Blowing the roof off: North Carolina plan taps legislature for money for fortification

Blowing the roof off: North Carolina plan taps legislature for money for fortification | Insurance Business America

Catastrophe & Flood

Blowing the roof off: North Carolina plan taps legislature for money for fortification

‘How can we incentivize somebody to want a fortified roof like they would want a granite countertop? That’s our mission’

Catastrophe & Flood

By

Mark Schoeff Jr.

When people buy a beach home, they often seek – or add – features and amenities that make it as attractive a dwelling as the coast on which it’s located. Gina Hardy also wants them to consider what’s above their heads.

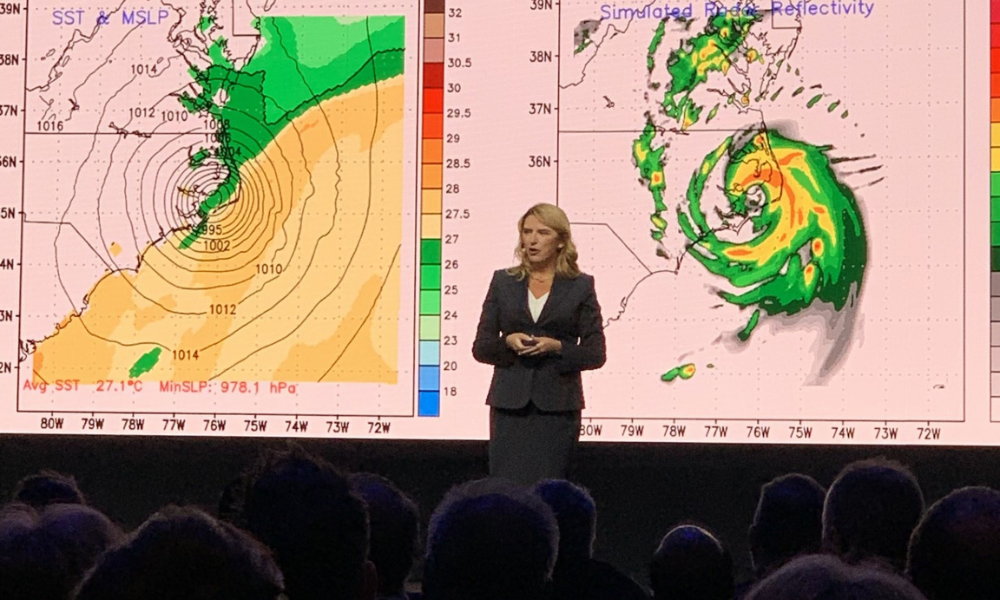

“How can we incentivize somebody to want a fortified roof like they would want a granite countertop? That’s our mission,” said Hardy (pictured above left, and below, in front of storm maps) CEO of the North Carolina Insurance Underwriting Association, an arm of the state’s insurer of last resort that’s also known as Coastal Property Insurance Pool, or the “beach plan.”

The NCIUA launched its Strengthen Your Roof program for the Outer Banks and Barrier Islands in 2019. Since then, it has invested $42.1 million in roof fortification from its surplus of more than $1 billion. A companion program for the state’s other coastal counties – Strengthen Your Coastal Roof – started in 2022 and has spent $14 million.

The NCIUA has allocated another $20 million for SYR that will be targeted at the Outer Banks. Separately, it has allocated $20 million for the SYCR program that is dependent on a dollar-for-dollar match for the 18 coastal counties excluding the Outer Banks, Hardy said.

The SYCR funding match can come from federal, state and local sources – or a combination of them. Hardy and other proponents for the program will turn to the North Carolina legislature when it opens its next session on Monday.

“We need our General Assembly to lean to give us some matching dollars because we want to make sure we can cost-justify any money we’re spending out of our surplus,” said Hardy, who also is CEO of the North Carolina Joint Underwriters Association, or FAIR Plan.

Using state budget surplus

Don Hornstein, a professor at the University of North Carolina School of Law and a member of the NCIUA board of directors, points out that the state has a budget surplus. He would like to see some of it go to the roof initiative, which would help the state reduce recovery costs.

“There’s no better way to spend that money,” said Hornstein (pictured above right), who chairs the NCIUA’s mitigation committee and helped develop the roof-fortification program. “This is a cost-effective benefit for everyone.”

The NCIUA launched its roof fortification effort in 2019, following Hurricane Florence’s landfall the previous December. Demand was low at the beginning. There were 274 strengthened roofs built by April 2019, which was up from only four in December 2016 — prior to the launch of the fortification initiative.

The program was transformed from an endorsement on insurance policies to grants to homeowners. The grants started at $6,000 and were bumped up to $8,000 in 2022. That move caused the take-up to increase sharply. As of the end of January, the NCIUA had completed 7,518 fortified roofs with another 3,310 in progress.

“We’re very pleased we’re starting to see a lot of traction in North Carolina,” Hardy said.

Fortification lowers insurance costs

Hardy and other proponents say roof fortification ultimately lowers insurance costs. The Institute for Advanced Analytics at North Carolina State University analyzed insurance claims from several hurricanes – including Dorian, Florence, Matthew and Isaias – and found that claims fell by 34.5% and the loss per storm declined by 22.7% for homes with fortified roofs.

With a stronger covering overhead, homes are more likely to weather storms intact.

“It’s more about people having homes to come home to,” Hardy said. “These fortified roofs are really making a difference in hurricane-type situations. It’s something we feel very passionate about investing in.”

The state’s insurer of last resort also benefits from stronger roofs because it means having to cover fewer losses, Hornstein said.

“We make money by putting on these roofs,” Hornstein said. “We don’t have to buy as much reinsurance, and that’s gold because reinsurance is through the roof.”

Educating homeowners through brokers

Even though the number of fortified roofs on the North Carolina coast has soared from four in 2016 to several thousand today, Hardy and others are still trying to educate homeowners about strengthening the structure over their heads.

Insurance agents and brokers can help spread the word, said Frank Lopez, extension director of North Carolina Sea Grant, an organization that promotes coastal resilience, economic development and environmental conservation. They can point out any premium savings that can emanate from a stronger roof.

“That’s something that I hope insurance [professionals] look at and have in their toolbox as potential options for clients,” Lopez said.

A stronger roof is a good investment in a home, which for most people is their most valuable asset, Lopez said. “They will get their money back.”

Stability for insurer of last resort

North Carolina doesn’t get hit as hard by hurricanes and climate disasters as other states, such as Florida. That has helped the state’s insurer of last resort.

The NCIUA has seen its market share, based on premiums, decline in the Outer Banks from 80% in 2013 to 58% in 2022 and from 51% in 2014 to 45% in 2022 in the other coastal areas. But total insured value has increased as beach homes become more expensive.

“We’re as stable as we can be given that it’s a challenging time for risk transfer,” Hardy said. “We’re managing very well in North Carolina.”

Hardy attributes stability in part to the strong support she said NCIUA receives from the legislature and governor. Those are relationships she’ll draw on again over the next few weeks to obtain more money for roof fortification.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!