Canada insurers count cost of "horrific" Fiona

The last hurricane to hit Canada was Igor, which hit Labrador and Newfoundland in 2010 with wind speeds exceeding 170km/h in some areas. Adjusting for inflation, insured losses from Igor, which temporarily cut 150 communities off, were approximately US$268 million, according to Swiss Re figures.

Hurricane Juan, which hit Halifax in 2003, cost US$233 million in today’s money.

Tropical cyclone Dorian, which made landfall in 2019, cost the equivalent of US$166 million today.

“When we consider the fact that there were four provinces this time round that were impacted from Fiona, we could only estimate that the losses would be around this ballpark,” Dipika Deol, head P&C treaty underwriting, Canada & English Caribbean, senior vice president, Swiss Re, told Insurance Business, referring to the figures for Igor, Juan, and Dorian.

“I’d be surprised if they’re lower than these amounts, because not only do we see a larger impacted area, but we also have much more urbanisation, we have many more people who are living in harm’s way.”

Read more: Asia counts typhoon cost as Atlantic heats up

Loss adjuster Crawford saw its claims line activity spike to six times normal levels over the weekend of the storm, while its contractor hotline saw 50 times the usual level of engagement.

“Fiona came in with a wrath; she was angry,” said Crawford chief client officer Heather Matthews.

“Ironically, it could have been worse though, because the city of Halifax didn’t get as much of a direct hit, [the storm went] a little bit further north, but we are seeing damages of historic proportions.”

Crawford has seen claims from hospitals, infrastructure projects, and government buildings, Matthews said, with downed trees from the wind impact driving personal property and auto claims.

In Newfoundland, structures have been pictured being washed away.

Meanwhile some are having to contend with fire risk. In Charlottetown, Prince Edward Island, the Stanhope Golf and Country Club reportedly saw its clubhouse burn down. Further fires have occurred, Matthews relayed from a colleague based in Halifax, with downed trees and hydro lines having potentially sparked blazes.

Thus far the loss adjuster has seen no evidence of cranes being downed, something that has proved an issue in built up areas in the past.

With the hydro (electric) still down for many, and rain forecast over the next week, Matthews predicted that any reporting lag could be exacerbated by network issues and “long tail” flooded basement claims where sump pumps have stopped working.

“We’ll also start to see food spoilage and business interruption claims,” Matthews said.

Read more: UBS: Hurricane Dorian insured damage estimates reach US$25 billion

At insurer Aviva, personal property and automobile claims have already started coming through, according to Paul Gilbody, SVP, Healthcare and Property Claims, Aviva Canada.

“We are starting to see some commercial claims come in,” Gilbody said.

“But they typically take a couple of days longer to come through, so it may very well be later this week that we see some of that.”

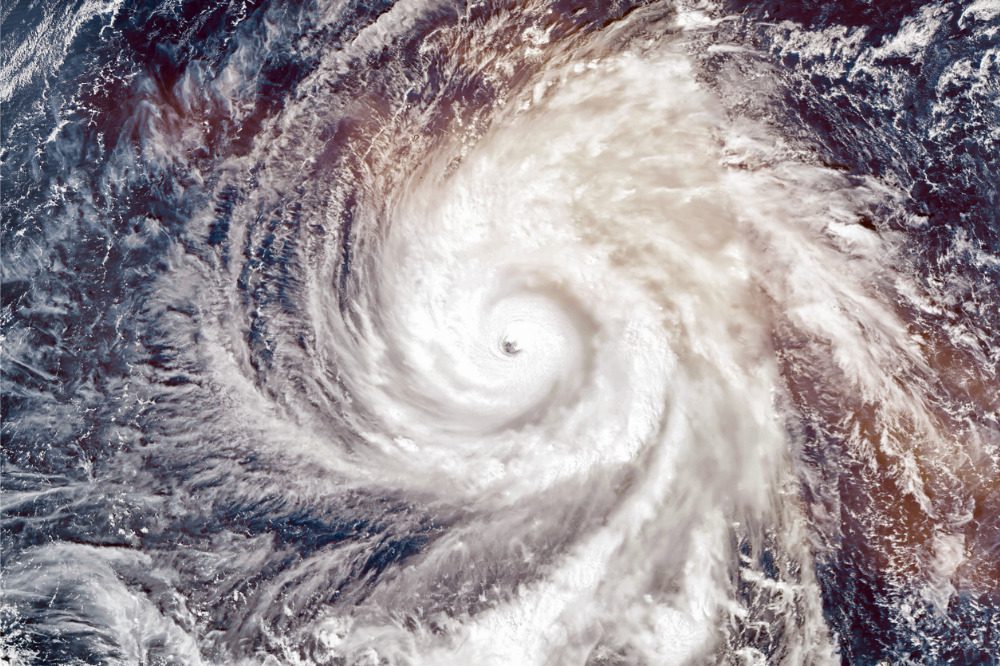

Prior preparation meant Aviva had staff working over the weekend to assist with the effort. The insurer has seen “quite severe claims” and, with the storm roughly 300 miles wide, some have come in from areas further afield from the eye wall.

“One of the things that I’m really proud of the Aviva team on is that the fact that we were so well prepared, and I think the speed of response is going to help some of the claims be mitigated from a value point of view – so we’ll see how it goes,” Gilbody said.

Gilbody declined to put a number on potential insured losses, but did say: “It’s going to be a very, very, very big event, and given the scale of the storm, we are going to see an awful lot of claims.”

“Hopefully the damage for people’s properties is as minimal as it can be,” he added.