Bharti Axa Term Insurance

Bharti AXA Life Insurance commenced its operations in 2006. It is a joint venture between AXA Group and Bharti Enterprises. Presently, Bharti Group holds a 51% stake whereas AXA carries 49%.

Bharti AXA offers an array of insurance products ranging from traditional to investment plans and ensures protection for their children through child plans. Bharti AXA Term insurance brings together strong values wherein they function

on being customer-centric. Their commitment to solving insurance problems is reflected in their impressive claim settlement percentage

Here’s a brief overview of the available Bharti AXA life insurance products.

Recommended Videos

Bharti AXA Term Insurance Plans

Bharti AXA Life Best Term Insurance Plans

To secure your family’s needs, Bharti AXA Life Term Insurance offers 9 term insurance plans, from which you can choose a well-suited plan for yourself:

Comprehensive Plan

The plan offers a lump sum or monthly income to the family upon the policyholder’s demise, with guaranteed payouts of up to 150% and tax benefits.

Unique Features

100% to 150% of total premium

Death Benefits

Special Surrender Benefit

Maturity Benefit

Loans Are Allowed

Guaranteed Monthly Income

1 Yr WP For Suicide

Unpaid Policy Lapses

Limited Revival Period

Flexi Term Pro (Other Benefits)

Easy Enrollment

Life Cover For Policy Term

Flexible-Premium Payment Modes

Flexi Term Pro (Eligibility Criteria)

Entry Age -18 Years

Max Entry Age- 65 Years

Minimum Sum Assured – NA

Maximum Maturity Age – 75 Years

Premium Payment Term – 5 To 20 Yrs

Standard Plan

Bharti AXA Saral Jeevan Bima

Non-Linked Non-Participating term insurance plan with a double sum assured on death due to accident and tax benefits.

Unique Features

Flexible policy term

Rider benefit

Discounts for women

Available for Online Buying

Choose to pay Premium Once

Max Sum Assured 50L

No Survival Benefit

No Maturity Benefit

No Surrender Benefit

Saral Jeevan Bima (Other Benefits)

Suicide Cover

Spouse Cover

Policy Revival Within 5 Years

Saral Jeevan Bima (Eligibility Criteria)

Entry Age -18 Years

Max Entry Age- 65 Years

Minimum Sum Assured – 5L

Maximum Maturity Age – NA

Premium Payment Term – RP/SP/LP(5&10 Years)

Critical Illness Plan

Bharti AXA Flexi Term Plan

An individual pure risk premium plan that covers critical illness at the age of 75 and comes with2 cover options.

Unique Features

75 CI covered

Comprehensive cover

Major illness cover

Cancer of Specified Severity Cover

Flexibility for Coverage Period

105 % Death Benefit

No Survival Benefit

No Maturity Benefit

No Surrender Benefit

Flexi Term Plan (Other Benefits)

Suicide Cover

Waiver of Premium on CI

Multiple Death Benefit Payout Options

Flexi Term Plan (Eligibility Criteria)

Entry Age -18 Years

Max Entry Age- 65 Years

Minimum Sum Assured – 10L

Maximum Maturity Age – 85 Yrs

Premium Payment Term – Fixed (5 & 20 Yrs)

Rural Plan

Bharti AXA Grameen Jeevan Bima Yojana

Non-Linked Non-Participating Life Term Micro Insurance Plan. It offers flexibility to opt 2 plan options and tax benefits.

Unique Features

Pure protection plan

Protection with ROP

Tax benefits

Grameen Jeevan Bima Yojana (Pros)

Loans Are Allowed

Surrender Benefit

Rider Benefit

Grameen Jeevan Bima Yojana (Cons)

No HIV Cover

No Discount Available

1 Yr Waiting Period For Suicide

Grameen Jeevan Bima Yojana (Other Benefits)

Death Benefit

Max Sum Assured 2L

Policy Can Be Bought Online

Grameen Jeevan Bima Yojana (Eligibility Criteria)

Entry Age -18 Years

Max Entry Age- 65 Years

Minimum Sum Assured – 10K

Maximum Maturity Age – 65 Yrs

Premium Payment Term – RP/SP

Specialised Plan

Bharti AXA eProtect Term Plan

An affordable online term insurance plan that ensures protection for your loved ones with an inbuilt family care benefit feature and covers up to 75 years of age.

Unique Features

Life Insurance Benefit

Family Care Benefit

Reward for Non-Smokers

eProtect Term Plan (Pros)

Premium Discounts Available

Quick Family Care Payout

Cost Effective Payout

eProtect Term Plan (Cons)

1 Yr WP For Suicide

Unpaid Policy Lapses

No Maturity Benefit

eProtect Term Plan (Other Benefits)

Online Purchasing Of Policy

Easy Revival

Flexible-Premium Payment Modes

eProtect Term Plan (Eligibility Criteria)

Entry Age -18 Years

Max Entry Age- 65 Years

Minimum Sum Assured – 25 L

Maximum Maturity Age – 75 Years

Premium Payment Term – 10 To 75 Yrs

Standard Plan

Bharti AXA POS Saral Jeevan Bima Yojana

Non-Linked Non-Participating term insurance policy provides double the sum assured on death due to an accident.

Unique Features

Flexible policy term

No medical test required

Tax benefits

POS Saral Jeevan Bima Yojana (Pros)

Available for Online Buying

Choose to pay Premium Once

Max Sum Assured 50L

POS Saral Jeevan Bima Yojana (Cons)

No Survival Benefit

No Maturity Benefit

No Surrender Benefit

POS Saral Jeevan Bima Yojana (Other Benefits)

Suicide Cover

Spouse Cover

Policy Revival Within 5 Years

POS Saral Jeevan Bima Yojana (Eligibility Criteria)

Entry Age -18 Years

Max Entry Age- 65 Years

Minimum Sum Assured – 5 L

Maximum Maturity Age – NA

Premium Payment Term – RP/SP/LP(5&10 Years)

Comprehensive Plan

A comprehensive term insurance plan that provides whole life cover, flexible premium payment options, with joint and single life coverage at reasonable prices.

Unique Features

100% Death Benefit

Two Plan Options

Special Exit Value

Surrender Benefit

Maturity Benefit with ROP

Lower Rates for Non-Smokers

No Policy Loan Allowed

Excludes Suicide Within 1 Year

Limited Revival Window After Policy Lapse

Life Suraksha (Other Benefits)

Suicide Cover

Paid-Up Benefit

Discounts for Females

Life Suraksha (Eligibility Criteria)

Entry Age -18 Years

Max Entry Age- 65 Years

Minimum Sum Assured – 5 L

Maximum Maturity Age – 99 Years

Premium Payment Term – 5 To 85 Yrs

Group Term Plan

Bharti AXA Group Suraksha

A group term plan designed for co-operatives, institutions, and NGOs, offering life insurance coverage to members’ families in case of unfortunate death.

Unique Features

Death Benefit

Size of Group 15

Lower Rates for Non-Smokers

Surrender Benefit

No Requirement For Medical

Flexible-Premium Payment Mode

No Policy Loan

No Survival Benefit

Max SA is 25 K

Group Suraksha (Other Benefits)

Suicide Cover

Paid-Up Benefit

Affordable Premiums

Group Suraksha (Eligibility Criteria)

Entry Age -18 Years

Max Entry Age- 54 Years

Minimum Sum Assured – Rs 5000

Maximum Maturity Age – 55 Years

Premium Payment Term – Adaptable

Standard Plan

Bharti AXA POS Saral Bachat Yojna

This is a simple insurance policy with low premiums, offering Maturity and Death Benefits, along with tax advantages.

Unique Features

Death Benefit

Loan Benefit

Flexible-Premium Payment Terms

POS Saral Bachat Yojna (Pros)

Maximum SA 10 L

Surrender Benefit

Maturity Age of Policy 60 Yrs

POS Saral Bachat Yojna (Cons)

No ROP

No Rider Benefit

No Bonus Available

POS Saral Bachat Yojna (Other Benefits)

Surrender Benefit

Maturity Benefit

Suicide benefit

POS Saral Bachat Yojna (Eligibility Criteria)

Entry Age -18 Years

Max Entry Age- 55 Years

Minimum Sum Assured – Rs 15000

Maximum Maturity Age – 60 Years

Premium Payment Term – 6, 8, 10 & 12 Yrs

Key Features of Bharti AXA Term Insurance Company

Bharti AXA Term Insurance offers an economical way of securing your family after you. Let’s have a look at some of the brilliant features of the policy making it one of the best available term insurance plans in the domain.

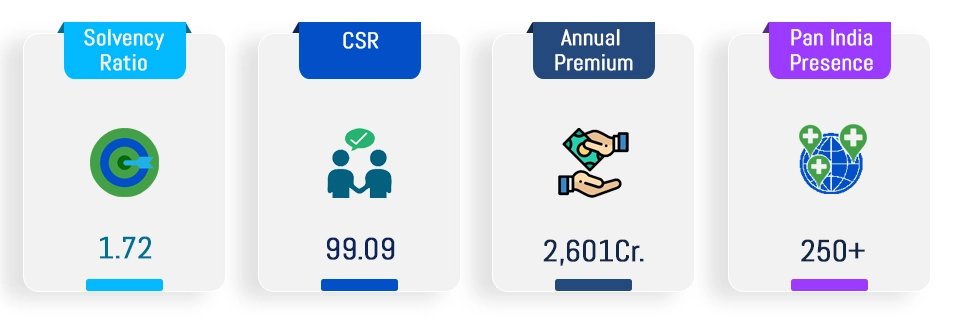

Annual Premium: As per the IRDAI report 2021-22, Bharti AXA Life Term Insurance recorded an annual premium of Rs. 2,601.56 cr.

Solvency Ratio: The solvency ratio of the company helps an individual ascertain the company’s ability to meet its long-term financial obligations.

The Solvency Ratio of Bharti AXA Life Term Insurance company

for 2021-22 is 1.72. (As per the IRDAI, it is mandatory for every life insurer to maintain a solvency ratio of 1.5).

Claim Settlement Ratio: The company holds a good and reliable claim settling process with a CSR of 99.09%. (CSR as per IRDAI report of the year 2021-22). The Bharti AXA Term Insurance holds one of the highest

claims settlement ratios amongst all the insurance companies.

Operating Network: Bharti AXA Life Insurance Company has 250+ branches across India and additional distribution touch-points through several new tie-ups and partnerships. Apart from its PAN India presence,

it has consultants that will guide you through their wide array of products and help you pick what is right for you.

Read More

Benefits of Bharti AXA Term Insurance Company

During a difficult time in the family, people want to rely upon a term insurance company that is efficient and offers hassle-free services and support. Bharti AXA offers

multiple benefits to its consumers:

Reliable and hassle-free claim settlement: The claim settlement ratio of Bharti AXA Life is among the finest in the country. At an impressive 99.09%, it is one of the healthiest claim settlement ratio and one of the highest amongst the insurance companies.

24*7 customer service: Bharti AXA is connected with its customers through various channels, which include phone, email, and social media assuring them a quick response despite the gravity of their queries.

A wide variety of options: Bharti AXA Life Insurance recognizes various needs of every individual and therefore offers multiple alternatives. Besides, there are a variety of riders available to supplement your

term insurance coverage.

Longer coverage: You can opt for term insurance plans with longer coverage options that offer Life covering up to the age of 85, and you can also receive whole life insurance up to the age of 99.

Economical term plans: The nominal premiums of Bharti AXA ensure that they fit within your budget.

Why You Should Buy Bharti Axa Term Insurance Plans

The Bharti AXA life term insurance policies give your loved ones the financial security and peace of mind they will need in your absence. Here are some reasons why you should consider buying a Bharti Axa term plan:

Financial Security: The policy provides a lump sum payout to your nominee in case of your sudden demise, which can provide financial security to your family in your absence.

Affordable Premiums: A Bharti Axa life term plan offers affordable premiums, which makes it an attractive option for individuals who want to secure the financial future of their loved ones without having to pay high premiums.

Customizable Coverage: These term insurance plans allow you to choose the amount of coverage and the policy term that suits your needs. You can customize the policy to match your financial goals and obligations.

Tax Benefits: Bharti AXA’s life term insurance plans offer tax benefits under Section 80C of the Income Tax Act, 1961. The premiums paid towards the policy are tax-deductible, which can help you save on taxes.

Additional Benefits: This plan also offers additional benefits, such as accidental death benefit, critical illness cover, and waiver of premium benefits, which can provide enhanced financial protection to you and your family.

Who Should Buy a Bharti AXA Term Plans

Bharti AXA life term policy is a pure protection plan that offers financial protection to the policyholder’s family in the event of their untimely demise. Here are some points that can help you determine if the term insurance plan is right for you:

Breadwinner of the family: If you are the primary breadwinner of your family and have dependents, this term plan can provide much-needed financial protection to your family in your absence.

Young and healthy: If you are young and healthy, you can avail of the benefits of lower premiums by purchasing this term insurance plan at an early age. As you age, the premiums for insurance policies increase due to the higher risk associated with age-related health issues.

Sole earner: If you are the sole earner in your family, the Bharti AXA life term plan can provide your family with financial stability in case of your sudden demise. The policy payout can cover your family’s day-to-day expenses, children’s education, and outstanding debts.

High-risk job: If you work in a high-risk profession, such as construction, mining, or transportation, this plan can provide you with financial security in case of accidental death or disability.

Debt repayment: If you have outstanding debts, such as a home loan or a car loan, this life-term plan can provide your family with the funds to repay the debt in case of your demise.

Business owners: If you are a business owner, this plan can help protect your business from financial losses in case of your sudden death. The policy payout can be used to repay business debts, provide funds for business operations, and pay employee salaries.

Bharti AXA Term Plan Riders

There are some general exclusions against which the above-mentioned term insurance plans by the Bharati Axa Term Insurance company would not provide coverage. Let’s have a look at them:

Bharti AXA Life Term Rider

This Life Term Rider pays out an additional sum assured in case of death of the life insured. This amount is in addition to the death benefit under the base policy. This rider provides enhanced coverage in case of death with

the flexibility to choose rider term.

Bharti AXA Life Premium Waiver Rider

Provides you with additional protection that waives off your future premiums, in case you are faced with an unfortunate and sudden event like critical illness, permanent disability, or death.

Bharti AXA Life Accidental Death Benefit Rider

This non-linked and regular pay insurance rider provides 100% sum assured in case of death of the life insured due to an accident, subject to the rider policy being in force.

Bharti AXA Life Group Accidental Death Benefit Rider

A rider that offers better protection for the family, in case of loss of life of the life insured due to any sudden accident.

Bharti AXA Life Hospital Cash Rider

Provides you with additional protection that waives off your future premiums, in case you are faced with an unfortunate and sudden event like critical illness, permanent disability, or death.

How To Buy Bharti AXA Term Insurance Plans?

Bharti AXA Life allows you to buy a term insurance plan via two platforms. You can either buy the plan online from the official website of the company or through third-party intermediaries like agents, brokers, etc. Below we have elaborated

both the buying processes for you.

Buy from PolicyXBuy from the Company

Steps to buy from Bharti AXA Life insurance company

Visit the official website of Bharti AXA Life Insurance Company.

Click on ‘All Plans’ on the navigation bar and select ‘Term Insurance Plans’.

Click on the ‘Buy Now’ button and fill in the required details.

Tap on ‘Next’ and select a plan as per your requirements.

Select the cover option you want and make your payment.

**Once the payment is made, you will get a payment confirmation at your registered email address.

Steps to buy from PolicyX.com

Fill out the form given at the top of this page with the necessary details.

Select your income and city. Click on ‘Proceed’.

Update your education and occupation details.

Choose your preferred plan and click on ‘Buy this plan’.

Select policy term, premium period, and riders (if required) and then proceed to do the payment.

**Once the payment is made, you will get a payment confirmation at your registered email address.

How to File Bharti AXA Term Insurance Claims?

Filing a claim for Bharti AXA Term Plan is a simple and hassle-free task. You can easily fill and submit their claims online or walk into your nearest Bharti AXA Life branch. To file a claim for Bharti AXA Term Plan, you need to follow

the below-mentioned steps.

1. Claim Intimation

Inform the company about the incident via various channels- by writing an email at lifeclaims@bhartiaxalife.com, calling on the toll-free number (1800 102 4444), filling the online claim form on its website, or by visiting the nearest

branch. The following details have to be provided during the intimation of your claim:

Name of the policyholder

Policy number

Date of death/event of the life assured

Nominee name

Cause of death

Contact details

A claim reference number/intimation number will be provided to you upon successful registration of the claim.

2. Document Submission

Submit the necessary documents requested by the company to process the claim. In the case of natural death-

Death claim form.

Death certificate.

Original policy documents.

Claimant’s identity & residence proof.

Medical records at the time of death & past illnesses.

Account details of the nominee.

In the case of unnatural death (Accidental death/Murder/Suicide)-

Death claim form.

Death certificate.

Account details of the nominee.

Original policy documents.

Claimant’s identity & residence proof.

FIR, police inquest report & panchanama

Post mortem report.

3. Claim Settlement

After receiving all the documents and claim forms, the company will verify the details as per their norms. On successful completion, the claim will be settled and the amount will be transferred to the nominee’s bank account and the same

will be communicated to him/her over call or email.

Bharti AXA Life Term Plans: FAQs

1. Is the option of the grace period available under Bharti AXA Life term plans?

Yes, the life assured is given a grace period of 30 days to pay the due premium. After termination of the grace period, the policy will be declared as lapsed or terminated.

2. Can we revive a lapsed policy?

Yes. If the life assured wants to regain the lost benefits and coverage, he/she has to fulfil the below criteria-

Payment of all the due premium till the date of revival.

Pay the additional interest on due premiums.

Revival can be practised within two years starting from the date of unpaid premium.

3. Can I share a bank statement as an alternative document if I don’t have income proof?

No, the Bank statement cannot be considered as income proof for Bharti AXA Life Term Plan.

4. Can a self-employed person invest in Bharti AXA term Insurance?

Yes. To invest in Bharti AXA Term Insurance Plans, you have to submit documents and details related to your Proprietorship/Partnership.

5. What if I cannot pay the premiums of the Bharti AXA Term Plan?

Bharti AXA Term Plan offers a grace period of 15 days to pay the pending premiums but If you are still unable to pay your premiums after the grace period, your policy will lapse.

6. What are the premium payment frequency modes for the Bharti AXA Term plan?

The policyholder of a Bharti AXA term insurance plan can choose to pay the premium annual, half-yearly, quarterly, or monthly basis.

7. What critical illnesses are covered by Bharti AXA life term insurance?

Below mentioned are the critical illnesses covered by Bharti AXA Term Insurance:

Open Chest CABG

Cancer of specified severity

Open heart replacement or repair of heart valves

Surgery to aorta

Cardiomyopathy

Kidney failure

Organ transplant

Bone marrow transplant

8. What is the minimum and maximum age limit to purchase the Bharti AXA term plans?

The minimum age to purchase Bharti AXA term policy is 18 years, while the maximum age limit is 65 years.

9. What is the minimum and maximum policy term for Bharti AXA term policy?

The minimum policy term for Bharti AXA term insurance is 5 years, while the maximum policy term is 40 years.

10. What is the minimum and maximum sum assured for the Bharti AXA term plans?

The minimum sum assured for Bharti AXA life term insurance policy is Rs. 25 lakhs, and the maximum sum assured is Rs. 25 crores.

11. Does the Bharti AXA term plan offer any riders or additional benefits?

Yes, this term insurance offers riders such as accidental death benefits, critical illness cover, and waiver of premium benefits, among others.

12. What is the claim settlement ratio for Bharti AXA term insurance?

The claim settlement ratio of term insurance for Bharti AXA Insurance Company ,for the financial year 2021-22 is 99.09%.

Other Term Insurance Companies

Term Insurance Articles

Latest

Popular

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.