Can Your New Year’s Resolution Affect Your Life Insurance?

Eeek! The dreaded ‘New Years Resolution’ period is in full swing and if previous years are anything to go by most of us will be hanging up our newly bought gym ware, picking up the wine, and having buyers remorse when the postie lands a parcel the size of Everest at our front door by the end of next week.

Because we all start the year with great intentions but sticking to those new habits can be hard as hell!

How about I give you a little extra incentive to keep hitting that pavement and keep chewing that gum?

Ah, your interest is piqued now.

You see those New Years Resolutions can do wonders for the cost of your life insurance. That’s right I’m giving you a financial incentive to keep on keepin on.

I mean, c’mere it makes sense. Healthier habits, healthier lifestyle means less risk of serious health issues.

It’s just something we all kind of forget.

And the insurers are all ears if you can improve your health because it means less chance of them having to pay out.

Tis a win-win for everyone.

If your resolution is not yet in full swing, we’re going to give you a quick rundown of how some of those bad habits really do affect your life insurance costs.

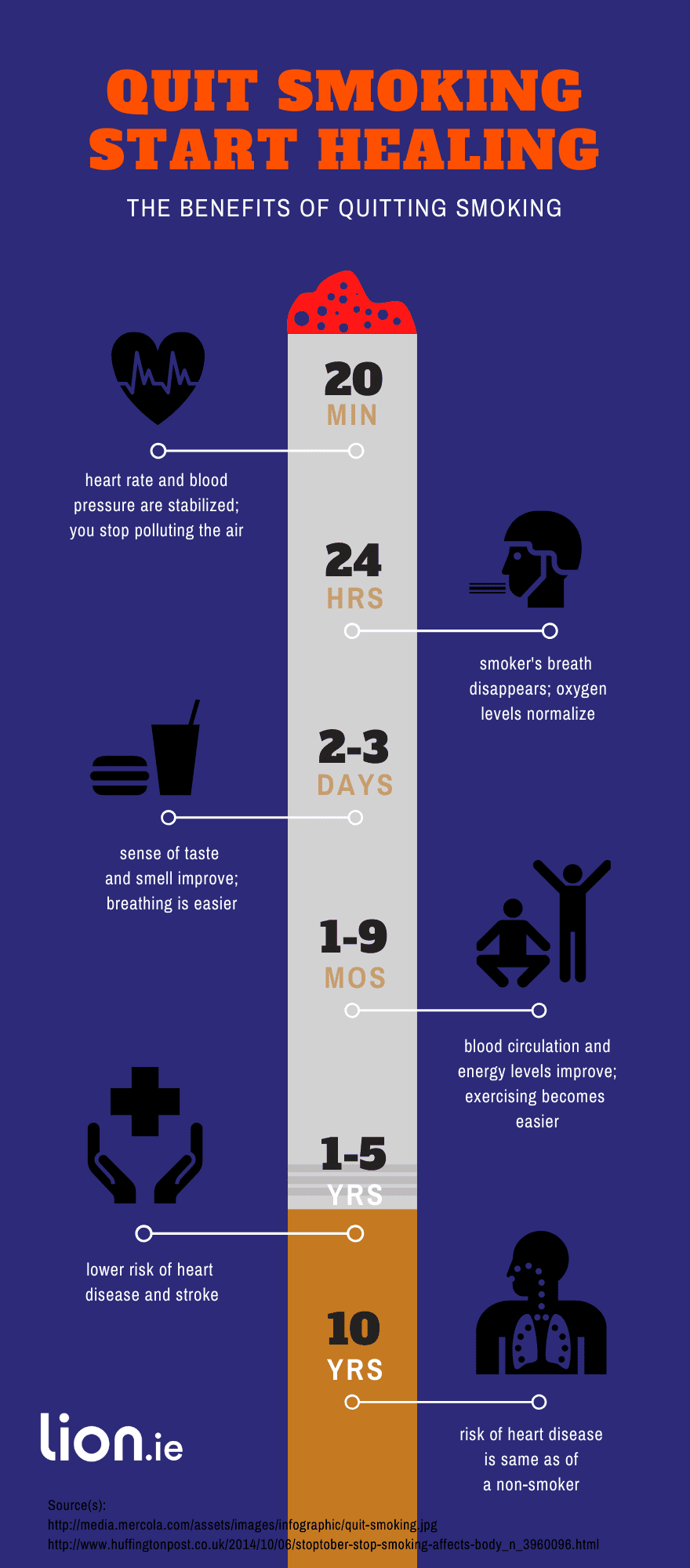

Kicking The Ciggies

The price of a pack of cigarettes is pricy on its own.

I know, if you want to smoke you’re going to.

Something’s going get you in the end, if you’re happy it’ll be the smokes, well sure fair play. I’m not here to slap your wrists and send you to the naughty step.

In the words of every girl boss around the globe

You do you boo

But you might be a little curious as to how much extra you are paying thanks to those little tobacco-filled sticks.

Now I’ll be honest I can’t give you an exact figure. Every life insurance quote is a precarious little thing.

Dependent on more than just your age and any previous health issues.

On average you’ll fork out around double the amount of wonga to your insurance company if you are a smoker.

And yes, you social smokers will pay the same as the diehard 40 a dayers.

Honestly, that adds up. I don’t know about you but I’d rather that money go towards a week in sunny Tulum (google it)

For you e-cig and vape users, you’re not out of the woods either. The same premiums that apply to smokers also apply to you.

So if you have told the world that December 31st, 2021 was your last day of smoking and you’re still smoke-free – kudos to you but I bet you’re wondering when this no smoking privilege comes into effect?

Once you are 12 months free of all smoke paraphernalia you are considered a non-smoker and you can see a dramatic reduction in your life insurance payments.

Losing A Few Lbs

I’m all for body positivity but there’s no escaping that the higher your BMI is, the larger costs you’ll be hit with when it comes to your life insurance.

Much like our baccy-loving pals, you could be forking out almost 50% more than your slimmer-waisted friends.

In fact, if your BMI is over 45 you may find it very difficult to get life insurance at all. Think Frodo and his journey to Mount Doom.

It seems extreme but finding a provider who will cover your life insurance with a BMI of 45+ is that hard.

So losing weight may be your only option if you want to protect your family in the event of something terrible happening to you.

Plus if you’ve just dropped a couple hundred on new fitness wear in those wonderful January sales you might as well get a decent bit of intended use out of it.

Although a higher BMI doesn’t always result in a health issue, unfortunately, the insurance gods that make the rules have to draw their line somewhere and BMI is hill they’ve chosen to die on.

The little men like me just want you to get the best insurance deal you possibly can and if that means dropping a few of those sneaky pounds, it’s definitely something to mull around in the ole noggin’ before you apply.

If your BMI is 45+ and your goal is to get a mortgage this year, you’re going to struggle to get mortgage protection unless you can drop some pounds so that’s even more incentive to eat healthily in 2022.

Cutting Out The Booze

How your alcohol consumption affects your life insurance really depends on how much you drink.

If you’re a one-and-done type of drinker or just a social drinker, you’re grand. These drinking habits aren’t red-flagged by any provider.

However, if you are a very heavy drinker, alcohol dependant, or have been told to abstain from drinking alcohol and you’ve decided to continue anyway, finding an insurer who will cover can be virtually impossible.

Giving up the booze is a massive step for dependants. I applaud any and all who have tried.

Sobriety for 2 years will make the life insurance doors swing open, the heavens sing and the angels defend.

Okay not quite but after that time, at least you’ll be insurable. Although it is important to be aware that if you suffer from any alcohol-related chronic illness, it just may cost you a little more.

What Next?

So now you have a little more pep in your step, an extra reason to keep up the good work and fight the good resolution fight.

What now?

Keep her lit!

We’re a species that thrives on instant gratification and it can be hard to keep up a habit that requires time to reap massive benefits. Think of it this way though next January might seem miles away but look back at last January.

Doesn’t feel so long ago right?

As we told the kids as they gripped the Christmas tree like a drowning man clutching a log, “we’ll be putting it back up in 10 months”.

You’ll feel like a boss when you reminisce about 2022 and how you stuck to that new healthy habit and hit your goal.

Plus you’ll have the added bonus of lower monthly life insurance payments.

Is your NY resolution to finally, FINALLY sort out your family or income protection, or are you on the mortgage bandwagon in 2022? Either way, if you need some help, I’d love to guide you.

Complete this financial questionnaire and I’ll take a look at your personal circumstance and give you my thoughts for nada – think of it as a late Christmas present 🙂

Happy New Year!

Nick

nick @ lion dot ie | 05793 208236