CA individual health insurance for LA ICHRAs

Looking for the best individual health insurance options in Los Angeles to use with an ICHRA? You’re in the right place – and there’s good news! The individual coverage HRA (ICHRA for short) is taking off where you live, thanks to a vibrant local individual health insurance market. That means more ACA-compliant, high quality health insurance choices for employees.

We’ve put together this guide to help employees orient themselves to the local individual health insurance market in Los Angeles to use with their Individual Coverage HRA. Health insurance can be confusing, and many employees offered an ICHRA will be buying their own health insurance for the first time. We’ve got you covered!

Who this guide is for:

Employees shopping for health insurance to use with their ICHRA

Employers wanting to help their employees make educated decisions about their health plans to use with their ICHRA

Employers of any size considering implementing an ICHRA

What this guides covers:

What is an ICHRA?

First things first. An Individual Coverage HRA (ICHRA, for short) is a fundamentally new model of benefits that allows employers to set aside tax-free dollars to reimburse employees for health plan premiums that individuals choose themselves. That means employees get to choose the best plan for their family, their unique health needs, and their budget.

2022 Los Angeles individual health insurance options for ICHRA

Individual coverage HRAs are taking off in L.A. thanks to the health, competition, and affordability of the individual health insurance market.

More and more employers in Los Angeles are realizing their benefits dollars stretch further on the individual health insurance market instead of group plans, and this brings ample employee benefits too, like personalization and choice.

Disclaimer: These rates are estimates for Los Angeles in 2021 in the 90011 zip code. Your premiums may vary and we expect slight changes for 2022. See our window shopping tool to check for exact premium rates in your area.

Market Snapshot

Los Angeles’ competitive individual health insurance market and innovative carrier lineup mean more choices for employees. The infographic below demonstrates the wide range of carriers, network types, and average lowest cost premiums by tier.

Pro-tip: To calculate costs for adding a spouse or family to a plan, use double the rate for married, or triple for families.

L.A. has seven individual health insurance carriers to choose from and a wide range of network types.

Disclaimer: Plan information is based on 90011, the most populated zip code in Los Angeles. Rates will vary by zip code and county.

Remember, all of the plans listed here are ACA-compliant, meaning they cover pre-existing conditions and 10 essential benefits.

These benefits include coverage with no annual cap for the following:

Ambulatory patient services (outpatient services)

Emergency services

Hospitalization

Maternity and newborn care

Mental health and substance use disorder services, including behavioral health treatment

Prescription drugs

Rehabilitative and habilitative services and devices

Laboratory services

Preventive and wellness services and chronic disease management

Pediatric services, including oral and vision care

Have questions? Get in touch.

Employees: If you are an employee looking to sign up for individual health insurance in Los Angeles to use with your ICHRA, our enrollment team is standing at the ready to help. You can set up a call with enrollment team here.

Business owners: If you’re a business owner and have questions about ICHRA, please schedule a time to chat with our HRA Design team to see if ICHRA is a good fit for you.

Brokers: If you’re a broker considering ICHRA as an option for a client, submit an HRA Design request to see if this is a good fit for your client.

The lineup: Los Angeles’ best individual health insurance carriers to use with ICHRA

Los Angeles has a great group of individual health insurance carriers to choose from.

These include (in alphabetical order):

Anthem Blue Cross of California

BlueShield of California

Kaiser Permanente

L.A. Care Health Plan

Molina

Health Net

Oscar

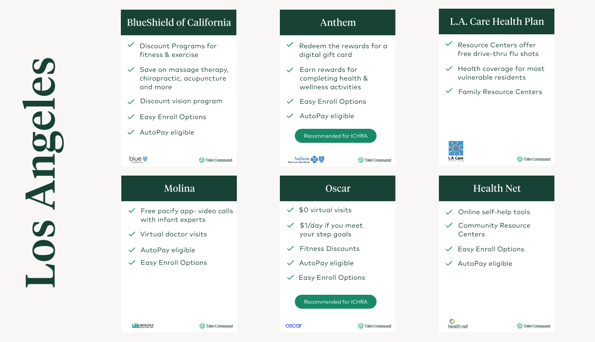

Here’s a Los Angeles health insurance infographic for a quick visual.

Anthem Blue Cross of California

BlueShield of California

Kaiser Permanente

L.A. Care Health Plan

Molina

Health Net

Oscar

Recommended for ICHRA

✔️

✔️

✔️

✔️

Easy Enroll options

✔️

✔️

✔️

✔️

TBD

AutoPay eligible

✔️

✔️

✔️

✔️

TBD

Off-exchange options

✔️

✔️

✔️

✔️

✔️

✔️

*Autopay is a new feature on our platform that enables employers to take advantage of ICHRA and all its benefits without asking their employees to pay premiums out of pocket and wait for reimbursements.

One simple monthly payment that covers all of the reimbursements for insurance premiums (and medical expenses) for all employees. Our platform will manage the payments for employees’ health benefits, reconciling their premiums and allowance with payroll. Learn more here.

*Easy Enroll is a plan feature that allows employees on the Take Command platform to enroll directly in the portal with no further steps needed. This is the simplest type of plan to choose.

*Off-exchange options are important for employees that choose a plan that costs more than their allowance, since they’ll have to put in some of their own money to cover the difference. That difference can be tax-free when combined with a Section 125 payroll deduction but only for off-exchange plans (due to some ACA restrictions).

Here’s another handy infographic that includes some of our favorite things about each individual health insurance carrier in LA.

![]()

How much does individual health insurance cost in Los Angeles per carrier?

While 2022 rates haven’t been released yet, these are the lowest cost plans per metal tier for 2021 for each carrier in L.A. We expect these to change only slightly from this past year. We will update this section as new information is released for 2022.

Note: The below rates are 2021 estimates based on LA zip code 90011 only.

What we love:

Anthem Skill for Alexa

Smart Rewards program to earn points for health and wellness activities and redeem them for retail gift cards

24/7 Virtual care

24/7 Nurse line

AutoPay eligible

Easy Enroll options

Recommended for ICHRA

Lowest cost by metal tier for Anthem in Los Angeles

Age

Bronze

Silver

Gold

Platinum

20

$250

$260

$340

$470

30

$290

$300

$400

$550

40

$330

$340

$450

$620

50

$450

$470

$630

$870

60

$690

$720

$990

$1,320

What we love:

Discount programs for fitness and exercise

Save on massage, chiropractic care, acupuncture, etc.

Discount vision program

AutoPay eligible

Easy Enroll options

Recommended for ICHRA

Lowest cost by metal tier for BlueShield of California in LA

Age

Bronze

Silver

Gold

Platinum

20

$280

$270

$280

$330

30

$330

$310

$330

$384

40

$370

$350

$370

$430

50

$570

$490

$520

$600

60

$870

$750

$790

$990

What we love:

In network with any Kaiser Permanente health facility in multiple geographies across the country

Integrated structure

Easy Enroll options

Recommended for ICHRA

Lowest cost by metal tier for Kaiser Permanente in LA

Age

Bronze

Silver

Gold

Platinum

20

$230

$290

$320

$360

30

$270

$340

$370

$420

40

$300

$380

$420

$470

50

$420

$540

$580

$660

60

$640

$810

$880

$1,000

What we love:

Drive Thru flu shots and vaccines

Family Resource Centers provide free health education classes, exercise classes, and health screenings.

Lowest cost by metal tier for L.A. Care Health Plan in Los Angeles

Age

Bronze

Silver

Gold

Platinum

20

$210

$260

$270

$300

30

$240

$300

$310

$360

40

$270

$340

$350

$400

50

$380

$470

$500

$560

60

$580

$720

$750

$850

What we love:

Free Pacify App that supports video calls with infant experts

Virtual doctors visits

AutoPay eligible

What we don’t love:

Really bad customer service

On-exchange plans only

Lowest cost by metal tier for Molina in Los Angeles

Age

Bronze

Silver

Gold

Platinum

20

$250

$260

$280

$310

30

$300

$310

$320

$370

40

$340

$350

$360

$410

50

$470

$480

$510

$580

60

$710

$730

$770

$880

What we love:

Easy Enroll options

AutoPay eligible

Lowest cost by metal tier for Health Net in Los Angeles

Age

Bronze

Silver

Gold

Platinum

20

n/a

$260

$340

$410

30

n/a

$300

$400

$480

40

n/a

$340

$450

$540

50

n/a

$480

$630

$760

60

n/a

$730

$960

$1,150

What we love:

Talk to a doctor 24/7 for $0

Free telehealth

Earn $1/day for meeting step goals (up to $100!)

Prescription refills over the phone

Great customer service

AutoPay eligible (TBD)

Easy Enroll options (TBD)

Recommended for ICHRA

Lowest cost by metal tier for Oscar in Los Angeles

Age

Bronze

Silver

Gold

Platinum

20

$250

$310

$340

$450

30

$290

$360

$390

$530

40

$330

$400

$440

$590

50

$450

$560

$620

$830

60

$690

$850

$940

$1,1260

For rates in your area based on your age, family size, and other variables, check out our window shopping tool!

What health plans are in network with your hospitals in Los Angeles?

CHART COMING SOON!

How do I choose the best individual insurance plan for me?

One of our favorite things about ICHRA is that it allows employees to choose the best plan for them, as opposed to a one size fits all group plan where they only have one or two options. At Take Command, we have tools to help employees sort through the options.

Doctor search: Try out our doctor search tool to ensure that your trusted doctors stay in network with your new health plan. Try out our window shopping tool and search for plans that work with your doctors!

Prescription search: Prescriptions can also be a big expense! Different carriers cover them differently, so it’s important to price check and take a good luck at formularies for all of your health plan options, especially if there’s something you take regularly to manage chronic conditions. Our new prescription search tool allows you to compare plan coverage and formularies side by side to find the best coverage at the lowest cost to you. Check it out here.

Be informed! We’ve put together an Open Enrollment Guide that will give you all of our best tips and tricks.

To get started shopping for a plan, head on over to our individual health insurance shopping page to compare plans side by side and find one that will work for you and your HRA.

How Take Command can help

With an abundance of quality health insurance plans for employees to choose from throughout the state, LA employees are positioned for success in terms of satisfaction with their ICHRA.

Have questions?

Employees: If you are an employee looking to sign up for individual health insurance in L.A. to use with your ICHRA, our enrollment team is standing at the ready to help. You can set up a call with enrollment team here.

Business owners: If you’re a business owner and have questions about ICHRA, please schedule a time to chat with our HRA Design team to see if ICHRA is a good fit for you.

Brokers: If you’re a broker considering ICHRA as an option for a client, submit an HRA Design request to see if this is a good fit for your client.

![]()

Other questions? Email support@takecommandhealth.com or chat with us on the website. We’d be pleased to help!

→ Read our California small business health insurance guide!