Benchmarking Report Reveals Changes in Manufacturing Insurance

As risks change, manufacturers change their insurance purchasing habits.

Supply chain disruption, labor shortages, a global pandemic, state sponsored hacking. These shifting concerns over the last two years have contributed to an aggregate trend of manufacturers choosing to insure more risks than prior to COVID-19. Monitoring these purchasing changes along with rate differences was the focus of a newly released 2022 Benchmarking study by Assurex Global.

The 2022 Manufacturing Benchmark Report surveyed over 1,200 manufacturers of varying sizes and industries representing over $79 billion of revenue and 92,000 employees. Assurex Global is the world’s largest privately held insurance brokerage group of which R&R Insurance is a proud member.

A summary of the report’s key findings can be found here while some notable trends from the full 79-page report are posted below. Request the full report here.

Manufacturers are buying more excess liability insurance policies, especially Cyber

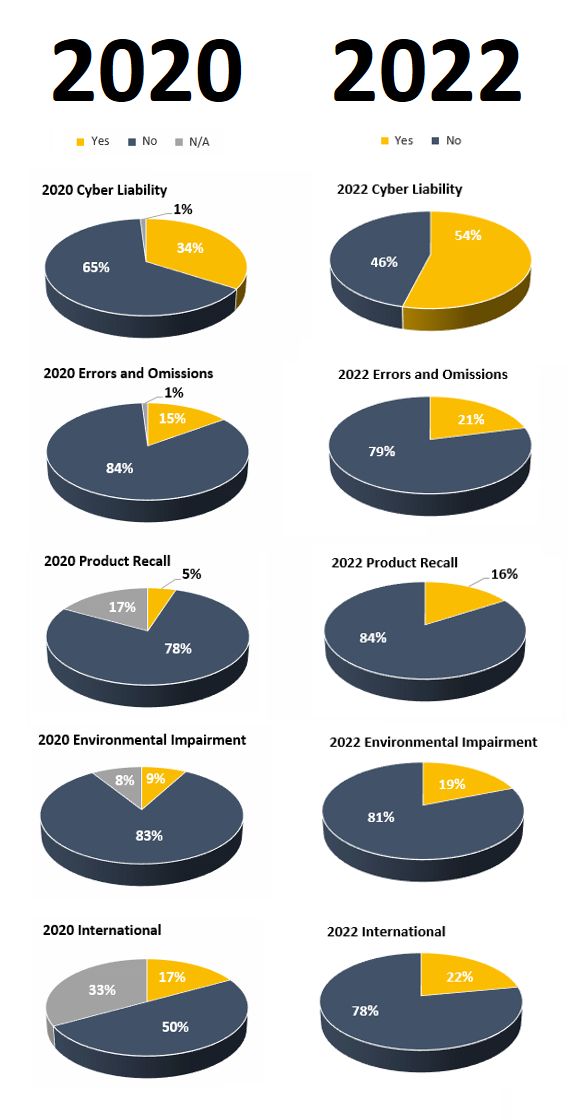

Assurex analyzed data on over 800 manufacturers in 2020 and over 1,200 in 2022. Some of the most striking differences between the reports is how many of these firms carried standalone excess liability policies on certain lines. The results show an increase in excess liability purchases across the board, but especially in cyber.

Cyber risk is becoming obvious to the Manufacturing Industry. There is a sizable 20-point pickup in standalone Cyber insurance policies compared to Assurex’s 2020 Manufacturing Benchmark Report.

Other excess liability insurance policies are being picked up at a greater rate by manufacturing business, though not to the same degree as cyber. Most surprising to Assurex was that despite increasing supply chain disruption, International insurance only picked up a few points compared to 2020.

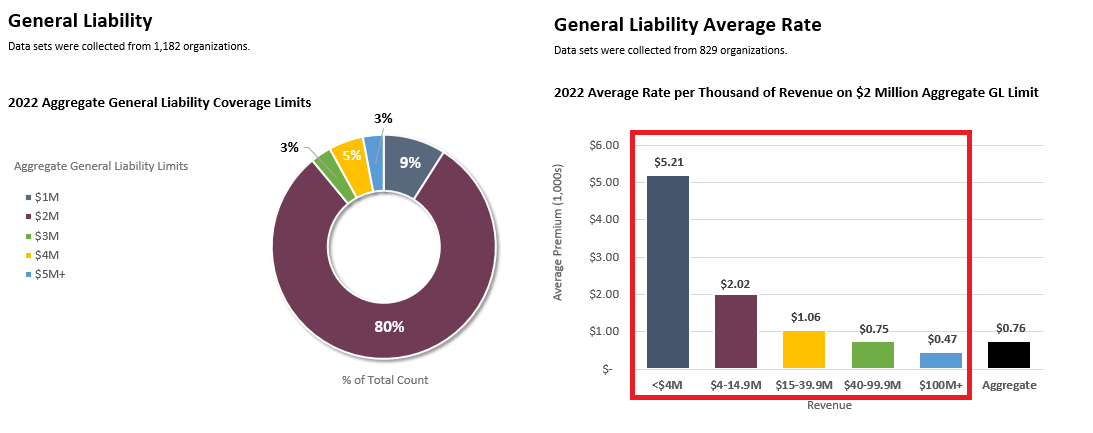

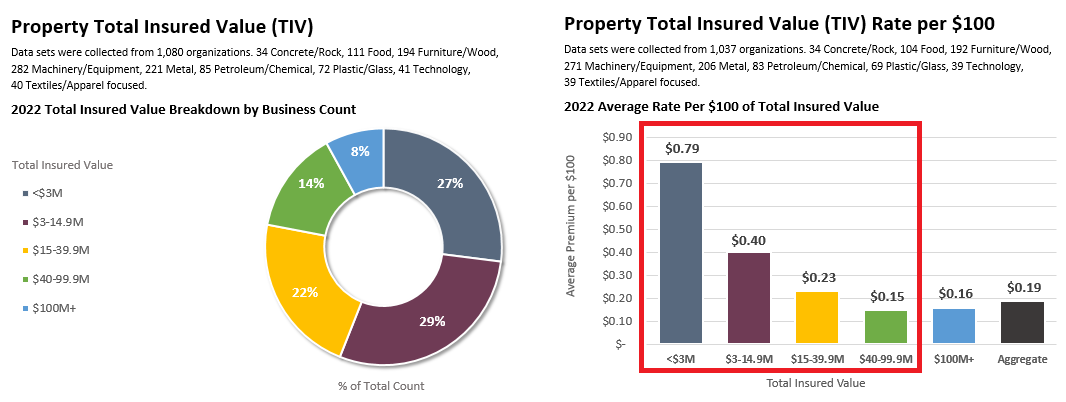

Small Manufacturers are Paying Much Higher Liability and Property Rates than Large Manufacturers

With tangible goods it’s generally cheaper to buy in bulk, but when buying an intangible insurance policy does the same principle apply? Even though the level of risk doesn’t change it’s surprising to see such a large gap in liability and property rates between small and large firms. Small manufacturers are paying dramatically higher rates than larger firms.

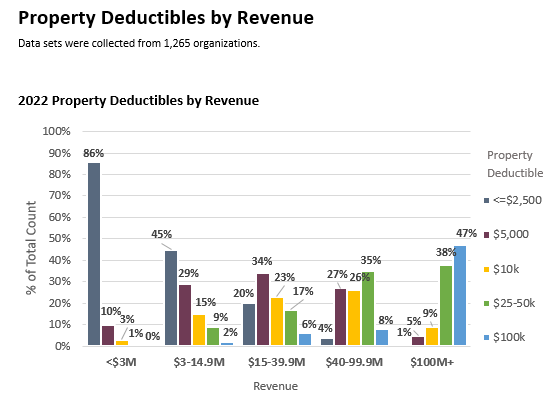

The reason for the difference likely has to do with larger firms taking on higher deductibles to achieve lower rates. This is especially noticeable in property (see image below). Never the less, a doubling of rates at just about every level of account size measured is still a greater difference than what many experts might suspect, including Assurex.

Larger Organizations Tend to Purchase Significantly Higher Excess Liability Limits than Smaller Ones

It isn’t that surprising to see a direct relationship between revenue and the propensity to purchase greater excess liability limits (umbrella policies). The greater the revenue of a manufacturer, the larger their excess liability limits they tend to purchase.

It isn’t that surprising to see a direct relationship between revenue and the propensity to purchase greater excess liability limits (umbrella policies). The greater the revenue of a manufacturer, the larger their excess liability limits they tend to purchase.

While the trend does seem predictable there is an area of concern. Though a minority, there are a disturbing number of manufactures with more than $40 million in revenue only purchasing $5 million or less in excess liability limits. In an increasingly litigious society, this seems incredibly risky – yet 19% of $100M+ manufacturers and 29% of $40M-$99.9M manufacturers are in this category.

Further Breakdowns Available In The Full Report

Click here to find the full 79-page Assurex Global 2022 Manufacturing Benchmark.

The report details further additional excess lines such as D&O Insurance, Auto liability and Employee Benefit trends. Industry break down also is detailed for Furniture/Wood Product Manufacturing, Metal Manufacturing, and Machining/Equipment Manufacturing.

Insurance purchasing is a complex decision for any business. With the pace of new business risks emerging it is becoming more important than ever to have the right data on hand when making insurance spend decisions. Click here to see a list of R&R Insurance Consultants specialized in the manufacturing space and ready to answer the growing number of questions in today’s dynamic landscape.