Can employer-based health insurance finance coverage of gene therapies?

According to a recent paper by Doshi et al. (2023), the answer is ‘yes‘! Why do people think otherwise?

Many people are concerned that there may not be a sustainable way for the private group insurance market, particularly in small self-insured firms, to cover gene therapies? If a firm—particularly a smaller, self-insured firm—gets one or two patients who needs gene therapies, this could ruin their profitability for reasons that have nothing to do with the underlying expense.

However, gene therapy is the perfect case for why insurance is needed:

After all, the primary goal of insurance, in theory, is converting a large, unexpected, unaffordable, but rare expense into a moderate insurance premium, by spreading an individual large expense over many premium payers.”

Moreover, in a competitive market, firms decision to cover cost-effective gene therapies may be a competitive advantage to attract labor.

…employers competing for risk-averse workers will offer such protection against financial risk if they are to match what other employers (large or small) offer.

However, the

issue still may be relevant for small firms who self-insure and do not hold any

stop loss provisions for patients with outlier cost. Firms self-insure for three primary reasons

(i) state taxes do not apply to self-insured plans, (ii) firms have more

control over self-insured plans, and (iii) costs may be lower if the firm has a

healthier than average population. What are stop loss provisions?

Stop-loss insurance is a form of insurance where an outside insurer agrees to cover self-insured employer claims in excess of some prespecified limits. It provides financing for unusually large claims or claim totals.”

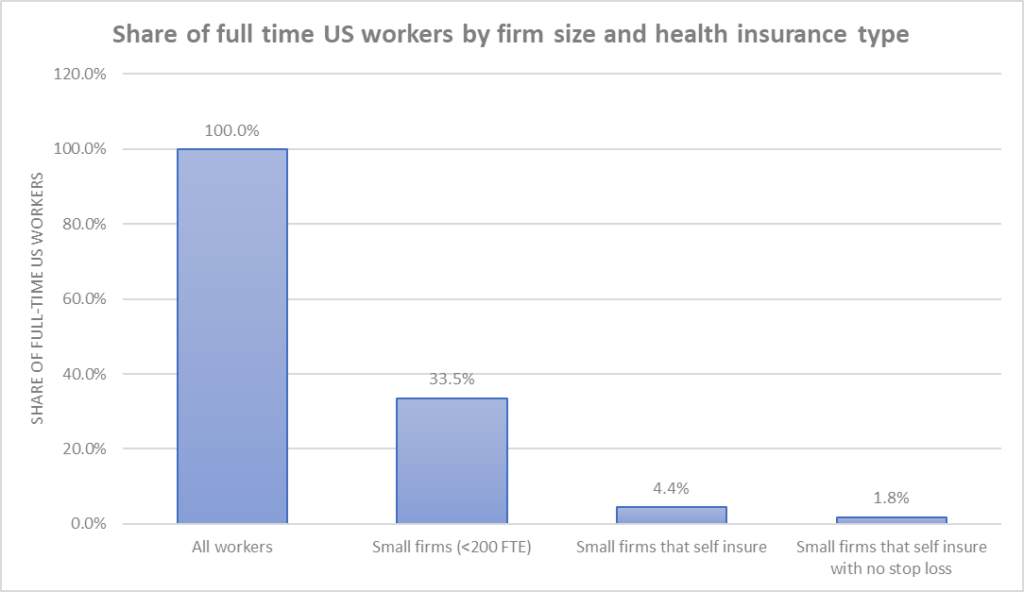

How many workers are included in these types of firms? Doshi et al. use data from the Medical Expenditures Panel Survey Insurance Component (MEPS-IC) and the Kaiser Family Foundation (KFF) Health Benefits Survey of Employer Health Benefit Offerings to find out. Overall, only 1.8% of workers are employed at small, self-insured firms with no stop-loss provision.

Moreover, they

find that data from MEPS finds that even among small, self-insured firms with

<200 FTE, 59.2% (MEPS) or 72% (KFF) have a stop-loss provision.

It is true,

however, that the cost of stop-loss coverage has been rising over time. Between

2012-2022, stop loss insurance coverage increased by 138% compared to family

premium increases of only 43% over that same time period.