Business insurance in Australia

Insurance Business shares everything you need to know about business insurance in Australia in this article. We will discuss which policies are mandatory and what optional coverages are available. We will also examine the benefits of purchasing protection. For the insurance professionals who visit this site, be sure to share this article with clients who have questions about Australian business insurance.

Is it compulsory to take out business insurance in Australia?

While the types of coverage that a business needs vary depending on a range of factors, there are three kinds of insurance policies that Australian businesses are legally required to take out, according to Business.gov.au. These are:

Workers’ compensation insurance, if your business has at least one employee

Compulsory third-party (CTP) insurance, if your business owns a vehicle

Public liability insurance, which is required in certain types of businesses

Here’s how each of these mandatory business insurance policies work:

1. Workers’ compensation insurance

Workers’ compensation insurance is a form of business insurance in Australia that pays out the cost of medical care and part of the lost income of employees who get sick or injured while performing their jobs. It also protects you, the business owner, from the financial liability of having to pay for expenses arising from work-related illnesses and injuries out of pocket.

Each state and territory have their own set of rules when it comes to workers’ compensation. If you want to know how this type of coverage works in your jurisdiction, you can visit your state or territory’s workplace health and safety authority’s website listed below:

You can also check out our comprehensive state-by-state guide on workers’ compensation insurance for additional information regarding COVID-19-related coverage.

2. Compulsory third-party insurance

All drivers in Australia, including those who operate commercial vehicles, are legally bound to carry at least one type of coverage – compulsory third-party (CTP) insurance. This type of coverage is paid for when you renew your vehicle registration.

CTP coverage, also known as green slip insurance in New South Wales or transport accident charge (TAC) in Victoria, is required by each state and territory. It covers the driver’s liability in the event other people are injured or killed in a vehicular accident. CTP insurance, however, does not cover injuries to the driver and their passengers, and damages to any vehicle or property.

And just like workers’ compensation, every state and territory operates CTP insurance slightly differently. You can check out how this type of business insurance in Australia works by visiting your local vehicle registration authority’s websites below:

3. Public liability insurance

Any business could potentially have an unexpected impact on a client or a member of the public. This is where public liability insurance comes into play. This type of business insurance policy helps protect your business against the following claims if these are caused by negligence in your business activities.

Third-party injury, including those suffered by a customer, supplier, or any member of the public

Damage to property owned by a third party

Legal and defence costs associated with a covered claim

Product liability in some cases

Certain types of businesses are legally required to take out public liability insurance before they can operate. These may include businesses that:

Participate in or host events attended by members of the public

Manufacture and sell any kind of product

Work on a client’s site

Deal with customers, suppliers, or members of the public who visit their business premises

Apart from the policies discussed above, which are considered mandatory business insurance in Australia, there are several other optional coverages that Business.gov.au suggest that enterprises consider. The government website grouped the policies based on the type of protection provided. These are:

Personal or loss of income insurance

These types of policies provide financial protection if something bad happens to you or someone in your business. Some pay a portion of a person’s salary, while others work as an investment-type fund where you contribute over a certain period and get money at the maturity date. These are:

Income protection or disability insurance: Pays out a portion of your income if you are unable to work due to an illness or injury.

Total and permanent disability insurance: Pays out a lump sum if you become permanently disabled before retirement.

Trauma insurance: Provides a lump sum if you contract a specified life-threatening illness.

Life insurance: Provides a lump sum or series of payments if you die or are permanently injured.

Business interruption (BI) or loss-of-profits insurance: Covers losses resulting from damage to property if caused by an insured peril. This has become one of the most contentious types of business insurance policies because of the COVID-19 pandemic.

Management liability insurance: Covers the business owner’s personal assets when a manager or director acts in an illegal or unethical way that causes losses to individuals or businesses.

Employee dishonesty insurance: Pays out for losses resulting from employee theft or fraud.

Stock, products, and asset insurance

These types of insurance policies protect the business assets that you cannot afford to lose.

Commercial property insurance: Insures your building and its contents against loss or damages due to unexpected events, including fire, earthquake, lightning, storms, flooding, and vandalism.

Burglary insurance: Covers your business assets against theft and burglary.

Deterioration of stock insurance: Pays out for spoiled or damaged stock due to refrigerator or freezer breakdown.

Farm insurance: Insures crops, livestock, building, and machinery.

Goods-in-transit insurance: Covers the goods your business buys, sells, or uses during transport.

Machinery breakdown: Protects your business when mechanical and electrical plant and machinery at the work site break down.

Tax audit insurance: Pays out the cost of fees incurred from a tax audit or investigation into the business.

Property-in-transit insurance: Covers theft or damage of items your business transports, including tools and equipment.

Accident and liability insurance

This kind of business insurance policy provides financial protection if the business is liable for damages or injuries to another person or their property. The most common coverages include:

Management liability insurance: Covers your business’ assets when a manager or director uses illegal or unethical management practices that cause losses to another person or business.

Product liability insurance: Protects your business against claims of bodily injury or property damage resulting from the use of your product.

Professional indemnity insurance: Protects your business against claims arising from negligent acts or omissions committed while providing professional services and advice. Coverage typically includes compensation, legal fees, and investigation costs.

Technology and cybercrime insurance

These types of policies provide coverage against new risks resulting from the use of technology. These include:

Electronic equipment insurance: Covers electronic devices and equipment your business owns from theft, destruction, or damage.

Cyber liability insurance: Protects your business from legal costs and expenses related to cybercrime. Coverage can include fines, penalties, and notification costs in the event of a data breach and may also cover loss of profits resulting from business interruption caused by a cyber event.

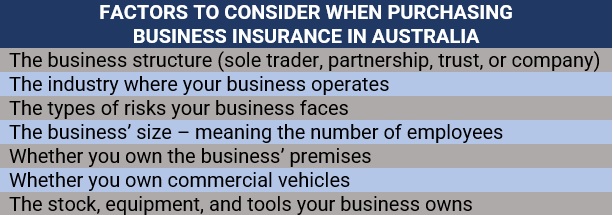

There are several factors that business owners need to consider before taking out business insurance in Australia. These are listed in the table below:

It would also be helpful for you to consult an experienced insurance agent or broker who can give you sound advice regarding which coverages suit your operations the best.

One of the biggest benefits of purchasing business insurance in Australia is the financial protection it provides when unexpected losses happen. In the course of your business’s day-to-day operations, you may face situations that can have an adverse impact on your profitability. Man-made and natural disasters can take a huge chunk out of your revenue, while mistakes can result in costly litigation – not to mention reputational damage. Having the right kinds of business insurance can help your business recover faster.

Another advantage of taking out business insurance is that it boosts your company’s credibility as most clients and stakeholders prefer working with businesses that they know are protected financially.

Business insurance, however, is just one facet of how Australian enterprises can minimize their losses. Pairing insurance coverage with good risk management practices is often the best way you can protect your business’ assets and finances.

The table sums up the top benefits that taking out business insurance in Australia provides.

Every year, giant insurance company Allianz surveys thousands of businesses from about 90 countries and territories and more than 20 industries to find out which risks these companies see as posing the greatest threat to their operations. Here are the 10 biggest risks businesses in Australia are facing, according to Allianz’s latest Risk Barometer report.

Natural catastrophes – such as storm, flood, earthquake, wildfire, and other extreme weather events

Business interruption – including supply chain disruption

Climate change – physical, operational, and financial risks resulting from global warming

Cyber incidents – cybercrime, malware, and ransomware causing system downtime, data breaches, fines, and penalties

Macroeconomic developments – including inflation, deflation, monetary policies, and austerity programs

Shortage of skilled workforce

Changes in legislation and regulation – such as trade wars and tariffs, economic sanctions, protectionism, and Euro-zone disintegration

Pandemic outbreak – including health and workforce issues, and restrictions on movement

Energy crisis – including supply shortage and outage, price fluctuations

Market developments – such as intensified competition and new entrants, mergers and acquisitions, and market stagnation and fluctuation

Technically, yes. But is it worth the risk? The latest figures from the Australian Small Business and Family Enterprise Ombudsman (ASBFEO) show that around 60% of all small businesses across the country consist of non-employing sole traders. This means that they cannot take out workers’ compensation insurance for themselves and, if they do not own a commercial vehicle, purchasing CTP insurance is unnecessary.

If you’re a sole trader trying to work out what types of coverage you need, our business insurance guide for sole traders can help you find the right policies.

Meanwhile, for Australian business owners with at least one employee, there’s just no way around it. You need to take out workers’ compensation insurance. The penalties for failing to do so vary depending on the state or territory where the business is located, but they almost always include hefty fines or even jail time.

In NSW, for example, an employer who fails to purchase coverage could receive a double avoided penalty, according to the State Insurance Regulatory Authority (SIRA). A double avoided penalty is a fine that is equivalent to double the amount of the insurance they failed to pay. They can even get prison time if one of their employees is injured at work.

As for CTP insurance, driving without one can likewise result in heavy fines, depending on the injury or property damage that you caused, as well as a voiding of your car registration.

One thing that business owners must remember is that while it can cost them money to take out these mandatory business insurance policies and other optional coverages, the financial protection these plans provide makes them a worthwhile investment in the long run, especially if an unforeseen disaster strikes their business.

You can learn how business insurance can help you navigate difficult times in our global business insurance primer.

Do you think it is worth taking out business insurance in Australia? Which policies do you think are necessary and which ones are not? Share your thoughts in our comment box below.