Beyond Bills and Mortgages: Unleashing the Power of Income Protection for a Life Full of Fun!

From Beaches to Mountains: How Income Protection Supports Your Adventurous Spirit

Picture this:

You’re sitting at your desk, bored out of your mind, daydreaming about that stunning beach getaway you just booked.

The sun-kissed shores, the warm breeze, the cold drinks —it all feels so close, yet so far away.

But, what if there’s a cruel twist to this daydream?

Imagine life throws you a curveball, and suddenly, you find yourself unable to work due to an unexpected illness or injury.

The thought of putting your dreams on hold and settling for the mundane can be disheartening, to say the least.

But fear not, because there’s a hero ready to save the day: income protection!

While income protection is boring as hell, it holds the key to not only financial stability but also the ability to go after and enjoy the craic.

It’s like having a trusty sidekick who ensures that your dreams and aspirations remain within reach, even if the shit hits the fan.

Sure, everyone bangs on about income protection paying bills and keeping a roof over your head, and while those aspects are crucial (but oh so 😴) they only scratch the surface of what it really does.

Income protection goes beyond the practicalities—it’s about safeguarding the moments that make life worth living, the experiences that bring a smile to your face and memories that last a lifetime!

It provides a safety net, not only for covering essential expenses but also for indulging in the things that bring you joy.

It’s the assurance that even if life takes an unexpected turn, you can still hold onto those plans of sipping margaritas on the beach.

So, my fellow dreamers and adventurers, let’s break free from the notion that income protection is all about the boring stuff.

It’s time to embrace the full potential of this superhero-like coverage.

It’s about protecting your ability to explore, to seek new horizons, and to revel in the thrill of life!

Who’s with me?

You’ve spent years working tirelessly, saving diligently, and dreaming fervently about those extraordinary moments in life.

Whether it’s traveling to exotic destinations, pursuing your passion projects, or indulging in thrilling adventures, these dreams are what give life its vibrant colors. They are the driving force behind your hard work and dedication.

When you encounter a health setback, income protection offers a lifeline that ensures your dreams don’t crumble under the weight of financial strain.

Here are the basics of how income protection works in Ireland:

Where to Buy:

To obtain income protection, you need to purchase a policy from an insurance provider (best to use a broker 👋). You pay monthly premiums in exchange for the coverage provided by the policy.

Tax Relief:

You can claim 40% tax relief on your premiums 🎉

Waiting/ Deferred Period:

Income protection policies typically have a waiting period before the benefits kick in. This waiting period can range from 4 to 52 weeks, depending on the terms of your policy. During this waiting period, you will need to rely on other sources of income or savings.

Benefit Amount:

The income protection policy specifies the percentage of your pre-illness or pre-disability income that you will receive as a replacement income. This percentage is typically between 50% and 75% of your pre-illness or pre-disability earnings. The benefit amount is replacement income so is liable to income tax, PRSI and USC.

State Illness Benefit:

If you are entitled to state illness benefit, you can claim it in addition to your income protection.

Benefit Duration:

Income protection policies also specify the duration for which you can receive benefits. This is until a specific age, between 55 and 70. The benefit duration depends on the terms of your policy.

Medical Underwriting:

When applying for income protection, you may need to undergo a medical underwriting process. This involves providing details of your medical history, current health status, and any pre-existing conditions. The insurance provider may request medical reports or assessments to evaluate the level of risk they are taking on by insuring you.

Claims Process:

If you become unable to work due to illness, injury, or disability during the waiting period, you can initiate a claim with your insurance provider. You will need to provide medical evidence, such as reports from doctors or specialists, to support your claim. The insurance provider will assess your claim and determine if you are eligible for benefits based on the terms of your policy.

Benefit Payment:

If your claim is approved, the insurance provider will start paying the agreed-upon percentage of your income as a replacement income. This payment helps you cover your living expenses, including bills, mortgage or rent payments 😴

But more importantly it also means you can afford to go on that dream holiday without worrying about how you will pay for it! 👌

And that’s what life is all about.

Over to you

Yeah, we all know the mortgage and bills need to be covered.

But come on, it’s the fun stuff in life that makes it bearable especially if you’re suddenly hit with an unexpected illness.

So, if you’re ready to protect future you, I’d love to help.

Complete this short questionnaire and I’ll be right back with some recommendations.

Thanks for reading

Nick

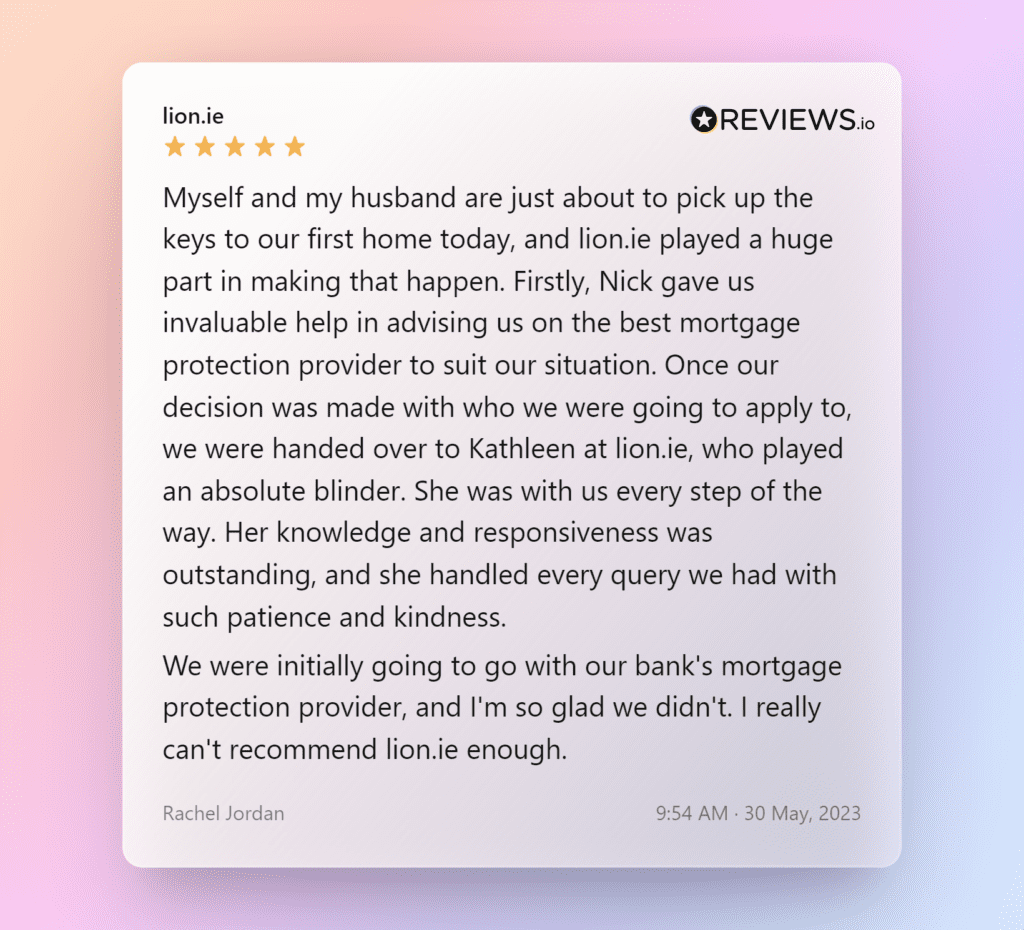

lion.ie | Protection Broker of the Year 🏆