Bridge Specialty International finalizes Acorn International Network deal

Bridge Specialty International finalizes Acorn International Network deal | Insurance Business America

Insurance News

Bridge Specialty International finalizes Acorn International Network deal

Transaction marks major regional expansion

Insurance News

By

Terry Gangcuangco

Bridge Specialty International, the international arm of Brown & Brown’s wholesale and specialty brokerage Bridge Specialty Group, has completed its acquisition of Singapore-based insurance broker Acorn International Network.

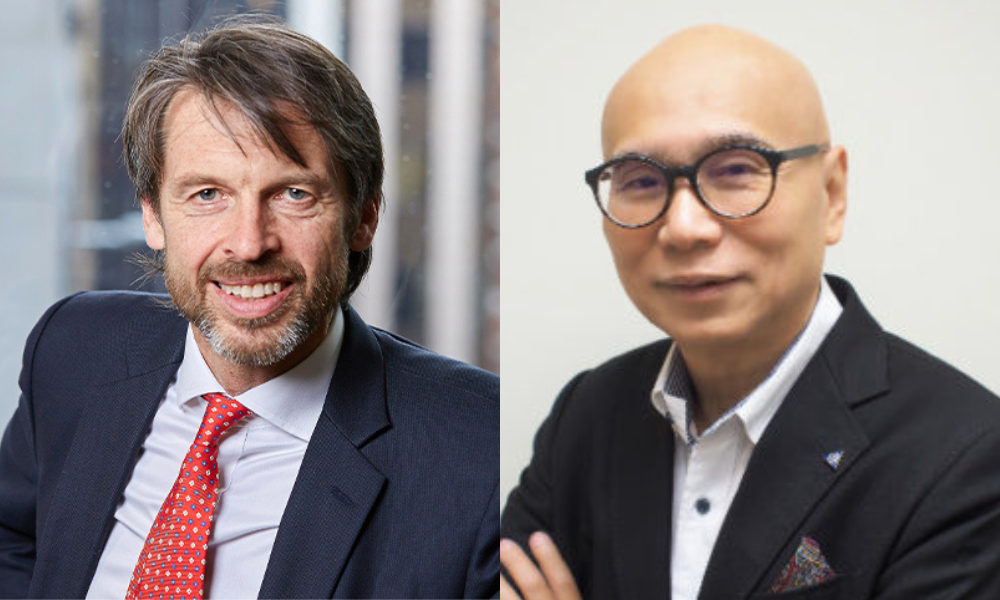

Licensed by the Monetary Authority of Singapore, Acorn has been trading since 2011. Under the deal, financial terms of which were not disclosed, founder and chief executive David Ong (pictured right) will remain at the helm. He brings nearly five decades of expertise to Bridge Specialty International.

“This acquisition establishes us in the Singapore insurance market, further expanding our Asia presence and enabling us now to build a leading wholesale and specialty hub in the region,” said Tim Coles (pictured left), CEO of Bridge Specialty International.

“David and his team have a longstanding, exceptional reputation, and we are looking forward to working with them.”

Bridge Specialty International already has a foothold in the Asian market through its subsidiary Capstone Insurance Brokers, a Hong Kong-based specialist in financial lines and digital asset insurance.

Capstone and Acorn will work closely together to drive growth, expand their capabilities, and attract new talent to better serve clients, producers, and coverholders.

Ong commented: “Today (October 9) marks an exciting new chapter for Acorn. By joining the Bridge Specialty International team, we are well-positioned to enhance our offerings and grow our footprint in Singapore and beyond.

“Together with Capstone, we will build on our shared specialties to deliver exceptional value to our customers across the region.”

Earlier this year, Bridge Specialty International’s Lonmar Global Risks acquired the renewal rights for a bloodstock portfolio from St Benedicts Limited in Norwich, UK.

The portfolio comprises mainly US wholesale bloodstock and reinsurance risks, alongside a book focused on agricultural disruption for poultry farming operations. International Risk Solutions managed the portfolio.

What do you think about this story? Share your thoughts in the comments below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!