if you’re sued.

Property damage liability (PD) coverage: This compensates the other driver for the property damage or losses they incur due to an accident that you’re responsible for. It also covers the legal and settlement expenses arising from a lawsuit.

Personal injury protection (PIP) coverage:

This pays out for the medical expenses you and your passengers sustain in a vehicular accident, regardless of who is at fault. It may also cover lost income if you’re unable to work and the cost of household services if you can’t do certain daily tasks.

Medical payments (MedPay) coverage:

This type of coverage works similarly to PIP, paying for the medical and treatment costs you and your passengers incur in an accident. However, it doesn’t cover lost wages.

Depending on the state, MedPay can serve as supplemental coverage for your health insurance or as your primary medical insurance after an accident.

Uninsured motorist (UM) coverage:

This compensates you and your passengers for the injuries and property damage if you are involved in an accident with an uninsured driver. It may also cover hit-and-run incidents. In some states, uninsured motorist coverage is compulsory.

Underinsured motorist (UIM) coverage:

Often bundled with UM coverage, this covers medical and treatment expenses you and your passengers pick up if you’re hit by a driver who doesn’t have enough liability insurance.

Collision coverage:

This pays for the cost to repair or replace your vehicle if it collides with another car or object. It also covers damage caused by potholes or if your vehicle rolls over.

Comprehensive car insurance:

This pays out the cost of repairing or replacing your car if it is lost or damaged due to non-collision accidents. Among the incidents that comprehensive car insurance covers are fire, theft, vandalism, falling objects, and natural calamities.

Here’s a checklist of the different types of coverage you may need in your car insurance policy:

Car insurance policy checklist – coverage types

CAR INSURANCE COVERAGE CHECKLIST

☐ Liability car insurance

☐ Bodily injury liability car insurance

☐ Property damage liability insurance

☐ Personal injury protection insurance

☐ Medical payments coverage

☐ Uninsured motorist insurance

☐ Underinsured motorist insurance

☐ Collision coverage

☐ Comprehensive car insurance

If you require specialized coverage, there is a range of car insurance policies that you can choose from.

If you’re leasing a vehicle, there’s insurance for leased cars. You can check out all types of auto coverage available in the US in our complete guide to car insurance types.

2. Coverage amount

Each state implements its own coverage requirements and mandatory coverage limits. We’ve compiled these in a single table in this guide to how car insurance works.

While states impose minimum coverage requirements, this may not always be sufficient to cover injuries and property damage that you caused in an accident. Often, you will need to purchase a car insurance policy that exceeds the limits of what your state requires. This is because you will be responsible for paying out any expenses that go beyond your coverage limits.

Many industry experts recommend that you get coverage enough to cover your net worth. This means a value that is equivalent to all your assets and investments, minus your debts.

Use the table below as a checklist to work out how much coverage you need for your car insurance policy:

Car insurance policy checklist – coverage amount

CAR INSURANCE CHECKLIST: HOW MUCH COVERAGE DO YOU NEED?

Policy type

Required

Ideal

Best

Liability

☐ State minimum

☐ $100,000 in bodily injury liability per person

☐ $300,000 in bodily injury liability per accident

☐ $100,000 in property damage liability per person

☐ $250,000 in bodily injury liability per person

☐ $500,000 in bodily injury liability per accident

☐ $250,000 in property damage liability per person

Personal injury protection/MedPay

☐ State minimum

☐ $40,000

☐ State maximum

Uninsured/underinsured motorist

☐ State minimum

☐ $100,000 in bodily injury liability per person

☐ $300,000 in bodily injury liability per accident

☐ $250,000 in bodily injury liability per person

☐ $500,000 in bodily injury liability per accident

Collision

☐ Optional

☐ Recommended

☐ Recommended

Comprehensive

☐ Optional

☐ Recommended

☐ Recommended

3. Car insurance provider

With the vast number of auto insurers across the country offering an equally extensive range of policies, picking the one that provides the best coverage can be difficult. To guide you in your search, Insurance Business lists the top factors you need to consider when choosing a car insurance provider. You can tick the box if the company you’re eyeing meets the criteria.

☐ Location: It is recommended that you pick an insurer that operates in your area. A local carrier is familiar with the legal requirements in your state, which makes compliance easier.

The company is also more likely to understand your needs and offer personalized coverage. Filing claims is likewise easier with a local insurer.

If you prefer an established brand, here’s good news: many of the country’s largest car insurance providers have nationwide reach.

☐ Company reputation: A good car insurance company knows how to provide excellent customer service. It has a reputation for being responsive, fair and efficient in handling insurance claims.

A quick way to find out if an insurer has an effective claims process is to check the National Association of Insurance Commissioners’ (NAIC) complaint index.

☐ Financial stability: Financial wellness and security are an indication that an insurer can pay your claims. There are several websites where you can check a company’s financial strength, the biggest of which are AM Best, Fitch, and Standard & Poor’s.

☐ License: This wouldn’t be an issue for established brands. But if you choose to go with lesser-known carriers, it pays to check if they meet your state’s licensing requirements as this affects the validity of your car insurance policy. You can contact or visit the website of your state’s insurance department to check an insurer’s status.

☐ Pricing: Car insurance isn’t cheap. That’s why it’s best to go with an insurer that offers the best coverage at an affordable price. The simplest and fastest way to find one is to shop around and compare car insurance quotes.

4. Premiums

As much as your car insurance policy helps cover the cost of repairing dents in your car, at the same time, the insurance premiums that you pay can put a huge dent on your savings. That’s why it can be tempting to go with the cheapest plan. But cheaper doesn’t always mean better, especially when it comes to getting the right protection.

Besides the price, there are several other factors you need to consider in getting the best deal possible. These include:

☐ Level of coverage: While states impose minimum car insurance requirements, these don’t necessarily provide adequate protection when unexpected accidents occur. When working out the types and amount of coverage you need, it’s best to assess how much you’re set to lose if you cause a major accident.

☐ Features and benefits: Your car insurance policy should have the features and benefits tailored to your unique needs. It should also give you the flexibility to modify coverage if your personal situation changes.

☐ Deductible: An insurance deductible is the amount you need to pay before your insurer picks up the tab. While a higher deductible allows you to reduce your premiums, you should make sure that the amount is at a level that you can afford to shell out.

☐ Mode of purchase: Purchasing car insurance online can be a quicker and cheaper way to access the coverage that you need, but it doesn’t suit everyone. If you prefer a more personal touch, you can contact an experienced car insurance agent or broker.

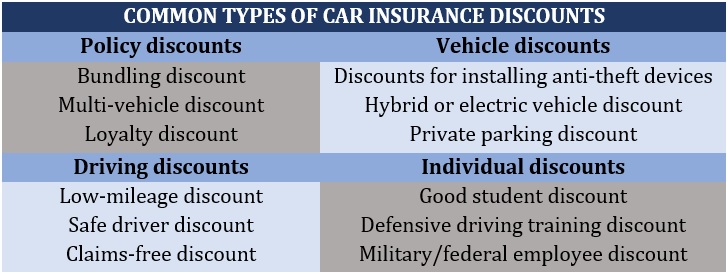

☐ Discount options: One of the best ways to access cheap car insurance is to take advantage of discounts. Car insurance companies offer a range of money-saving perks for different kinds of motorists, from young and inexperienced drivers to seasoned veterans with a spotless driving record.

The table below lists some of the most common discount offerings from the country’s auto insurers:

You can check out how rates differ between the country’s largest auto insurers in our latest car insurance comparison.

Car insurance is mandatory in almost all US states. The only exceptions are New Hampshire and Virginia.

New Hampshire drivers who choose to go without insurance are required to provide proof of their financial capability to cover for injuries and damages for an at-fault accident, according to the state’s Financial Responsibility Law.

Motorists in Virginia, meanwhile, can opt out of coverage if they can show evidence of financial responsibility. For those who choose to drive without a car insurance policy, they will need to pay a $500 uninsured motor vehicle (UMV) fee at the state’s Department of Motor Vehicle.

For the rest of the states, those who are caught driving without insurance can face hefty fines and have their future eligibility for obtaining coverage affected.

Our Best in Insurance Special Reports page is the place to go if you’re on the lookout for an auto insurer that can offer the coverage that best fits your needs. The companies featured in our special reports have been handpicked by their peers and vetted by our panel of experts as trusted and reliable market leaders. By choosing a car insurance policy from these providers, you can be sure that you’re getting the right kind of protection that matches your unique needs.

The car insurance market is constantly evolving, and changes occur without warning. Don’t get left out of the latest industry developments. Be sure to visit and bookmark our Motor & Fleet section, where you can keep abreast of the latest industry news and updates.

Do you have additional tips on finding the right car insurance policy? Did you find our car insurance checklist helpful? Share your thoughts in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!