Car insurance at Costco: What members need to know

Car insurance at Costco: What members need to know | Insurance Business America

Guides

Car insurance at Costco: What members need to know

Car insurance at Costco comes with cheaper rates and exclusive discounts. But is it the best option for you? Find out in this guide

Costco is well known for selling wholesale goods at discounted prices, but did you know that the retail giant also offers a range of insurance policies to its members? If you hold either a Gold Star or an Executive membership, you can access car insurance at Costco at relatively cheaper rates.

But how does Costco car insurance work and what types of coverages are offered? Does the wholesale retailer actually underwrite these policies? How much premium savings can you really get by choosing one? Insurance Business answers these questions and more in this guide.

Costco offers car policies through CONNECT, a wholly owned subsidiary of one of the nation’s leading auto insurers, American Family.

CONNECT underwrites car insurance at Costco. This technically means that you’re purchasing coverage from the insurer and not the warehouse club. What Costco does, however, is offer members a range of discounts that allow them to slash premiums, depending on their driving profile.

CONNECT also handles car insurance claims. Auto coverage is available in 45 states and Washington D.C., although the insurer has ceased issuing new policies in California. Car insurance policies are also not available in Alaska, Louisiana, Maine, North Dakota, and Wyoming.

Members can choose not to purchase car insurance at Costco, although the retailer claims an overwhelming majority of its membership opts in. Conversely, CONNECT auto policies are not exclusive to Costco members.

CONNECT also scores high in terms of financial strength, which is among the benefits of having the backing of one of the 10 largest car insurance companies in the US. This means CONNECT has the financial capability to pay out claims.

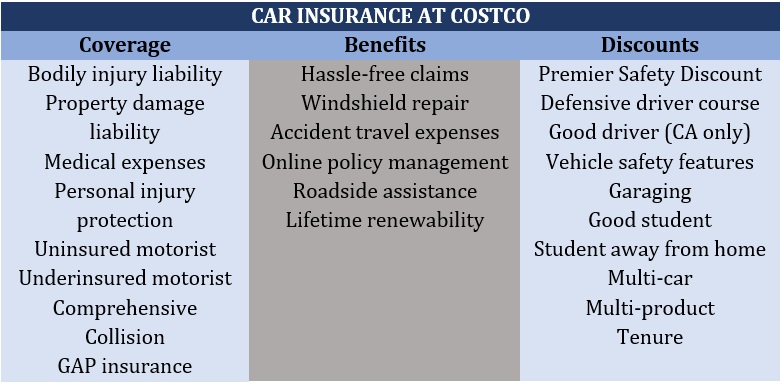

Car insurance at Costco comes with all the standard coverages present in regular auto policies, including state-mandated coverages. These include:

Bodily injury liability: This helps cover legal and settlement costs if you injure someone in an at-fault accident. Policies may also pay for a portion of the injured person’s lost income if they are unable to work, as well as costs related to their “pain and suffering.”

Property damage liability: This pays the cost to repair or replace another person’s property if it was lost or damaged because of an accident that you’re responsible for.

Medical expenses: This covers the cost of necessary medical treatments if you get injured in an accident, regardless of who caused it. Coverage includes diagnostics, hospital stays, doctor visits, and surgery. It covers anyone named in the policy and occupying the vehicle at the time of the collision, as well as your spouse and relatives living in your household.

Personal injury protection: This provides compensation for you, your passengers, and anyone listed in your policy if you get injured or die in an auto accident. Personal injury protection coverage or PIP is mandatory in no-fault states.

Uninsured/underinsured motorist: This compensates you for the injuries and property damage resulting from an accident caused by an uninsured driver. It also fills the gap in coverage if the liable party’s coverage limits are insufficient.

Collision: This covers the cost of repairing or replacing your vehicle if it collides with another car or object. If your vehicle is deemed a total loss, car insurance at Costco will pay for its actual cash value.

Comprehensive: This pays for non-collision damage that your vehicle sustains or those that you have no control over. These include damage resulting from natural disasters, falling objects, fire, explosion, and animals. Costco also offers stolen key coverage as part of this type of policy, with the deductible waived if the claim costs less than $250. You can learn more about how comprehensive car insurance works in this guide.

Roadside assistance and towing: This is designed to help you get back on the road faster. Car insurance at Costco pays for the cost to have your vehicle towed to a service station, your car battery or tire replaced, and gas delivered to fill your tank. However, it doesn’t cover the actual battery replacement and fuel.

Guaranteed auto protection: Also called GAP insurance, this covers the difference between how much your car is worth and the remaining balance on your loan. It can pay up to 120% of your vehicle value and includes new car replacement in your first year of ownership.

Members who take out car insurance at Costco can access a range of discounts and benefits. Among these are membership-only discounts that allow members to save about $596 in premiums during the first year after they switched. Here are some of the benefits and discounts members can access:

Costco car insurance benefits

Hassle-free claims: You can report an incident online or by calling an agent 24/7. You can also choose a repair facility for your vehicle. If you need a temporary vehicle, you can pick one from CONNECT’s preferred car rental service providers.

Windshield repair: Car insurance at Costco covers cracked windshields. It also offers a glass repair deductible waiver at no additional cost if the damage can be repaired without the need for a replacement.

Accident travel expenses coverage: This covers your out-of-pocket travel and accommodation expenses if you are involved in an accident or if your car breaks down 100 miles from home.

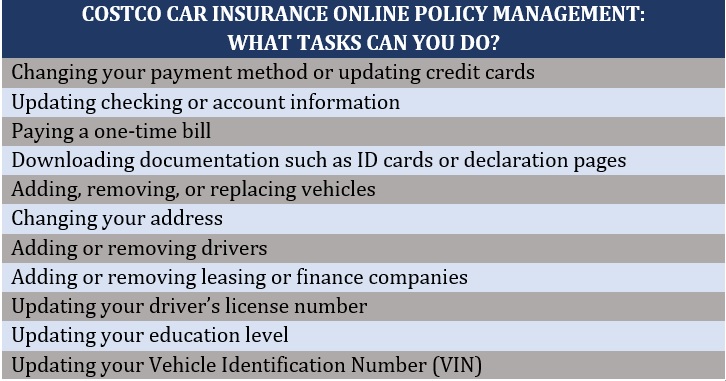

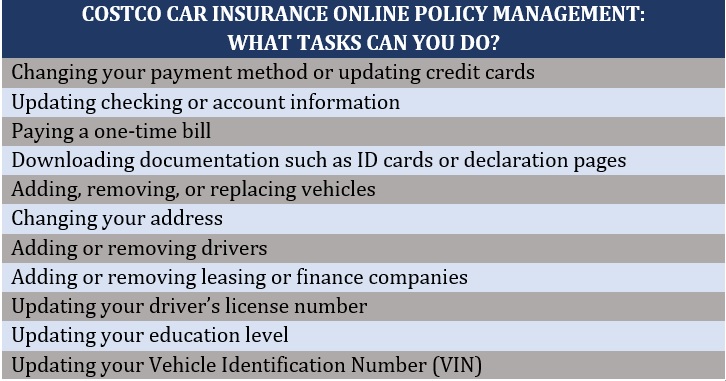

Online policy management: You can register your policy online, so you can make changes and perform important transactions in the comfort of your own home. The table below details the different tasks you can complete with this type of benefit.

Executive members can also access additional exclusive benefits, although the availability depends on the state you live in.

Roadside assistance: This pays out up to $75 for services that can help get you back on the road faster. However, you need to take out towing coverage to be eligible for this benefit. It also doesn’t cover the battery or vehicle fluids such as fuel, oil, and coolant.

Lifetime renewability: This guarantees that your coverage will not be dropped after an at-fault accident. However, there are a few restrictions:

The benefit is not available in Maryland and Michigan.

You cannot access the benefit if you have serious traffic violations.

You are deemed ineligible if you fail to pay your premium.

You are disqualified from getting the benefit if you fail to provide requested documentation.

You cannot be covered if you move to a state that doesn’t offer Costco car insurance.

You are disqualified if you purchase an uninsurable vehicle.

Costco car insurance discounts

Premier Safety Discount: Drivers who have maintained a spotless driving record for four consecutive years, or three straight years in Massachusetts and Florida, are rewarded with discounts. Florida is one of the states with a unique insurance situation. If you want to understand how auto coverage works in the state, you can check out this guide to car insurance in Florida.

Defensive driving course: You may be able to get a discount if you complete a defensive driving course approved by your state’s Department of Motor Vehicle (DMV) or an accredited organization. However, you must take the course as continuing education and not as part of a basic driver’s education classes.

Good driver discount: Available only in California, this rewards drivers with a clean driving record and those who don’t file a claim with reduced premiums.

Vehicle safety features: You can get a discount if your car has certain safety features, including airbags, anti-lock brakes, anti-theft devices, and automatic seatbelts.

Garaging discount: You may be rewarded with a discount if you use a garage for overnight parking.

Good student discount: You can slash premiums off your Costco car insurance if you have a full-time student in your policy who meets a certain GPA.

Student away discount: You can also access discounts if the student attends school at least 100 miles from home and doesn’t have a vehicle.

Multi-car discount: You can get a discount if you insure more than one car at Costco.

Multi-product discount: Bundling your car insurance at Costco with other policies can qualify you for reduced premiums.

Tenure: Costco rewards loyal policyholders with discounts, so if you have been insured under the retail giant for a certain period, you may be eligible for one.

The table below sums up the different policies, benefits, and discounts you can access by taking out car insurance at Costco.

You need to be a member to be eligible for car insurance at Costco, as well as the benefits and discounts that come with the policy. Gold Star members pay an annual fee of $60, while Executive members are charged $120 per year.

Costco members, however, are free to purchase coverage from another insurer. Non-members can also buy insurance directly from CONNECT, but they may not be able to access some of the discounts afforded only to Costco members.

Car insurance at Costco costs around $1,070 per year for full coverage. This figure is for a hypothetical male driver with a clean driving record and good credit, purchasing a policy with 50/100/50 liability coverage and a $500 deductible.

Costco’s annual premiums are between $50 and $400 cheaper than those from the country’s largest auto insurers featured in our recent car insurance comparison guide. And with the retail giant’s extensive list of discounts, members can slash more off their yearly payments.

https://www.youtube.com/watch?v=mBgDdjpEKPM

Among the biggest benefits of getting car insurance at Costco are the relatively cheaper premiums and the opportunity to slash these further with the extensive range of discounts. Executive members can also access guaranteed lifetime renewability even if they have been involved in accidents and minor traffic infractions.

However, these cheaper rates come with a caveat. CONNECT, the company that underwrites the retailer’s car insurance policies, has a higher-than-average level of complaints based on the latest data from the National Association of Insurance Commissioners (NAIC).

NAIC’s complaint index reveals that CONNECT got a score of 2.40. This means it has more than twice the number of complaints than the industry average of 1.0. While this shouldn’t necessarily deter you from taking out car insurance at Costco, it’s important to know that many of the country’s largest auto insurers have lower complaint levels.

The table below sums up some of the pros and cons of Costco car insurance.

If you’re looking for a great way to get cheaper premiums, then taking out car insurance at Costco may be a good idea. Members can also access a range of exclusive discounts to further cut costs.

But as industry experts have stressed many times before, price shouldn’t be the sole factor when picking coverage. Costco may offer cheaper rates but its high level of complaints on claims-handling may mean a longer wait before your claims are processed.

Have you experienced getting car insurance at Costco? How was it? Feel free to share your story below.

Keep up with the latest news and events

Join our mailing list, it’s free!