Best Private Health Insurance In The UK (Reviews of Top 11 Providers)

Best private health insurance in the UK

Based on customer reviews, industry awards and policy coverage, we found that the following companies are currently the best health insurance providers in the UK (in alphabetical order):

Why are these the best health insurance companies in 2022?

Our list of the best health insurance providers is based on the companies that offer comprehensive cover for the most commonly claimed medical treatments in the UK. All of the providers and policies we’ve featured in this guide, cover the following as a minimum, with many covering much more:

Cancer coverDiagnostic testsHospital and consultant fees

When reviewing the providers included on our list, we considered over 30 key factors relating to each of their policy’s to ensure they all meet the highest standards. Importantly, we’ve chosen to focus on each provider’s leading health insurance products but haven’t considered any additional options they might offer. When reviewing these providers, we’ve sought to answer each of the following questions, amongst others:

What’s covered and what isn’t?Which private hospitals can you access?Can the policy be tailored?Is mental health cover included?Do you get a choice of consultants?Do they offer a virtual GP service?Are their customer reviews positive?What is the policy’s Defacto rating?What discounts and benefits will you get?Have they received industry awards?

How to find the best policy for you

Private health insurance is one of the most important purchases you can make, providing security that private healthcare will be on hand should you become unwell. While there are many reasons why you might decide to take out a health insurance policy, for most, it’s the affordable access to first-class private healthcare services that is the biggest draw.

With the health insurance market in the UK growing and each year, more and more people are choosing to take out a policy. With that, new companies, products and services are continually being released, adding to the already vast array of available options. It can make finding the best health insurance policy complicated, but fortunately, health insurance brokers exist to help you navigate the options and find the right policy for you.

Always speak to an independent broker

While all of the private health insurance providers we’ve covered have excellent policies, which is best for you will be determined by your requirements, circumstances and budget. It’s therefore essential that you compare health insurance quotes to find the right one for you. To do that now, please click the button at the top of this page to answer a few questions about your requirements and receive a comparison quote. Alternatively, if you’d prefer to speak to someone, please call 01202 714176 to be connected to one of our independent financial advisers.

We’ve reviewed the best private health insurance companies in the UK

What is health insurance?

Health insurance is a type of insurance that’s taken out to cover the cost of private healthcare in the UK. Often called private medical insurance, it provides a faster route to recovery for individuals, families and businesses and their employees.

While almost everyone in the UK has access to free healthcare via the NHS, waiting times can be lengthy, and your options in terms of treatments are often dictated by where you live. As we’ve shown in the next section of this guide, you can reduce your reliance on the NHS and ultimately receive faster treatment for a wide range of medical conditions by paying a monthly or annual premium.

What are the different types of health insurance?

There are several types of health insurance policies you can get in the UK, and while this guide is focused on the best, meaning those which are the most comprehensive, we think it’s essential that you understand the other options in the market.

Treatment only private medical insurance (basic)

There are numerous policies on the market, including from the top providers, that cover the cost of inpatient treatment only in private hospitals across the UK. What that tends to mean is that unless the condition you’ve been diagnosed with requires an overnight stay in hospital or, in some cases, a bed for the day, it won’t be covered. The same is true of tests and consultations leading up to a diagnosis; you’d need to be diagnosed via the NHS before receiving treatment privately with a basic private medical insurance policy. For many, this reliance on the NHS to provide a diagnosis undermines much of the value of health insurance, as it may well be the diagnostic part of the process that has the waiting times. That said, for people who can’t afford comprehensive cover, treatment only policies offer an affordable way to have some protection.

Comprehensive private medical insurance (PMI)

Comprehensive policies, such as those we’ve detailed in this guide, cover significantly more than their basic counterpart, as they typically include all of the tests and consultations leading to a diagnosis too. Many comprehensive policies will also cover additional things, such as mental health support, virtual GP services, enhanced cancer cover and much more. The key difference here is that you usually won’t need to go via the NHS with a comprehensive policy, bar perhaps seeing your GP initially. Unlike basic policies, which don’t cover outpatient treatments, many comprehensive policies will, meaning the scope of private healthcare services you have access to is far greater.

Cash Plans

A Cash Plan is an insurance policy that helps cover routine medical costs, such as visits to the dentist, opticians or even physiotherapy. They are quite different from private health insurance in that they cover predictable healthcare costs, not unpredictable acute medical conditions. Because of that, people will often take out both a private health insurance policy and a Cash Plan, with many providers offering them as additional options to their core policies.

Many Cash Plans usually offer a percentage (often between 50% – 75%) in cashback against the cost of routine medical appointments. Every time you go to the dentist, opticians or physio, you send your provider your receipt, and they’ll reimburse you the pre-agreed percentage.

While these policies are useful, they’re not really what we’re here to look at today and are not in any way comparable to basic or comprehensive private health insurance.

SME or Group healthcare plans

In addition to private health insurance, which you take out yourself personally, there is a range of business health insurance policies available, aimed at both SMEs and corporate businesses. What is and isn’t covered and included will vary from policy to policy, but by in large, they work in a similar way to private health insurance, albeit your employer pays for it instead. Click the following link if you’d like to learn more about business health insurance in the UK.

What is the best private health insurance?

We would define the best private health insurance as a comprehensive policy from a leading provider covering both inpatient and outpatient treatments, diagnostics and testing, with award-winning customer service and excellent customer reviews. While the price is an essential factor, this article will focus on policy features and service levels.

The best private health insurance policy for you may well be different from those reviewed in this guide, and you should always compare policies and health insurers and speak to a health insurance broker to find the right policy for you.

Considerations when looking for private health insurance:

Do you require access to quicker diagnosis (outpatient cover)?are there specific hospitals you’d like to be able to use?Are there any particular illnesses or drugs you would like to cover?What your budget is? (bear in mind your premiums will usually rise each year)

For more information about the cost of health insurance, please read our guide “how much does health insurance cost?” or request a quote to receive personalised pricing.

How does health insurance work?

So, to recap, private medical insurance, be that a basic or comprehensive policy will cover you for the treatment of acute conditions where an overnight stay in hospital is required, with the latter also covering you for outpatient tests, consultations and treatments.

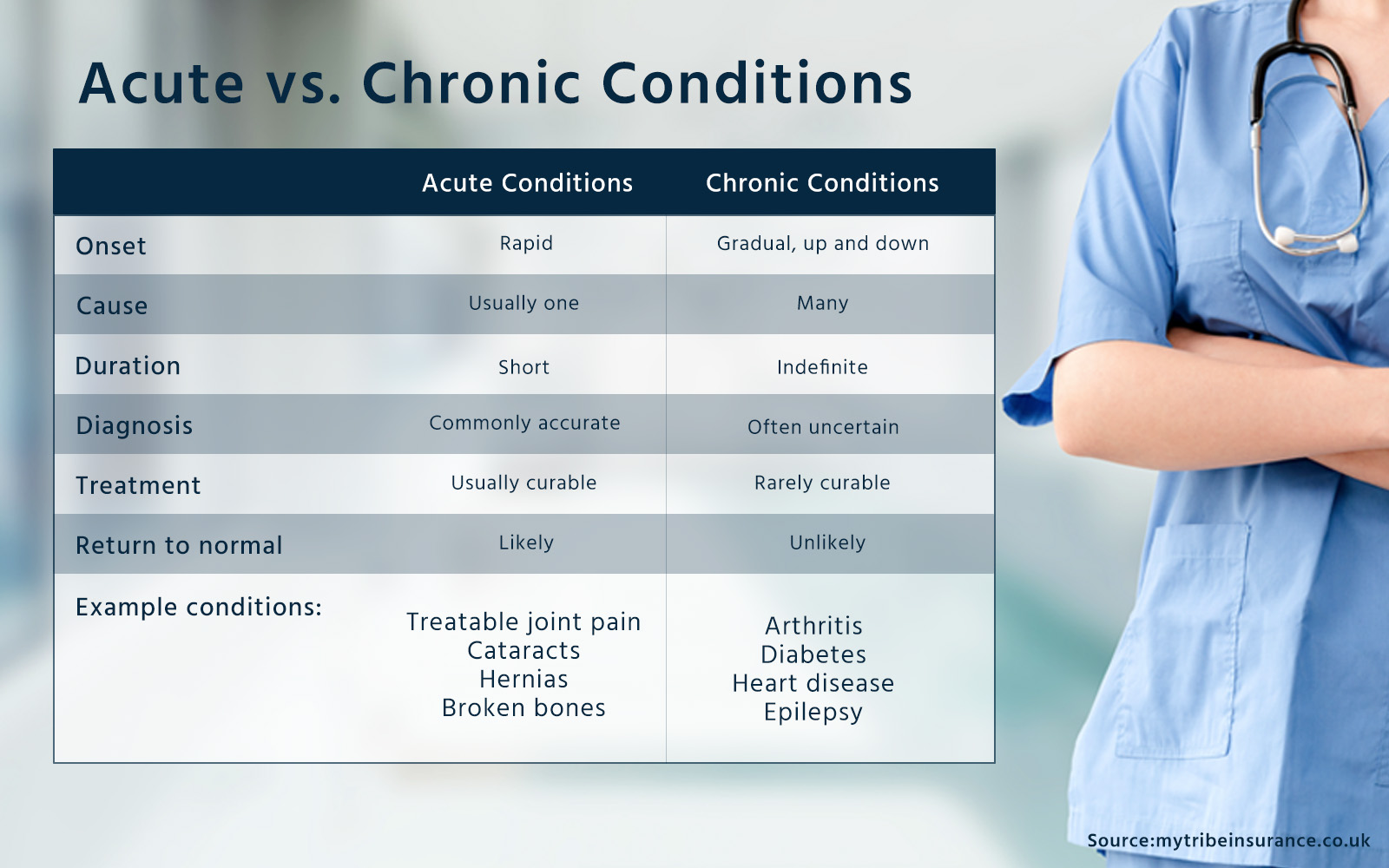

In this section, we briefly explain the differences between acute and chronic conditions before looking at the typical treatment routes for basic and comprehensive policies.

Acute vs. chronic conditions

Private health insurance is designed to cover ‘acute conditions’ that start after your policy begins, chronic conditions are typically excluded. Acute conditions are those that will likely respond to treatment, whereas chronic conditions typically won’t. Whereas people with acute conditions can usually recover, those with chronic conditions will typically be with them for many years, sometimes the rest of their lives. Chronic conditions are therefore not curable, and instead need management, more than treatment.

Acute vs. Chronic Medical Conditions

Acute vs. Chronic Medical Conditions

Basic vs. comprehensive cover

As we’ve outlined, the most significant difference between basic private medical insurance and the best comprehensive policies is whether any pre-diagnosis scans, tests and consultations are included. With basic treatment only policies, which typically only cover the cost of private healthcare if you are admitted to hospital for a day or more, you would need to be diagnosed via the NHS, before going private for your treatment. Comprehensive policies, on the other hand, will usually cover everything leading up to treatment, bar perhaps the initial GP appointment. That means that unlike a basic policy all of your scans, tests and consultations will be done privately, often speeding up the time to treatment.

What are the benefits of private health insurance?

The benefits of private medical insurance are without a doubt extensive, but we should remember that it provides a supplementary service to the NHS and doesn’t act as a complete replacement. The better your policy, the less you’ll rely on the NHS, but there will always be certain things private health insurance doesn’t cover you for. We’ll come back to what is and isn’t covered a little later in this guide.

Benefits of private health insurance:

Avoid potential delays on NHS waiting lists.Receive medical treatment at a time that suits you.Get more choice over where your treatment takes place and the specialist that treats you.Access the latest treatments and drugs, even those not yet available on the NHS.Have a private room during your hospital stay and more flexibility over visitor hours.Some providers offer virtual GP services allowing you to see a GP in the comfort of your own home.Many insurers will give you access to 27/4 health advice lines, where you can speak to a medical professional at any time of the day.Enhanced mental health support and helplines.Rewards programmes that incentivise healthy living, such as discounted gym membership.

What does private health insurance cover?

All private health insurance providers will cover the costs of treating acute conditions where an overnight hospital stay is required (inpatient treatment), with most covering day-patient treatments too. Chronic conditions, meaning those that aren’t curable, won’t be covered. It’s only in more comprehensive policies that outpatient treatment and diagnosis will typically be included.

Private health insurance will usually cover:

Costs relating to hospital admission (inpatient treatment)Diagnostic tests, such as CT scans and MRI scansPrivate surgeryConsultant’s feesHospital accommodation and nursing careCancer treatments – some policies will include drugs that are not available on the NHS

Additional cover options:

The best and most comprehensive policies will typically cover you for a range of additional services, such as outpatient treatment and diagnosis, enhanced mental health support and more. When you come to configure your policy, you can choose which are important to you from an extensive range of options, including:

Outpatient treatment and consultationVirtual GP servicesMental health treatmentPhysiotherapy and chiropodyComplimentary therapiesRoutine dental and optical cover

Cancer cover

Private health insurance gives you access to the latest cancer treatments, procedures and drugs, many of which aren’t currently available on the NHS. Access to cutting-edge private cancer care is often one of the most significant reasons people take out private health insurance, and with Cancer Research UK stating that 1 in 2 of us will develop cancer in our lifetimes, it’s little wonder. While most policies will include cancer cover as standard, only the best private health insurance will provide enhanced cover.

Benefits of private cancer care:

Access to cutting-edge medical treatments, procedures and drugs.You’ll usually be diagnosed faster, which tends to lead to better outcomes.Choice of where chemotherapy takes place, at home, for instance.Money to pay for scalp cooling to reduce hair loss from chemotherapy.Cover for the cost of prostheses and wigs that might be needed after cancer surgery/treatment.Access to home nursing for a certain number of days, with a private nurse visiting you at home.

Mental health cover

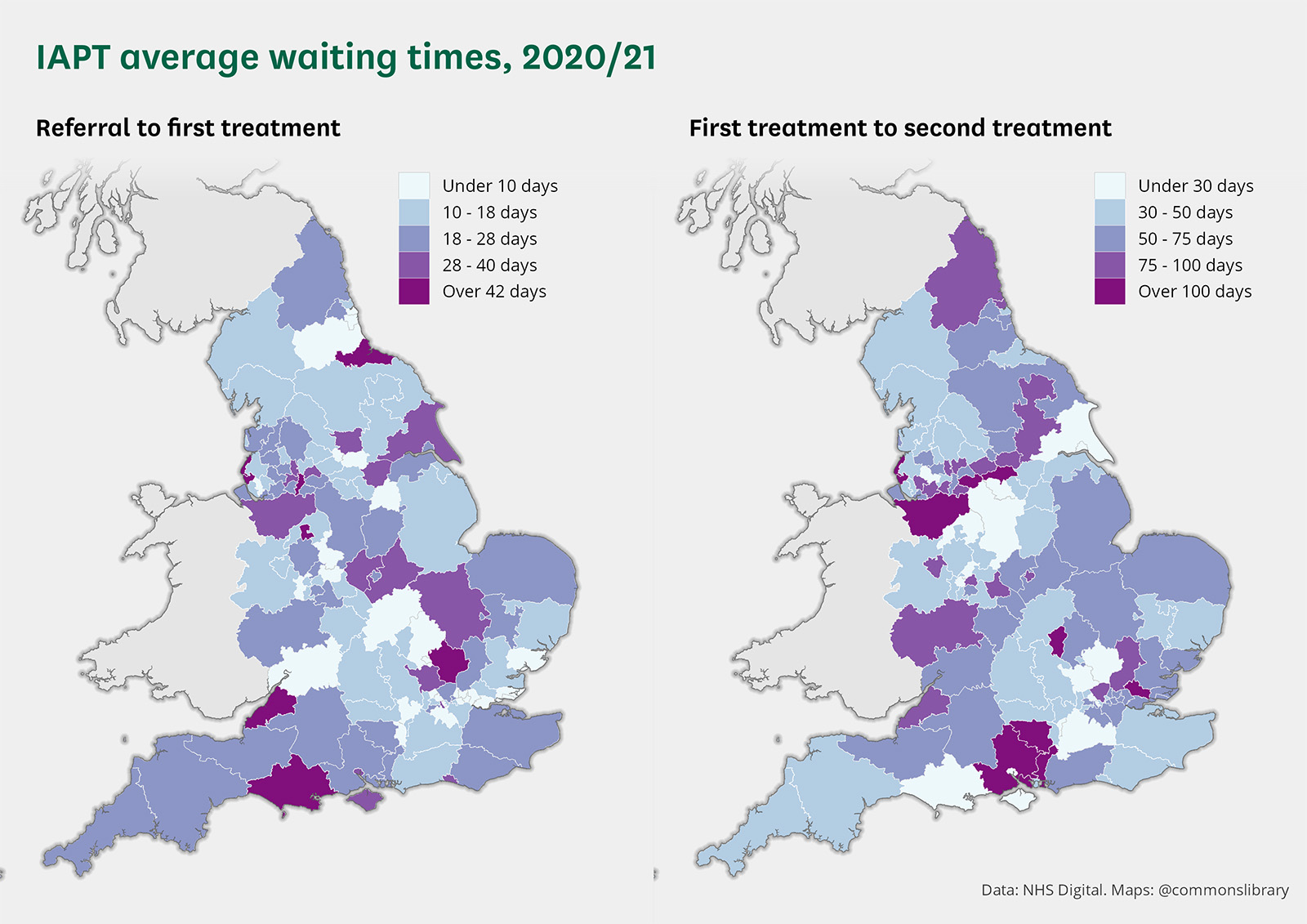

An estimated 1 in 4 people experience a mental health problem each year but with waiting times for NHS England’s Improving Access to Psychological Therapies Programme (IATP) varying from 4 days 86 days, where you live is a key factor in how quickly you’ll get help. Importantly, in most areas of England, patients waited three times along between their first and second treatments, so even if you were seen relatively quickly initially, chances are you’ll be waiting some time before you’re seen again. It’s perhaps no surprise then that mental health cover has become a key part of the best health insurance policies.

Two maps showing waiting times for IAPT in England. The left map shows waiting times from referral to first treatment, while the right map shows waiting times from first treatment to second treatment.

Two maps showing waiting times for IAPT in England. The left map shows waiting times from referral to first treatment, while the right map shows waiting times from first treatment to second treatment.

What’s included with mental health cover?

While exact coverage will differ between providers, many of the best providers and policies incorporate a level of mental health cover into their core products. Bupa, as an example, include mental health treatment in both their entry-level Treatment and Care plans and their Comprehensive policies too. On the other hand, WPA offers mental health therapies as optional extras available on both their Premier and Elite policies. As with all of your health insurance policy components, if mental health cover is essential to you, make sure you mention it to your health insurance broker when you speak to them.

Virtual GP services

Online, virtual GP services are becoming increasingly popular in the UK, not least because of the additional strain the pandemic has placed on NHS GPs. While there is no national data showing how long people have to wait to see their GP, this pre-pandemic report cites that the average wait for non-urgent appointments was over 2-weeks in 2019, so it would be reasonable to conclude this has only worsened since then. So then, it’s perhaps understandable that private health insurers have cottoned on and are plugging the gap with their own services.

What is a Virtual GP?

Sometimes called a “Digital GP”, a Virtual GP is usually provided as an app that gives you online access to healthcare professionals such as GPs, pharmacists and nurses. All of the best private health insurance providers give you the ability to have 24/7 online appointments (chat-based) and scheduled video appointments. Much like the other aspects of health insurance, virtual GP services are there to help you be seen and ultimately diagnosed and cured faster. All of the following providers currently offer virtual GP services, although how many consultations are included vary:

Optional extras

Alongside your core health insurance, there are several optional extras you can choose from to complement your policy. While we won’t spend too much time looking at any of these in this guide, if they are essential to you, be sure to mention them to your health insurance broker.

Premium hospitals

All health insurers will give you access to a range of private hospitals across the UK, but what isn’t always obvious is that specific, more expensive hospitals, mainly those in London, won’t be included. The simple reason for this is that it costs more to be treated at these exceptional private hospitals, and therefore if you would like them to be covered, you will need to pay an additional fee. When you set up your health insurance policy, take time to look at the hospitals you’re able to receive treatment at to ensure your favoured or local ones are included. Here are some examples of London hospitals that aren’t typically included as standard and will usually require you to take an additional extra:

BUPA Cromwell Hospital;30 Devonshire Street;Harley Street at Queen’s (Romford, Essex);Harley Street at UCH;Harley Street Clinic;Kingston Hospital (Surrey);Lister Hospital;LOC at Chelsea (Sydney Street);LOC – Leaders in Oncology Care;London Bridge Hospital;London Bridge Hospital at Guy’s and St. Thomas’;London Clinic;Portland Hospital;Princess Grace Hospital;Royal Marsden Hospital (London and Surrey);The National Hospital for Neurology and Neurosurgery;University College London;Wellington Hospital.

Dental and optical cover

While some health insurance policies will cover some acute dental and optical treatments, routine trips to the dentist and opticians won’t be included as standard. Many of the leading providers give you the option to enhance your cover by taking out optional dental cover or offering it as a standalone policy.

What’s included with dental and optical cover?

Whether you purchase it as an optional extra or a standalone product, dental and optical cover will typically include the following:

Oral surgical procedures – while your private health insurance may cover some dental treatments, a dedicated dental policy will typically cover you for more.Routine trips to the dentist – Check-ups and deep-cleans are typically referred to as routine treatments, and most of the providers will cover you for a certain number of trips to the dentist each year.Routine trips to the opticians – most providers will give you an annual amount you can claim for optical costs.

International health insurance

Some of the providers we feature in this guide offer a level of international health insurance in their policies, but not all of them. International health insurance shouldn’t be confused with travel insurance, which typically covers you for shorter trips abroad; instead, international health insurance will cover the cost of treatments for those that spend extended periods abroad.

If your private health insurance policy doesn’t include international cover or enough, don’t worry, you can purchase it separately.

Health insurance policies that include some international cover:

WPA’s Premier and Elite Flexible Health policies include emergency overseas treatment cover, which gives you some protection while abroad. Crucially, it will only cover trips up to a maximum of 70 days, and you must not exceed 180 days outside of the UK per policy year.Axa PPP doesn’t include international cover in their base product but do offer European or Worldwide Travel Cover as additional options. This extra is designed to cover the cost of emergency medical expenses abroad and includes protection for lost baggage, delays, and lost passports. Axa’s Worldwide Travel Cover offers even more protection and provides emergency dental treatment and business travel.

Therapies

Another optional extra you may consider is “therapies cover”, which includes outpatient treatment by physiotherapists, acupuncturists, homoeopaths, osteopaths, and chiropractors. While some providers will include a certain amount of physiotherapy in their core policies, especially that seen as necessary following surgery, most will require you to pay a supplementary fee to access complementary therapy under the policy.

Complementary therapies typically include:

AcupunctureChiropodyChiropractic treatmentsDietary servicesDietary servicesHomoeopathyPhysiotherapy (in some cases)

What’s not covered by private health insurance?

What’s not covered by your private health insurance will depend on your chosen insurer, policy and circumstances. However, generally speaking, the following will usually be excluded by most insurers:

Chronic, incurable conditions (except cancer and mental health conditions)Pre-existing medical conditionsBirth control, conception and sexual problemsAccident and emergency servicesAgeing, menopause and pubertyDeafnessIntensive care (other than in some specific circumstances)Allergies, allergic disorders or food intolerancesNormal pregnancyCosmetic surgeryLearning difficulties, behavioural and developmental problemsSleep problems and disordersOverseas treatment and repatriationPandemic or epidemic disease

Please refer to your policy documentation or ask your adviser before taking out a policy for a complete list of exclusions.

It’s essential that you perform a market review before taking our private medical insurance.

It’s essential that you perform a market review before taking our private medical insurance.

Private medical insurance underwriting explained

Underwriting is the process an insurer goes through to assess the risk of your policy and set a cover price. You will usually choose between several underwriting methods, which is best for you will depend on your medical history and circumstances. Here, we outline the three most commonly used methods of underwriting for personal health insurance policies in the UK:

Moratorium Underwriting

Moratorium Underwriting automatically excludes all pre-existing conditions from the past five years; however, in most cases, if you don’t have any symptoms or require treatment for two years, the condition will then become covered under the policy.

Moratorium Underwriting is the most popular form of underwriting in the UK as it usually offers the fastest and least complicated route to getting cover.

What’s important to understand is that you won’t honestly know what your policy does and doesn’t cover until you claim by opting for Moratorium Underwriting. If you have a relatively uneventful medical history, this might not be cause for concern, but for those of you who have more complex histories, Full Medical Underwriting might be a better option.

Looking into the future, if at some point you decide to switch health insurers, you’ll usually find that you’re able to carry over your Moratorium period to avoid you having to start again.

Full Medical Underwriting (FMU)

As the name suggests, Full Medical Underwriting looks at your medical history in its entirety, and the insurer will provide you with a policy with explicit exclusions. Full Medical Underwriting is time-consuming and can require the insurer to write to your GP for information. Still, unlike moratorium underwriting, you will clearly understand what isn’t covered in the policy.

Continuation cover

Finally, for those of you that already have a health insurance policy, some health insurance companies will allow you to switch and maintain the exclusions you had with your previous provider. Just be sure before you change that you’re not sacrificing any subtle policy terms.

Which private health insurance underwriting is best?

The best private health insurance underwriting method is best is subjective based on your circumstances. As we mentioned, Moratorium is the most commonly used, but FMU also has its place. As underwriting is such an essential part of your cover, we’d always recommend speaking to a broker to help you make a decision.

Brilliant from start to finish.

Peter Ernes

on Google

Compare Policies

It’s crucial when configuring your policy to choose the best form of underwriting for you.

It’s crucial when configuring your policy to choose the best form of underwriting for you.

How much does private health insurance cost in the UK?

The cost of private health insurance is influenced by a large number of factors, with the most significant being:

Your age – The age of those on the policy will affect the annual premium, and as you get older, the cost of the policy will increase.The level of cover you require –Whether you have outpatient cover, for example, will significantly impact the cost of your policy.Pre-existing conditions – If opting for Full Medical Underwriting, pre-existing conditions could affect the policy’s price.The excess on the policy – You can choose how significant the excess is on your policy – the higher it is, the lower your annual payments will be.Your selected list of hospitals – You can choose which hospitals you would like access to if you want only the very best it will be reflected in the price.Optional extras – Optional extras such as dental and optical cover will affect the cost of your policy.

Example health insurance prices

We appreciate you may be here looking for some indicative pricing, so for the sake of this guide, we’ve done a quick comparison of the leading providers. We’ve based these prices on comprehensive cover for one person, who lives at our office in Bournemouth. We’ve applied a £200 excess to the policy, and it’s been underwritten on a moratorium basis.

Example health insurance prices*

*The prices provided in this guide are merely examples, the cost of your policy will be different based on your requirements and circumstances.

Save up to 37% on your policy

Compare Now

Compare Policies

Rated 5 on

Top 5 Private Health Insurance Providers in the UK (by market share)

Four private health insurance companies currently dominate the UK market, with an approximate 90% market share between them. The remaining 10% is split between several smaller or niche insurers. This section of our guide provides a brief overview of the largest providers and a fifth experiencing growing demand.

Axa PPP Healthcare

Axa began as a company in 1940 and has for nearly 80 years been providing private health insurance to their UK customers. Multi-award-winning, with a reputation for innovation, they are rightly one of the biggest insurance companies in the UK.

Aviva

Founded in 1696, Aviva is the UK’s biggest insurance company with over 15 million customers. They provide insurance for a variety of purposes, including private health. As you might expect, they have won plenty of awards and recognition of excellence.

Bupa

Bupa, a household name in the UK, was founded in 1947 and now has over 2.7 million private health insurance customers. A provider of both insurance and private healthcare services, with a reputation for quality and customer care.

Vitality

Vitality, formerly Pre-health, is an insurance and investment provider based in Bournemouth. They are shaking up the market by taking a fresh approach to private health insurance, incentivising healthy living and rewarding those who keep active.

WPA

WPA isn’t technically one of the biggest providers in the UK, but they are growing fast and starting to have a real foothold in the market. They provide private health insurance to everyone from individuals and families through to small and large businesses.

Health Insurance Reviews

Okay, so here it is, our independent reviews of the UK’s best private health insurance providers. We’ve looked at the 11 leading health insurers and reviewed them on:

Policy coverage and exclusionsHospital listsCustomer reviews*Recent awards

All insurance providers covered in this article have at least one policy with a 4 or 5* defaqto 2021 rating; this scoring is updated each year on the 2nd of February, so we’ll revisit each provider’s score in February 2022.

*Where there are multiple customer review platforms available, we have sought out the ones that have the most recent reviews for the health insurer in question.

Axa PPP Healthcare Health Insurance Review

AXA PPP Healthcare Review

AXA PPP Healthcare Review

Axa PPP was founded in 1940 by a group of hospitals and doctors to help middle-income earners access expert medical care. With over 33,500 consultants and practitioners and 250 hospitals in their directory, they are the UK’s second-largest private medical insurance provider.

Axa PPP Healthcare Personal Health

Axa’s Personal Health health insurance plan provides an extensive level of cover and includes:

Fast Track Appointment service to help get you diagnosed sooner.Unlimited video, online or telephone consultations with Axa’s doctor at hand service.Cover for diagnostic surgery such as CT, MRI and PET scans.Full inpatient and day-patient hospital fees cover.Excellent no-claims discount.Free cover for newborns until your renewal date.No yearly limit on outpatient surgery.A directory of over 250 hospitals and thousands of consultants.Extensive cancer cover, including access to the latest, approved cancer drugs.

Axa PPP Optional Extras

In addition to the core benefits of Axa’s Personal Health policies, there’s several additional option you can choose from, including:

Standard or full outpatient cover –choose between three specialist outpatient consultations per year or unlimited.Dentist and Optician Cashback – covers up to 80% of your dentists (max £400) and opticians (max £200) fees each year.Therapies option – adds cover for up to 10 outpatient treatments by physiotherapists, acupuncturists, homoeopaths, osteopaths and chiropractors.Mental Health option – cover for inpatient, day-patient and outpatient psychiatric treatment.Travel option – ability to cover yourself for medical emergencies when travelling abroad.

The policy information provided has been taken from the AXA PPP website and is correct as of January 2022.

Axa’s Customer reviews and awards:

At the time of writing, Axa had amassed 7,443 reviews on the reviews platform Feefo, currently enjoying an overall rating of 4.5/5. In 2021, they were awarded Feefo’s Platinum service award, along with a five-star Defaqto rating and an award from Moneyfacts.

Axa review summary

In terms of private health insurance policy options and comprehensiveness, Axa is right up there as one of the best. Their Core cover provides an excellent level of baseline cover. You can upgrade to their standard or full outpatient treatment cover for those wishing to have speedier diagnosis and treatment.

Bupa Health Insurance Review

BUPA Review

BUPA Review

BUPA is perhaps the best-known provider of private health insurance in the UK, becoming synonymous with the service they provide. Their flagship product Bupa By You is as flexible as it is comprehensive and is highly thought of by industry experts and customers alike.

While Bupa’s policies typically have fewer options for you to choose from than other providers we’re reviewing, the comprehensiveness of their products can’t be disputed.

Bupa is the market-leading health insurer in the UK, but far from being just a health insurance provider, they also operate an extensive network of hospitals, care homes, clinics and dental practices.

Bupa offers two core health insurance policies:

Treatment and Care – their lower-cost offering where you’d need to be diagnosed by the NHS before receiving treatment.Comprehensive – their best policy covers everything from initial diagnosis through to treatment.

Seeing that this guide is about the best health insurance policies available, we will focus on the latter, Bupa By You Comprehensive.

Bupa By You Comprehensive Cover

Bupa’s comprehensive cover is designed to cover the cost of private healthcare, from diagnosis to treatment.

Bupa Policy highlights:

Faster diagnosis and treatment of major illnessesGet access to breakthrough cancer drugs and therapiesSee a GP usually within 24 hours in the comfort of your own home with Digital GP24/7 Healthline available for you to speak to a qualified nurse or doctor if you have any health concernsIncludes pre-treatment MRI, CT and PET scans.Outpatient therapies are included as standard.A cancer promise, where BUPA will pay for any eligible cancer costs in full, subject to T&Cs.Cover for more mental health conditions than any other leading UK insurer.A choice of three hospital lists gives you greater flexibility over where you are treated.Get discounts to popular restaurants and shops with 2-for-1 tickets to major UK attractions.

The policy information provided has been taken from Bupa’s website and is correct as of January 2022.

Bupa Customer Reviews and awards

BUPA collects reviews using Trustpilot and currently has a 4.4 out of 5-star rating from over 12,000 reviews and are classified as “Excellent”. Bearing in mind the size of BUPA’s customer base, we think this is incredibly impressive and a testament to the levels of cover and service they provide.

Like other policies in this article, Bupa By You Comprehensive scored a five-star Defaqto rating in 2021.

Aviva Health Insurance Review

Aviva Private Healthcare Review

Aviva Private Healthcare Review

Aviva’s health insurance product Healthier Solutions, offers prompt private medical treatment through a nationwide network of hundreds of hospitals. Like the other providers in this list, Aviva’s Healthier Solutions has a 5-star defaqto rating for 2021, demonstrating their excellent cover level. Winners of the Company of the Year and Best Individual PMI Provider 2019 at the Health Insurance & Protection Awards, Aviva has a track record as a reliable insurer.

Aviva Healthier Solutions

We would describe Aviva’s offering as a flexible private healthcare solution that can be tailored to almost anyone’s requirements. In terms of how comprehensive their private health insurance policies are, Aviva provides full outpatient cover and standard inpatient protection. You can adjust your cover in many ways, such as adding routine dental and optical treatments or changing your hospital list to reduce costs.

Aviva Policy Highlights:

Cover for acute short-term illnesses or injuries.Access to hundreds of nationwide private hospitals, including the BMI, Nuffield Health and Spire hospital networks.Digital GP provides around-the-clock video consultations.Excellent cancer cover as standard.Outpatient consultations and private healthcare treatment included as standard.24-hour stress counselling helpline.25% gym membership discount.Couples pay less.Younger children can be added for free.Flexible policies which can be tailored to your budget and requirements.

Information regarding Aviva insurance taken from the Aviva website and correct as of January 2022.

Aviva customer reviews and awards

Aviva has collected nearly 19,000 reviews on Trustpilot at the time of writing, with an incredible score of 4.7 out of 5. However, please remember that this score and volume of reviews relates to all of its insurance offerings in the UK, not just health insurance.

Vitality Health Insurance Review

Vitality Health Insurance Review

Vitality Health Insurance Review

Vitality provides both life and private health insurance, this part of our article focuses purely on their health insurance product called Personal Healthcare. Once again, Vitality’s health insurance offering scores an impressive 5-star defaqto rating for 2020.

Vitality – Personal Healthcare

Vitality is often described as an innovative provider of private health insurance as they have brought new ideas to the market, such as rewarding those who keep active. Their Core cover includes both in and day-patient cover, plus out-patient surgical procedures.

Reviews and awards

Vitality enjoy a 4.3 out of 5 star score on Trustpilot and are rated as excellent. As five times winners of Moneyfacts “Best Private Medical Insurance Provider” award, you can be sure that Vitality are committed to delivering the highest levels of customer service.

Vitality Policy Highlights:

High levels of customer satisfaction from an innovative providerExcellent cancer cover included as standardIncludes home nursing and private ambulance serviceNHS hospital cash benefitWeight loss surgery includedOral surgery included24/7 private GP helplineTalking therapies includedReceive discounts on a large number of healthy lifestyle activities

Information regarding Vitality insurance taken from the Vitality website and correct as of January 2022.

Health-on-line Health Insurance Review

Health-on-line reivew

Health-on-line reivew

Health-On-Line is a relatively new private health insurance company which started in 2000 to provide a new approach to the market. Since then it has grown significantly, resulting in it being acquired by AXA, albeit still trading under its brand name.

Health-on-line’s health insurance service aims to give you more control over your policy and your healthcare. You get a dedicated account manager, 24/7 nurses helpline, and you can manage your account, as you would hope, online.

Reviews and awards

Health-on-line currently has a score of 4.8 out of 5 on Feefo from 141 reviews in the past year.

Health-on-line is currently transitioning to the AXA brand and within the next few months, the brand will likely be replaced with one new brand AXA Health.

Other awards:

Your Money 2018 and 2019 AwardsFeefo Platinum Trusted Service Award 2020

Health-on-line Personal Health and inSpire

With access to over 200 quality assessed hospitals via the Axa PPP network, Health-on-line can provide excellent nationwide coverage. As with other providers, you can build a plan around your specific circumstances, including a bespoke hospital list.

Health-on-line policy highlights:

Comprehensive medical cover with over 250 UK hospitalsAccess more than 24,000 specialists nationwideDay patient and inpatient cover included24/7 nurse hotlineCancer cover included in both Personal Health and inSpire plansUp to three specialist consultations per year Discounted gym membership25% off health assessments

Information relating to Health-on-line insurance taken from their website and correct as of January 2022.

Freedom Health Insurance Review

Freedom health insurance review

Freedom health insurance review

Freedom Health Insurance was established in 2003 and is a specialist provider of Private Medical Insurance. Being that they only offer healthcare insurance, they are dedicated to the provision of first-class private medical protection. Unlike other providers, they don’t adjust their premiums based on your location, so even if you’re in a more expensive area such as London, you’ll pay the same as if you were outside of the capital.

Freedom Elite

Freedom’s best level of protection is their Freedom Elite product, which gives you comprehensive in and outpatient cover. Medical costs are settled directly with the hospital, and the whole plan can be tailored to your requirements.

Freedom Elite is by its nature a comprehensive, high-quality policy, with cover even for alternative therapies such as homoeopathy and podiatry as an optional extra. It includes full cancer cover, with oncology tests, surgery and private healthcare treatment. Psychiatric cover is an additional extra as is access to a private GP, Dentist and Optician.

Reviews and awards

Freedom only has a small number of reviews on Feefo but they are largely positive, with the company scoring 4.6/5 from 32 reviews.

Other awards:

2019 Health Insurance & Protect Awards Finalist

Freedom private health insurance policy highlights:

Medical treatment costs settled directly with the hospitalFull inpatient annual benefitHealth insurance tailored to your requirementsDay patient cover includedNo increase in renewal premium for making claimsCancer cover as standardOptional psychiatric and alternative therapies coverOptional virtual GP and routine dental and optical cover

Information relating to Freedom Health Insurance taken from their website and correct as of January 2022.

WPA Health Insurance Review

WPA Health Insurance Review

WPA Health Insurance Review

WPA are a smaller but growing private health insurance company that provides individual and family health insurance policies. Innovatively, WPA have introduced the multi-family policy, which allows you to create a plan which covers both your immediate and extended family.

WPA Flexible Health and Multi-Family Healthcare

WPA’s Flexible Health product gives you the ability to choose from three levels of cover, Essentials, Premier and Elite. Seeing as we are interested in the best private healthcare insurance, we’re going to focus on their Elite offering which includes full in and outpatient cover.

Reviews and awards

WPA have nearly 400 reviews on Trustpilot and currently score an impressive 4.8 our of 5 and are rated as Excellent. Having only started collecting reviews in 2018, the number of positive responses is especially impressive.

WPA health insurance policy highlights:

Extensive cover with a significant hospital listInpatient and day-patient cover as standardFull outpatient cover on their Elite planUnlimited annual benefit limit on their Elite plan

Information relating to WPA insurance taken from their website and correct as of January 2022.

Saga Health Insurance Review

Saga’s health insurance is for the over 50’s market and they have a range of policies. Their “Super” product range offers their best policies, covering both in and out-patient treatments as well as diagnostic procedures. Saga’s HealthPlan Super, Super 4 and Super 6 all scored a defaqto score of 5 in February 2020.

Saga HealthPlan Super

With Saga you have access to a nationwide network of over 500 private hospitals and you have access to special services which are not available on the NHS such as speaking to a GP at any time, day or night. They offer policy options such as a 4-week wait, where you can reduce the cost of your premium by agreeing to be treated by the NHS if the waiting time is less than 4 weeks.

Saga has an enviable level of reviews on Trustpilot, scoring a 4.5 out of 5 with over 10,000 reviews.

Saga policy highlights:

Outpatient consultations and treatment included as standardUp to £2,500 of mental health treatment per annum£2000 allowance per year for homoeopaths and acupuncturistsSecond opinion service

Information regarding Saga taken from the Saga insurance website and correct as of January 2022.

The Exeter Health Insurance Review

The Exeter is a society that was first founded in 1927, previously known as Exeter Family Friendly, it rebranded in 2015 to simply “The Exeter”. As an award-winning insurer providing everything from health insurance though to life and income protection policies, they are very popular among people of all ages.

The Exeter Health +

The Exeter’s best health insurance is called Health+ and it promises to give more control and flexibility over your private health insurance and treatments. At the heart of every policy is the determination to provide access to fast treatments of the highest quality. They’ve recently enhanced the product by giving the option for unlimited outpatient diagnostics.

Reviews and awards

The Exeter has over 400 reviews on Trustpilot, scoring a strong 4.6/5 and rated as Excellent.

The Exeter policy highlights:

A choice of three hospital listsUnlimited in-patient and day-patient treatmentComplete cancer coverOut-patient surgeryPrivate ambulanceHome nursingPost-op physiotherapy

Information regarding The Exeter taken from The Exeter insurance website and correct as of January 2022.

CS Healthcare Health Insurance Review

Only since 2019 has CS Healthcare opened their doors and said that anyone can get their private medical insurance, regardless of their profession. Prior to that, you would have to work in a particular profession to access their policies.

CS Healthcare Yourchoice

CS Healthcare’s Yourchoice private medical insurance policy is its flexible policy which can be tailored to your individual requirements. All Yourchoice policies start with their ‘Essential’ model, which can then be built on to create a bespoke service.

Reviews and awards

CS Healthcare has collected an impressive 605 reviews on Trustpilot and is rated excellent, scoring 4.4/5 when we checked in December 2020

CS Healthcare policy highlights:

In, day and out-patient surgery included under their Essential moduleSpecialised scans are includedPost-op carePrivate ambulance included24/7 health advice lineSpecialist and consult fees included

Information regarding CS Healthcare taken from the CS Healthcare website and correct as of January 2022.

General Medical Health Insurance Review

Check back soon for our review of General Medical and their leading products.

National Friendly Health Insurance Review

Check back soon for our review of National Friendly and their leading products.

About private healthcare and medical services in the UK

We’ve looked at the best private health insurance, but now perhaps we should look at the private healthcare services it’ll give you access to. In this section of our guide, we look at what private healthcare is, the benefits, the providers and anything else we think you might need to know on the subject.

what is private healthcare in the UK?

Private healthcare can be an attractive alternative to using the NHS, as patients will generally be seen quicker and have far greater flexibility over their medical treatment. That said, it isn’t cheap, which is why many people look to purchase private health insurance which covers the cost of many private treatments.

Benefits of private healthcare

There are a number of significant benefits that being treated privately can offer:

Avoid NHS waiting times, be seen, diagnosed and treated quickly.Access treatments and drugs which may not be available on the NHS.Receive results of tests and scans quickly.Get more choice over the specialist that treats you. Have greater flexibility over where you’re treated.Stay in a private room, with more flexible visitor hours.

NHS Patient Choice Programme

The NHS recognises that patient choice is extremely important and it, therefore, has a dedicated programme aimed at improving the communication of the available options to patients. You can ask your GP about treatment via private healthcare, and they should be able to help you make an informed decision as to whether it is appropriate in your circumstances.

Private hospitals and health insurance

Every private health insurance policy provider has its own hospital directory or list, which is a collection of hospitals which they will allow you to receive treatment at, as outlined in your private medical insurance policy. This list tends to be exclusive to the insurer, although most policies will allow you to access the largest hospital providers such as Nuffield, Spire, Ramsay, BMI and Circle Healthcare. It isn’t always the case though, so be sure to confirm this with your insurer or check with us.

To access more extensive hospital directories, such as those based in London and HCA hospitals, your insurance company may allow you to receive medical treatment for an additional policy premium. You should also bear in mind insurers may update their hospital list throughout the year, adding or removing to their standard directory.

If you’re in doubt or would like a helping hand, we’d be happy to work with you and advise on the hospitals that you’d benefit from accessing for your needs.

Private healthcare providers in the UK

There are a variety of Private Healthcare providers across the UK, some of which specialise in certain conditions, with others offering a broad range of medical services. In this section, we provide an overview of four of the leading providers, where their hospitals are and what they are best known for.

Nuffield Health

One of the best known Private Healthcare providers in the UK, Nuffield Health is a not-for-profit charity, which invests its income back into improving the nation’s health. They currently have 31 hospitals and over 100 fitness and wellbeing clubs across the UK. They work with the NHS, private medical insurers, employers and the public to provide private health and wellbeing services.

Spire Healthcare

Spire Healthcare has 39 private hospitals across the UK and provides a large range of treatments, from cancer and cardiac care, through to diagnostic scans, tests and investigations. An award-winning provider, Spire Healthcare are committed to providing high-quality care to the UK.

BMI Healthcare

BMI Healthcare started in 1970 and today has 54 private hospitals and clinics throughout the UK. Offering over 500 different medical treatments, they have centres of excellence for cancer, spinal, orthopaedic, neuro and cardiac care. According to their website, as of 2020, they handle over 296,000 inpatient and 1,700,000 outpatient visits each year.

HCA

HCA operates six world-class private hospitals across London and the Christie Private Care Hospital in Manchester. Due to location and their first-class facilities, healthcare at these hospitals tend to cost more than with some of the other providers mentioned.

Ramsay Healthcare

Ramsay Healthcare has a network of 33 private hospitals in England and Wales, which provide a comprehensive range of clinical services to over 200,000 people per annum and employing over 5,000 people.

Other providers of private healthcare

In addition to the four providers we’ve mentioned, there are numerous others that provide excellent services to their patients. We always encourage people to research the providers themselves, we’re more than happy to share what we know, but you’re more likely to discover things that are pertinent to you.

Private hospitals in the UK

With well over 100 private hospitals scattered across the UK, each with their own specialisms and consultants, it can be tricky to locate the one which is best for you. If you’re insured, you should always start by speaking to your insurer, to see which hospitals they include in your cover. If you’re not insured and looking to pay directly.

Types of private hospitals

There are several types of private hospitals that you will come across in the UK:

Large hospital groups such as BMI Healthcare, Nuffield and SpireSmall Independent hospitalsCharitable HospitalsPrivate patient clinics or units within NHS Trusts

Key points to consider when choosing a private hospital

Price of the private treatment: if you are self-paying or have a private medical insurance policy which gives you a certain amount of cash to spend, the price of private medical treatment will be an important consideration.Specialists or consultants: who works at the hospital and do they have the specialisms that you require? Infection rates and MRSA levels: getting an infection shortly after surgery can slow down recovery, so checking how your chosen hospitals compare to others in terms of infection rates is crucial.Customer ratings and reviews: what do existing customers say about the hospital and the services it provides?Private room facilities: Will you receive a private room and are there flexible visiting hours for your friends and family?Location: How easy is it for you to get there and for your family to visit too?“Part of the service myTribe provides is helping clients to build a bespoke hospital list based on their location and requirements”

How much does private healthcare cost in the UK?

The cost of treatment in a private hospital will depend on a variety of factors, such as your location, the private healthcare treatment you require and whether you do or don’t have a private health insurance policy. This is a hugely important question to ask, and one we’ve written a dedicated article about.

How do you pay for private healthcare?

There are a number of ways you can pay for private healthcare in private hospitals around the UK. The three most common are:

Having Private Health Insurance: Paying a monthly premium which covers you for a range of potential healthcare treatments. Often accompanied with an excess on the policy at the point of claim. Paying for the services directly: Arguably the simplest method with the most flexibility, pay for the services as you require them.Via a personal medical loan: Similar to paying direct, albeit finance is provided to allow you to spread the cost of the private medical treatment.

Accessing private healthcare via private medical health insurance

Having private medical insurance is one of the most popular ways of accessing private healthcare in the UK. It gives you a predictable monthly cost, while also providing peace of mind that should you become unwell, you’re covered.

What isn’t covered by Private Health Insurance

What is and isn’t covered by health insurance, including which hospitals you can access will vary from provider to provider and of course the terms of your policy. However, most private health insurers will exclude the following from your policy:

Pre-existing conditionsNormal pregnancyCosmetic surgeryRoutine dental and optical careEmergency servicesChronic conditions

For more information about what isn’t included, it is always best to look at your policy documentation, or ask us, when we’re discussing your policy options.

Insurers’ Hospital Lists

Every insurer will have their own hospital directory which will detail the hospitals you can receive private medical treatment at in the event of a claim. Usually, the insurer will offer a national hospital list comprising primarily of mid-range hospitals, spread across the UK. You can, however, ask for a different list, be that of hospitals which are more local to you, or even higher-end hospitals, usually located in central London. As with any option within private health insurance, the hospital list you choose will affect your premium.

“myTribe’s advisors have an excellent understanding of the UK’s private hospital network and work will work with you to build a hospital list tailored to your location and requirements”

Compare private health insurance providers with myTribe

Compare the best providers of private medical insurance with us and get free, impartial advice from one of our UK based Financial Conduct Approved authorised and regulated partners. Health insurance quotes can at times be complicated, and choosing the best health insurance policy isn’t always straightforward, which is why we’re here to help. Simply get in touch and we’ll provide you with bespoke health insurance quotes based on your personal circumstances.

Benefits of our service:

Our private medical insurance comparison and advice services are free of chargeWe will provide you with the best insurance policy pricing availableYou’ll have a dedicated account manager from start to finishOur advice is impartial and independent – we aren’t tied to a single insurerOur advisors are authorised and regulated by the Financial Conduct AuthorityAccess pricing not available on comparison sites

Frequently asked questions

What is an acute medical condition?

Each insurer will define an acute condition slightly differently. Still, we define it as an illness that is curable through medical intervention. Acute conditions can include injuries, but only those that are likely to respond quickly to treatment. As a reminder, most acute conditions will be covered by private health insurance policies.

What is a chronic medical condition?

A chronic condition is defined as one that isn’t curable and will probably require management instead of medical treatment. Two examples are diabetes and asthma, both of which would be excluded from a policy. For a complete list of exclusions, or if you have any concerns, be sure to ask your adviser what is and isn’t covered before taking out your policy.

What is inpatient treatment?

Inpatient treatment means that you need to be admitted to the hospital and stay overnight. All private health insurance policies include inpatient treatments, meaning those which require an overnight stay in hospital. However, it’s important to point out that your treatment could be delayed without a level of outpatient cover as your testing and diagnosis would take place via the NHS.

What is day-patient treatment?

Day-patients typically still require a bed and will be admitted to the hospital, but they won’t need to stay overnight and be discharged on the same day. While day-patient treatment is included in most policies, the same issue we raised with inpatients applies. You will most usually need to be diagnosed via the NHS before being referred to a private hospital and consultant for treatment.

What is outpatient treatment?

Before receiving treatment for your condition, you will inevitably go through one or multiple consultations and tests before receiving a diagnosis. If you’d like the fastest route, you will need to opt for a level of outpatient cover in your policy. Most of the best health insurance policies, including those we have reviewed in this guide, include a level of outpatient cover and can therefore be defined as comprehensive.

Bear in mind, though, whether you do or don’t have outpatient cover, you always start with a visit to your GP. If you have a comprehensive policy with outpatient cover, you’ll be referred by your GP to a private specialist, and from that point on, all of your tests, consultations and treatments will take place privately. Comprehensive policies with outpatient cover will typically also include things like physiotherapy and mental health support.

What is a pre-existing condition?

A pre-existing condition is a medical illness, disease or injury which you have sought treatment for in the past. It may be that you had a one-off issue, or it could be that you required ongoing treatment; either way, both are pre-existing conditions.

With Moratorium underwriting (95% of policies use this form of underwriting in the UK), any pre-existing conditions from the past five years will automatically be excluded from your policy. However, the exclusion will be removed if you don’t suffer any symptoms or require treatment for said condition/s for two years after taking out a policy.