Being a Good Pet Parent Starts With Pet Insurance

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers, listeners, and loyal fans benefit from her practical advice.

Laura is a trusted source for national media who frequently seek her practical advice on various finance topics for T…

Full Bio →

Written by

Laura D. Adams

Insurance & Finance Analyst

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states.

After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health insu…

Full Bio →

Reviewed by

Rachael Brennan

Licensed Insurance Agent

UPDATED: Nov 19, 2021

Advertiser Disclosure

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

Here’s the Scoop

In the U.S., 3.1 million pets are covered by pet health insurance

In 2020, U.S. pet industry sales reached $103.6 billion, and $31 billion of that was on veterinary care and products

Depending on the type of policy you choose, pet insurance covers wellness, accident, and illness care

In today’s uncertain world, in addition to the health risks of the global pandemic, loneliness has reached epidemic proportions. One way that many of us have chosen to try to deal with the situation to the best of our ability is by bringing more pets into our lives. It has reached such high proportions of pet ownership that there has even been a dog shortage.

Pet ownership is at an all-time high — last year alone, pet ownership in the United States rose by 70%. Pet insurance may be the right move for you to consider to help offset some of the high, unexpected costs associated with your pet’s health. Let’s explore the costs below.

The Cost of Pet Ownership

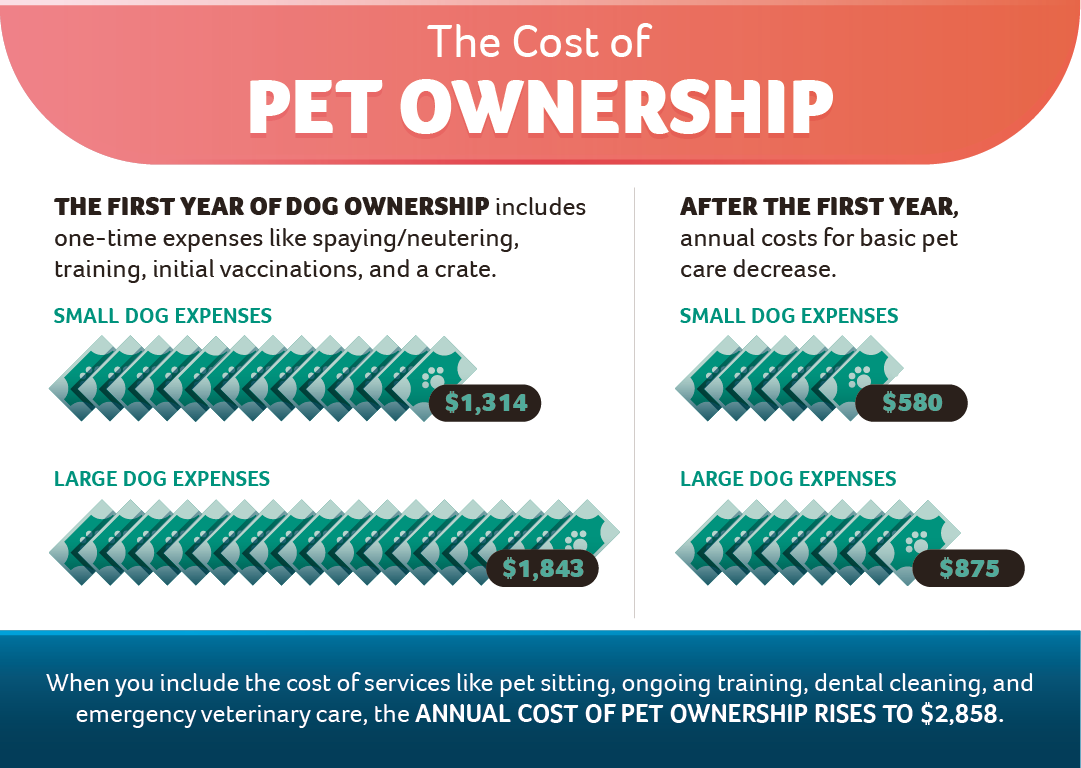

It is worth noting that there is a lot more that goes into the cost of owning a pet other than the startup costs, food, and basic necessities. But what do these basic necessities include? One time expenses such as spaying/neutering, training, initial vaccinations, and a crate.

A rule of thumb when thinking about the costs associated with owning a pet would be to break down the costs in 2 different ways: first if you have a small or large dog, and next by the first year of ownership versus ongoing ownership. Small dog ownership in the first year on average costs $1,314 versus large dog ownership at $1,843.

Ongoing costs for small dogs are $580 with large dogs at $875. However, once you start counting the additional costs such as pet sitting, ongoing training, dental cleaning, and emergency veterinary care, annual pet ownership costs skyrocket to $2,858 a year.

Where does pet spending go?

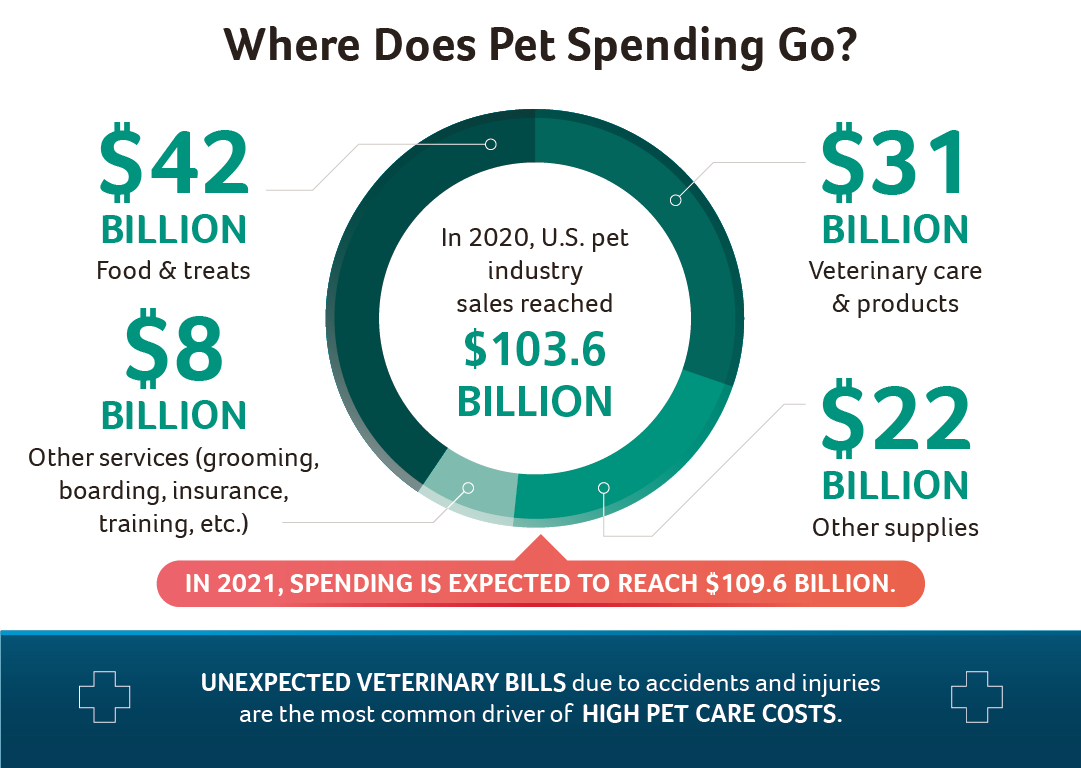

It’s useful to take a look at the cost breakdown of where the costs of pet ownership go towards. Last year, the U.S. pet industry hit a whopping $103.6 billion, expecting to go to $109.6 billion this year. A breakdown includes $42 billion in food and treats, $31 billion in veterinary care, $8 billion in services such as grooming and boarding, and $22 billion in other services.

Preparing for Pet Injuries and Illness

Aside from the costs of pet ownership that we have already discussed above, it’s important to establish a rainy day fund for if and when your pet may become injured or seriously ill. Even taking the utmost care of our pets, medical events such as this are bound to happen.

The three highest pet illnesses include poisoning ($1,783), torn ACL ($3,300), and cancer treatment ($5,000).

Preventing Unexpected Vet Bills Starts With Keeping Your Pet Healthy

A great way to mitigate against unexpected veterinary bills is to be proactive with your pet and keep them healthy. 80% of pet owners bring their pets to the veterinarian at least once a year – try to make this a conscious practice in your life. In addition to regular checkups, brushing your pet’s teeth or bringing them to have dental cleanings will go a long way in the long term.

Be sure to use flea and tick prevention, and keep your pet away from toxic houseplants and other hazardous materials. A surprising 3 in 4 pet owners do not have pet insurance. Having this type of insurance can cut down on seriously expensive unexpected vet bills.

Do you need pet insurance?

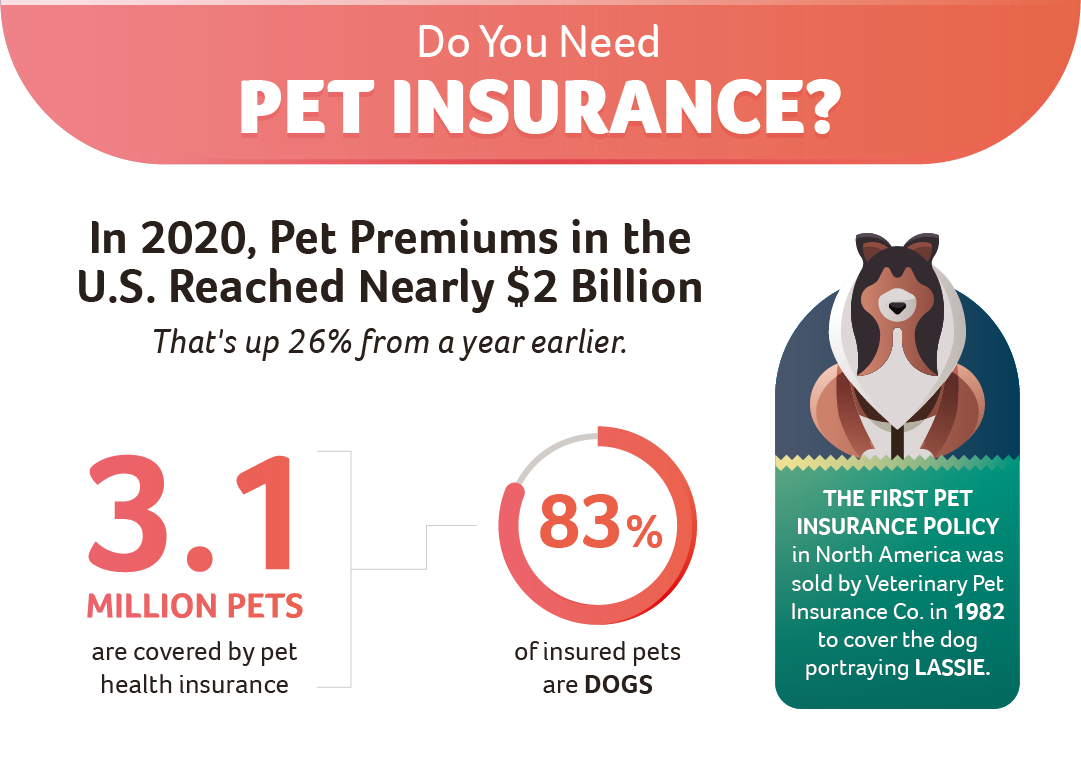

Is pet insurance worth it? Depending on the specific needs of your pet, you may or may not be a good candidate for pet insurance. Last year, pet premiums in the U.S. reached nearly $2 billion, up 26% from the prior year. A total of 3.1 million pets are covered by pet insurance, 83% of the insured pets being dogs. Having pet insurance still comes with a lot of benefits.

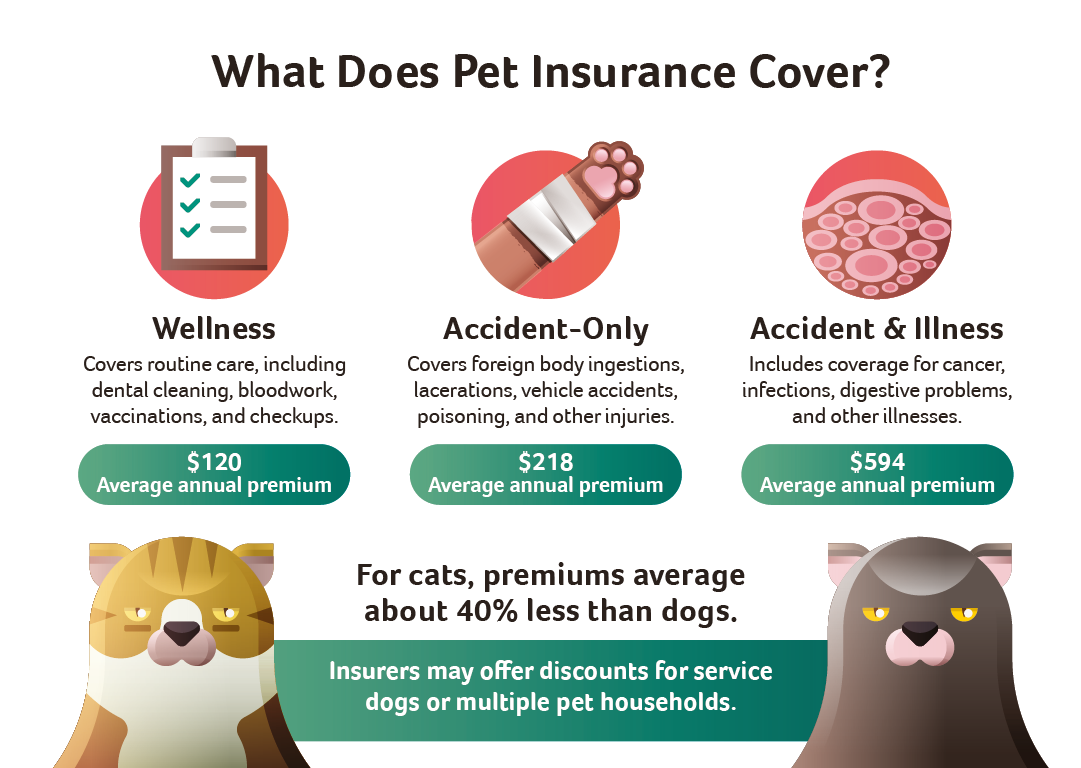

What does pet insurance cover?

Even if you and your pet are good candidates for pet insurance, it is important to note what exactly pet insurance covers and how that can vary based on the type of pet insurance you get. The basics of pet insurance coverage include wellness – routine care, dental cleaning, bloodwork, vaccinations, and checkups.

Accident only covers foreign body ingestions, lacerations, vehicle accidents, poisoning, and other such injuries. An accident and illness plan includes coverage for cancer, infections, digestive issues, and other illnesses. If you’re a cat owner, rejoice! Cat premiums are 40% less than dogs on average.

What does pet insurance not cover?

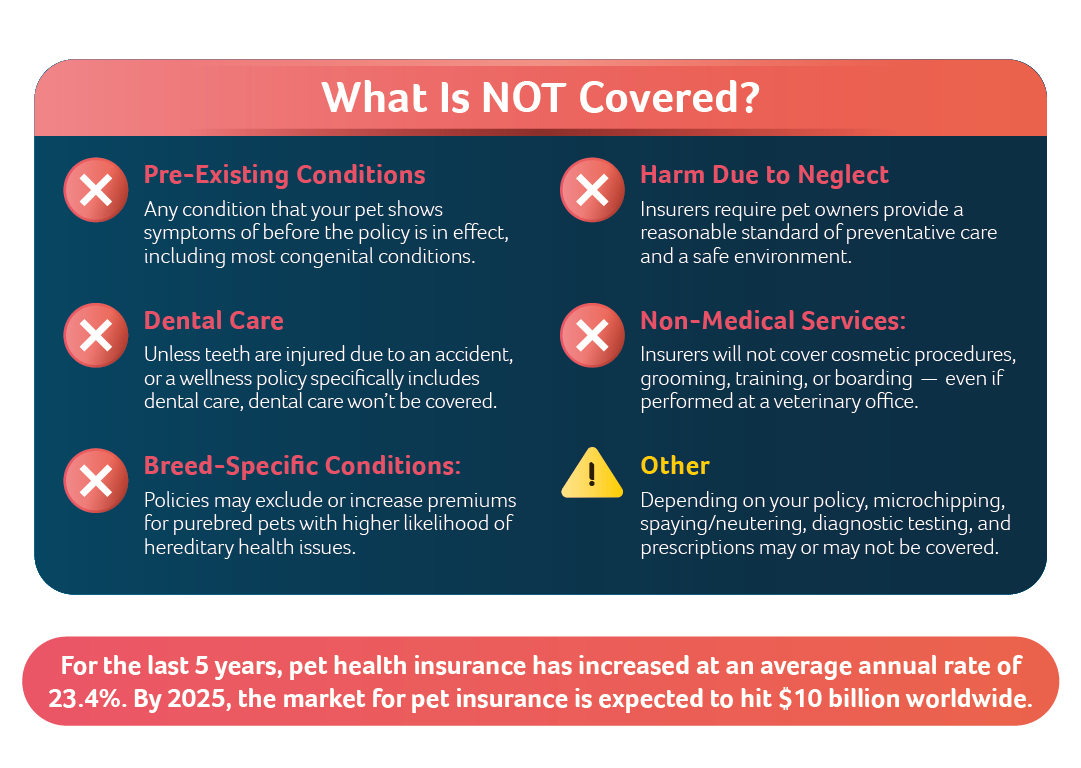

Now that we have established that pet insurance is right for you and have explored what pet insurance can cover, let’s take a look at what expenses are not covered by pet insurance. Pre-existing conditions before the policy is in effect, including most congenital conditions, are not covered.

Dental care, unless caused by an accident, as well as breed-specific conditions also aren’t covered by pet insurance.

Harm due to neglect – which you should never do – wouldn’t be covered by pet insurance providers. Non-medical cosmetic services also won’t be covered.

Find the Best Pet Insurance For You and Your Pet

Not all pet insurance plans are created equal. You have choices in today’s market – let’s explore which is the best pet insurance for you and your pet.

There are currently 20 pet insurance providers in North America, and Nationwide is the only current pet insurance provider that covers beyond pet insurance for dogs and cats. Nationwide pet policies include coverage for birds, rabbits, snakes, turtles, and more.

You Still Need Savings to Cover Pet Costs

Despite even the best of pet insurance for you and your pet, you’re still going to need some savings to back it up in the event of serious illnesses and costly medical bills. Keep in mind that most pet insurance providers will reimburse you once you have paid the bill in full. Vet-specific wellness plans will not require reimbursement, such as Banfield and PetVet365.

So, is pet insurance worth it?

Pet parenthood is a lot of responsibility, but oh so worth it in the end. Keep your pet healthy and well and they will love you back. Stay ahead of the game by being proactive, getting the best care for your pet, and finding the right pet insurance for you and your pet.