Bupa Health Insurance Review [2022 Guide To Bupa]

![Bupa Health Insurance Review [2022 Guide To Bupa]](https://www.cheapsr22.us/wp-content/uploads/2022/01/Bupa-Health-Insurance-Review-2022-Guide-To-Bupa.jpeg)

Bupa’s background in private medical insurance

Bupa was founded in April 1947 with the primary purpose to ‘prevent, relieve and cure sickness and ill-health of every kind. These core values are enshrined in their original constitution, combining both freedoms of choice with a caring ethos. Originally called the British United Provident Association, Bupa today is limited by guarantee without shareholders.

Today, Bupa serves more than 31 million people worldwide, with health insurance representing 72% of their revenues, 17.9 million of its customers. In addition to health insurance, Bupa runs various private healthcare services such as outpatient clinics, dental centres and aged care facilities in a select number of countries.

In addition to their consumer insurance services, Bupa also provides business health insurance policies to a growing number of companies in the UK.

Bupa’s customer reviews

At the time of writing, Bupa has amassed some 9,911 reviews on Trustpilot with an enviable score of 4.3 out of 5. Granted, their service isn’t unblemished, but with the number of customers they serve, we think the score is an excellent indicator of the quality they consistently provide.

Here is what just some of their customers have said on Trustpilot:

So good! Worth every penny to be seen by a specialist quickly. (5 stars June 2021)

Excellent service and support as always from BUPA through its Cataract Surgery Pathway Programme at a local specialist private clinic, including helpful advice and flexibility on delaying the surgery for several months due to the need to support my wife at home. (5 stars June 2021)

Bearing in mind, I had not claimed and was charged for a non-existing consultation not impressed.(1 star June 2021)

It’s important to note that Bupa is responsive to their reviews and actively reaches out to customers who have had a bad experience trying and putting things right.

Bupa medical insurance

Bupa provides two primary levels of cover: Treatment and Care and Comprehensive, both of which can be customised to suit your requirements.

Bupa Treatment and Care

Bupa’s Treatment and Care health insurance is their cheaper alternative for those who wish to be treated privately but are happy to be diagnosed by the NHS. Importantly, cancer cover is included as standard, with the option for Bupa to cover your radiotherapy, chemo, drug therapy or surgical operations if they aren’t available via the NHS.

What’s included with a Bupa Treatment and Care policy:

Hospital treatment – eligible out-patient, day-patient or in-patient treatments.Mental health cover – eligible mental health treatment from a consultant, mental health or wellbeing therapist. Limited to 28 days in-patient or day-patient care each year.Outpatient therapies – therapies such as physiotherapy.Post-treatment diagnostic tests – tests that your GP or consultant may ask for following treatment.Post-treatment outpatient consultations – eligible consultations when they are related to an eligible in-patient or day-patient treatment.Post-treatment scans – Scans requested by your consultant following treatment where you are treated as an in-patient or day-patient.A choice of either full cancer cover, NHS cancer cover plus or no cancer coverAnytime HealthLine – around the clock telephone consultations with Bupa’s team of GPs and nurses.Parental accommodation – Bupa will pay for each night a parent needs to stay in hospital with their child, assuming the child is on the policy.Private ambulance – travel by road by private ambulance.NHS cash benefit – Bupa will pay a cash benefit for treatment you receive for free via the NHS if eligible. NHS cancer cash benefit – Bupa will pay a cash benefit for eligible cancer treatment provided to you for free by the NHS.Access to three hospital networks – Choose between Essential Access, Extended Choice and Extended Choice with Central London hospital lists.

Excluded from Bupa’s Treatment and Care policy:

All of the following exclusions are reserved for those taking out a Comprehensive policy.

Pre-treatment outpatient consultations – you’ll be diagnosed via the NHS, not privately.Pre-treatment outpatient diagnostic tests – if required, this will take place via the NHS.Pre-treatment MRI, CT and PET scans – if required, these will take place via the NHS.

Bupa By You – Treatment and Care defaqto rating

defaqto ratings are updated each year and score insurance policies from one to five stars, based on their market research and robust standards. A defaqto rating demonstrates the overall level of cover and the quality of service provided by a company. Importantly, these ratings are product based, so Bupa’s Treatment and Care will have a different score from their Comprehensive product.

Bupa’s Treatment and Care product scored a respectable 3-star defaqto rating for 2022, broadly comparable to other provider’s products.

Bupa Treatment and Care defaqto rating

Bupa By You Comprehensive

Bupa By You Comprehensive is their best private health insurance, designed to cover you for as many things as possible and, importantly, see that you are not only treated privately but diagnosed privately too. With long delays on NHS waiting lists for both treatment and diagnosis, having this level of cover is seen as essential by many people.

What’s included with a Bupa Comprehensive policy:

Everything that’s included in a Treatment and Care policy, as detailed above, is included in Bupa’s Comprehensive policy, but in addition, all of the following are covered:

Pre-treatment outpatient consultations – Bupa will pay for consultations when you’re being seen as an outpatient to diagnose your eligible condition.Pre-treatment outpatient diagnostic tests – tests that your GP or consultant may ask for pre-treatment are included. Pre-treatment MRI, CT and PET Scans – scans that your consultant may ask for to help them determine your condition are included.

Being Bupa’s highest level of cover, their Comprehensive product, as you might expect, scores the top marks from defaqto in 2022, which is a testament to the level of cover and the quality of the service provided.

Bupa By You Comprehensive defaqto rating

Bupa By You Comprehensive defaqto rating

Bupa’s general exclusions

Depending on your policy and indeed your medical history, what’s covered may vary, but Bupa do have several standard exclusions you should be aware of:

Chronic conditions – those which cannot be curedPre-existing conditionsNatural ageingAllergies, allergic disorders or food intolerance

Bupa exclusions

For a complete list of exclusions, please click here to download Bupa’s policy benefits and terms.

Bupa health insurance benefits

Bupa’s health insurance gives you many of the benefits that any UK health insurance will, such as:

Potentially faster treatmentPotentially faster diagnosis (if Comprehensive)Access to drugs and treatments not routinely available on the NHSMore choice over when your treated and by whoA private room while you’re in a hospital

In addition to these standard benefits, Bupa also gives you:

Bupa covers more mental health conditions than any other leading UK insurerSee a GP within 24 hours from the comfort of your own home24/7 health adviceA rewards programme with various discounts such as reduced gym membership

Bupa family cover

Bupa’s family cover gives you access to their market-leading policies at a 10% discount compared to buying individual policies for each member of your family. You get all of the benefits you would typically get, plus additional children’s mental health support services.

Bupa couples health insurance

Similarly to Bupa’s family policy, you can opt to take out a joint policy with your partner, and Bupa will give you a 5% discount. This is pretty rare with insurers, with many not discounting joint policies.

One thing to note is that while Bupa does discount their couple’s health insurance, it still may not be the most cost-effective way to buy your policies. In many cases, taking out different policies with different providers will be cheaper as you and your partner will undoubtedly have other requirements and medical histories.

Compare Bupa To Other Leading Providers

Compare the UK’s leading health insurance providers and save up to 37% on your policy.

Compare Policies

on

Bupa business health insurance

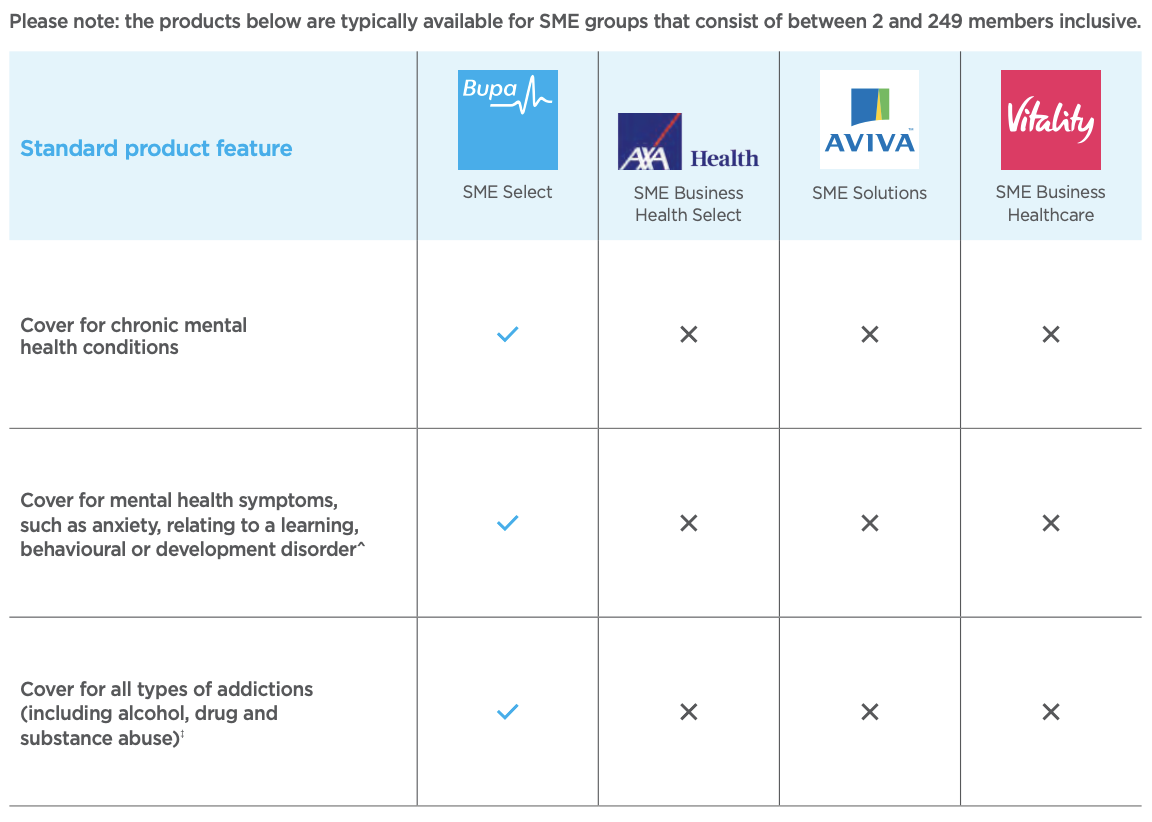

Bupa can provide health insurance to small businesses (2-249 employees) and corporates (250+ employees) in the UK. With a range of options to choose from, you can give your team an excellent perk and even extend it to their family if you so wish. A big plus with Bupa’s business health insurance is the comprehensive level of cover for mental health conditions, which, as shown by the table below, stands them out from the other leading providers.

Table comparing Bupa business health insurance with other providers

Table comparing Bupa business health insurance with other providers

Bupa private healthcare

Alongside Bupa’s private health insurance, they have a network of private healthcare services in the UK, ranging from care homes and specialist dementia care through to health centres and retirement villages; of course, as you would expect from any leading insurer, Bupa has an extensive list of recognised consultants, and therapists, alongside a significant hospital list. To find out more about the private healthcare options provided by Bupa, please visit their website or get in touch.

Frequently asked questions

Here we detail some of the commonly asked questions about Bupa and their private health insurance.

How much does Bupa cost?

How much your policy costs will depend on your requirements, the number of people that need cover and your medical history. However, to illustrate approximate prices, we have asked Bupa to quote for a 36-year-old male who lives in Dorset and doesn’t smoke. The results are as follows:

Treatment and Care – £28.17 per month

Comprehensive – £36.76 per month

These prices are only indicative, and your cost will be different. It would be best to always speak to an independent health insurance broker to compare the market before purchasing a policy.

What does Bupa cover?

Depending on whether you take out Bupa Treatment and Care or Comprehensive, what is covered will differ. That being said, broadly speaking, you can expect Bupa Treatment and Care to require that you’re diagnosed via the NHS before being treated privately and with Comprehensive both diagnosis and treatment taking place privately.

As with any insurance policy, there are standard exclusions that can be found in the policy terms.

How does BUPA health insurance work?

With Bupa health insurance, you pay a monthly fee and then in the event you become unwell, you will be able to be seen privately rather than via the NHS. Precisely what is and isn’t covered will vary from customer to customer and policy to policy.

Is Bupa worth joining?

Yes, many people see private health insurance as an essential with those who do have it, often citing the many benefits associated,

What does Bupa not cover?

Similarly to other leading providers, there are several standard exclusions all Bupa policies will have:

Natural ageingPre-existing conditionsAllergiesChronic conditions

Here is a link to the complete list of exclusions.

How to buy a Bupa policy

The best way to buy a Bupa policy is through a health insurance broker, as this allows you to compare all of the providers before making a decision. If you only go to a single provider, you risk missing out on a better deal or perhaps even better terms.

Bupa contact details

customerrelations@bupa.com

0345 606 6739

Bupa Place, 102 The Quays, Salford Quays

M50 3SP

United Kingdom