Can you get health insurance with pre-existing medical conditions?

If you currently have or have had medical conditions, you may wonder whether they’ll affect your ability to get private health insurance. In this guide, we explain how pre-existing medication conditions may affect your cover, highlighting one insurer that often covers more than others.

What is a pre-existing medical condition in relation to health insurance?

Technically, a pre-existing medical condition is anything you’ve suffered from, had treatment for, or sought advice about in the past, and unless you’re something of a super-human, you’ve likely got at least a couple.

When it comes to health insurance, you usually only need to worry about those you’ve suffered from in the past five years, thanks to how Moratorium underwriting works.

Moratorium underwriting is a method insurers use to simplify getting a new policy, removing the need for a detailed medical questionnaire. With moratorium underwriting, the insurer automatically excludes pre-existing conditions that you’ve experienced in the past five years. Anything before that won’t affect your cover levels unless you’ve had symptoms or sought advice for it!

Can you get health insurance with pre-existing conditions?

Yes, you can get private health insurance if you have pre-existing medical conditions, but anything you’re currently suffering from or have suffered from in the last five years will be excluded.

Will my insurer ever cover pre-existing conditions?

After getting a private medical insurance policy with moratorium underwriting, if you go two years without having symptoms or needing medical advice or treatment for that condition, then your insurer will usually remove the exclusion. So yes, if the condition goes away, it’ll likely be covered in the future.

Here’s an example of how it works:

Jessica is a keen sportswoman who twists her knee and tears her meniscus during a football match. She doesn’t have private health insurance, and given long NHS waiting times, she decides to pay out of her pocket for a private MRI scan and then surgery, setting her back around £5,000, but getting the issue resolved.

Her surgeon explains that due to the surgery, it’s more likely she’ll develop arthritis in 20-30 years, possibly requiring a knee replacement.

Jessica accepts this and, off the back of the unexpected expense, decides to buy a health insurance policy to better protect herself in the future.

If Jessica doesn’t suffer any further symptoms or need more treatment on the knee over a two-year period of having a policy, then anything related to it should be covered in the future, including the potential knee replacement in later life. Assuming she continues paying her premiums of course.

On the other hand, if Jessica is left with knee pain or seeks further advice or treatment for it, it won’t be covered until she’s gone two full years without any troubles.

Chronic conditions are excluded

A chronic medical condition is one that, by its nature, can’t be recovered from and instead requires life-long monitoring and management. All health insurance policies exclude chronic medical conditions, regardless of whether they start before or after you get a policy. However, some will occasionally pay for the treatment of acute flare-ups of the chronic condition but not the ongoing monitoring and management.

If you have out-patient cover, your insurer will often cover the cost of being diagnosed privately, as it could be something other than a chronic condition causing your symptoms. But, as soon as it’s established that it is chronic and not an acute medical condition, you’ll be referred to the NHS for ongoing management.

Examples of chronic medical conditions:

DiabetesAsthmaChronic fatigueIrritable bowel syndrome

Again, like with pre-existing conditions, while chronic illnesses are excluded, you can still get or keep a health insurance policy, as many people do, it’s just that your chronic illness, and likely anything related to it, will be excluded from cover.

Which private health insurance is best for pre-existing medical conditions?

Currently, the best and fairest health insurance provider for pre-existing medical conditions is The Exeter and their Health+ policy.

Whether you opt for their Full Medical Underwriting or Moratorium Underwriting, you’ll usually find that they will cover more conditions related to pre-existing and chronic conditions than others.

Exeter will still exclude the actual pre-existing or chronic condition; it’s just that they don’t usually exclude many, if any, related conditions.

Strangely, The Exeter is somewhat shy about this unique selling point, and you won’t find anything about it on their website or in their policy documents. However, we’ve heard from numerous brokers and even The Exeter themselves that it’s true.

Indeed, in May 2024, we received a document that came from The Exeter stating:

The Exeter do not exclude related conditions under their moratorium terms.”

This means that if you develop a new condition that is related to any of your pre-existing conditions, as long as you didn’t have any symptoms, treatment, medication or advice relating to the new condition, in the 5 years prior to the policy start date, this will be eligible to claim for.”*

*myTribe was given this information in May 2024. While it is our understanding when writing this article, The Exeter could change or withdraw this benefit anytime.

So why isn’t it on their website or in their terms?

Only The Exeter knows why this isn’t being more publically pushed, as it’s a huge selling point and a significant differentiator between them and the rest of the market. They are telling brokers but not including it in their terms or policy documentation. So, some care is needed when buying a policy.

Get it in writing from someone before you buy

As this USP isn’t baked into Exeter’s terms and conditions, it could be withdrawn at any point and without notice. This article, written on June 5th, 2024, may be outdated tomorrow, so please, if you are planning on getting a policy from Exeter with the expectation that things related to pre-existing conditions will be covered, GET IT IN WRITING first.

Ask your broker, or if you’re going direct, The Exeter themselves, to put it in writing that related conditions won’t be excluded under their moratorium terms.

By doing this, you know that if this gets suddenly withdrawn, you have first-hand evidence that it’s what they agreed to when you took out the policy.

How underwriting affects what’s covered by your policy

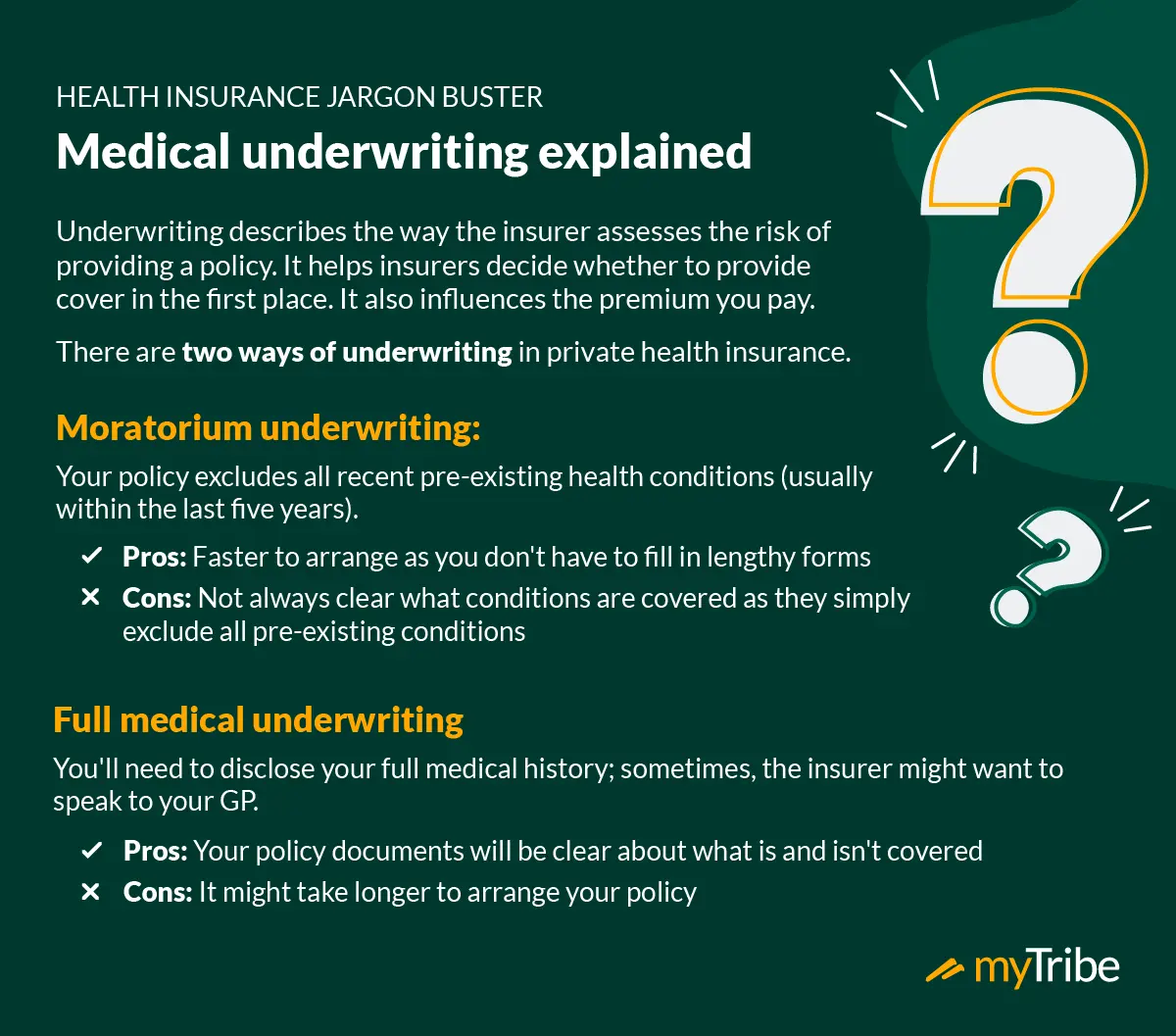

For people taking out a new health insurance policy, there are usually two choices when it comes to underwriting, which, as a reminder, is the process the insurer goes through to determine what it will and won’t cover.

Moratorium Underwriting – as explained earlier, this is the simplest option, and most new policies use this type of underwriting. The added benefit of moratorium underwriting is that if pre-existing conditions get better, and don’t cause ongoing symptoms or need treatment for two years, they’ll become covered into the future. The disadvantage is that as the initial exclusion is “Any pre-existing conditions in the past five years”, along with related conditions often being excluded too, you don’t get clarity when taking out the policy of precisely what isn’t covered, and that might only be learnt when you need to claim.Full Medical Underwriting – the alternative to moratorium underwriting is Full Medical Underwriting, where you complete a detailed medical questionnaire before getting the policy, and your insurer will let you know precisely what will and won’t be covered. Again, The Exeter are strong when it comes to this type of underwriting, often excluding less related conditions than others. The main disadvantage of Full Medical Underwriting is that once you have an exclusion on your policy for a pre-existing condition, even if you go symptom-free for several years, it’s unlikely to be added back into the policy unless you go through the underwriting process again.

There’s no categorical “best” type of underwriting, as it’ll depend on your circumstances and medical history, but it should be high on your agenda to raise with your health insurance broker, as the decision you make today can affect cover levels for many years.

Do pre-existing conditions make health insurance more expensive?

Pre-existing medical conditions don’t usually affect the cost of your health insurance. The insurer effectively removes any risk associated with the condition by excluding them, so there is no need to charge you more.

While strictly speaking, your health insurance won’t cost more, as you’ll have exclusions, you will be essentially paying the same as someone without those exclusions, so it could be argued that you’re paying the same for less.

How to compare health insurance for pre-existing conditions

If you have pre-existing conditions, we strongly recommend that you consult a health insurance broker (request a quote from us to speak with one for free). They will be able to help you choose the best type of underwriting, compare leading providers, and determine which insurer is best based on your circumstances and requirements.

Tips for finding the right health insurance with pre-existing conditions:

Which type of underwriting is best for youWhich insurer offers the most cover based on your medical historyWhat are the benefits of each insurer and any disadvantagesWhich insurers are fairest when it comes to how claims affect premiumsWhich insurers have the best claims and customer service levels

Disclaimer: This information is general and what is best for you will depend on your personal circumstances. Please speak with a financial adviser or do your own research before making a decision.