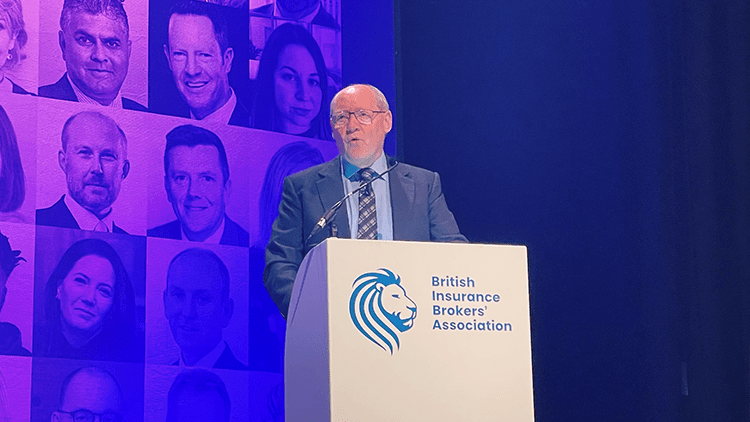

BIBA Chair Jonathan Evans delivers conference speech

11th May 2022

Welcome back! It is so good to see you all

I am delighted to be here, standing before you as the chair of BIBA.

Never before has there been such a need for an active, engaged and successful trade body representing insurance brokers as there is today.

And this trade body has been all of the above as we are set on progressing the many member issues in our 2022 Manifesto – Managing Risk.

I welcome you all and would like to give a big thank you to our international guests who have travelled to be here today. In all there are 24 nations represented including delegates from far afield, from the continents of America, Australia and Africa, plus our many friends in Europe.

Now, Steve will cover many points in his address but let me make mine in three short parts, which all demonstrate the benefits of working together in our insurance community, the first

Working with Industry

In the spirit of ‘our insurance Community’ the BIBA Team has worked with our sister bodies and partners forming very effective alliances to deliver on a number of Manifesto issues

We worked with the ABI to create our new flood insurance directory to help people more easily access flood insurance.

We are also burning the midnight oil with the ABI to develop property insurance proposal to help with the challenges of insuring cladded buildings.

We brought in new capacity for SME’s at risk of flood with our SME flood scheme via MI Commercial.

The BIBA Team ensured Covid Professional indemnity insurance cover was available for members via our Professional Indemnity Insurance initiative, despite being in the hardest market in a generation.

We work closely with Pool Re and are delighted that Treasury have retained the unlimited guarantee that we called for in our manifesto.

We worked with the team at Flood Re and welcome the recent change that now see it able to allow ‘build back better’ – a term we used long before those in Downing Street!

And, we worked with partners Allianz to produce a new guide on underinsurance, launched today, guidance we believe is vital since our associates at CILA provided us with data showing that underinsurance is evident in 40-45% of claims and the degree of underinsurance typically varies by around 35-40%.

Working with BIPAR, the MIB, the MIA and ABI we are delighted that after six years of lobbying the Vnuk motor insurance problem has been resolved

My second point is Working with Government

Our insurance community extends to those in Whitehall, as BIBA continues to work closely with all relevant government departments, of which there are many.

One of them – HM Treasury, has a chance to make a real difference with the future regulatory framework review and I was delighted to see this included in the Queens Speech yesterday.

Now I agree with balanced regulation, but over regulation and excessive cost is impacting the sector’s ability to innovate, with knock on effects for customers.

The increasing weight of FCA regulation is now the number one concern of our member firms. The FCA is not making our market work well and in my mind that should be its NUMBER ONE priority and indeed I understood it to be their main role!

But, the regulator is affecting competition, productivity and the ability to innovate, it has also taken its eye off its own responsibilities. For example, with some authorisations and changes in permissions for members taking up to 9 months. How can this help us to be a leading sector in financial services I ask. Let us see what the FCA’s Sheldon Mills has to say later today.

I suggest to the FCA that it takes a take a long hard look at its own responsibilities and approach to our low risk sector.

We demand the FCA pay attention to the importance of proportionality in the way it regulates. I am sure that the Minister, John Glen, to whom I am very grateful for his work on this, can help to find the right balance through his regulatory framework review and will enact the growth and international competitiveness objective on the regulator as mentioned in the Queens speech– which we believe should help ensure more proportionate and balanced regulation going forwards – something that I know all of you in this auditorium believe cannot come a day to soon.

Another issue of great importance to thousands of people in communities across the UK is the issue of dangerous cladding on their properties. This is why the BIBA Team has worked closely with Building Safety Minister Lord Greenhalgh’s office on their imminent PI insurance intervention for Fire Engineers,

Separately, we were pleased to have another major manifesto win with HMRC, which backtracked on their proposals to add IPT to broker fees following our strong and detailed objections.

We worked closely with DHSC, DCMS and HMT on the much needed and very successful temporary Covid interventions on film/ TV, live events, and designated settings in care homes

And Steve and Graeme recently met Transport Minister Baroness Vere to discuss a key part of the Transport Bill and the plethora of motor insurance issues arising from that, led by our Motor Committee.

I also welcome the FCA review of the FSCS funding model and can assure members we have submitted a comprehensive response and the team are meeting the FCA on this next week.

Finally, for my third point lets also look at the Future issues for our insurance community

Where will the fundamental risks of the future start and finish between the insurance industry and government?

We will be sure to work with the Governments Contingent Liability Central Capability unit, so that if there is a severe lack of capacity, we can look for a path forward together between state and industry.

Risks will continue to evolve – from e-scooters to autonomous vehicles to cyber-attacks, these issues are all in the manifesto and the BIBA team will do its part to look after the interests of you and your customers in the future so that brokers can do what they do best – delivering on the theme of our 2022 Manifesto – Managing Risk

We will do our best to enhance the reputation of the industry and will be producing new guides including ‘making a successful claim’ as well as guides on ‘valuations’ and ‘cyber insurance’ amongst others

To Summarise

There has never been a greater need for our insurance community to work more closely together than ever before.

Steve, Graeme and myself will continue our lobbying in the most transparent and productive way we can, although much of the work we do is in the margins and will never get the credit it deserves. I must say however that since Lord Hunt last stood here three years ago, it has been the most intense period for BIBA, and I am grateful for Steve and Graeme’s leadership and their determined efforts in supporting members throughout these challenging times.

I am deeply grateful for you all attending this fantastic conference and supporting your association.

We couldn’t do what we do without our advisory boards and committees and of course we couldn’t run our conference without our sponsors, so thank you to our Principal Sponsor Aviva and our other very welcome sponsors, I hope you all have time to visit their stands.

Speaking of Lord Hunt, I feel obliged to provide a quote from his favourite bard:

“Summer’s lease hath all too short a date.”

So enjoy the next two days, it will be over all too quickly,

Please come and say hello to us on the BIBA stand and keep up the great work that you do. Thank you

…….<<< PAUSE FOR APPLAUSE>>>…..

It is now my pleasure to hand over to BIBA’s CEO, to make his Keynote address, would you all please give a warm welcome to Steve White