Behind the Wheel: Navigating Hard Market Challenges in the Personal Auto Insurance Industry

Erik Bahnsen, Industry Analyst, CCC —

It’s no secret that we’re in the midst of a uniquely challenging time for personal auto insurers due to a convergence of factors including risky driving and significant increases in the cost of auto repair/replacement, labor, and medical bills. The industry has reacted to those challenges with unusually steep premium increases. In the last year alone, the average auto premium cost increased by 17%. With the latest projections predicting profitability challenges to persist until at least 2025, it’s reasonable to expect this current hard market to continue through at least the same time period.

Some downstream impacts have already been articulated, including increased policy shopping and lower customer satisfaction scores. Others are starting to creep in under the radar, yet all have the potential to compound current challenges to insurers, as well as create opportunities. It’s the less immediately obvious downstream impacts that are the focus of this feature, both for purposes of raising awareness and preparing insurers to take proactive measures. Confucius once said, “Plan ahead or find trouble on the doorstep.”

Let’s start with the impact on drivers most vulnerable to the financial strain of sustained premium increases: Faced with inflation on all fronts and incomes unable to keep pace, a subset of previous “adequately insured” drivers shift into the category of “underinsured”, dropping and/or gutting needed coverages as a cost-saving measure. The other at-risk subset, most of which were previously insured at state-minimum levels, now shift from “underinsured” to “uninsured”, electing to drop coverage altogether and take their chances.

For reference, the best baseline (pre-pandemic) estimate of the percentage of uninsured drivers nationally was about 13%, with some states notably higher.

Taken as a whole, it’s reasonable to expect substantial growth in the percentage of BOTH uninsured and underinsured drivers on the roadways. This has the potential to shift a significant additional cost burden to the standard book of business, as more “standard book” customers who are involved in collisions with uninsured or underinsured drivers are now forced to file with their own carriers, even when they are not liable. Additionally, the potential for subrogation and/or legal actions to recoup costs against this distressed subset is very poor.

This hypothesis is rooted in recent objective evidence: A survey conducted by Policygenius shortly after the latest wave of premium increases found that 26% of respondents were currently considering driving without insurance altogether. That number rises to an alarming 54% for drivers aged 18 – 34. Within CCC estimating data, we have observed a notable change in the ratio of auto property damage collision to liability claims over the last five years, with collision increasing and liability decreasing (Figure 1). This trend is consistent across internal and external data sets, supporting the point about a growing number of customers filing collision claims even when they are not liable.

Figure 1

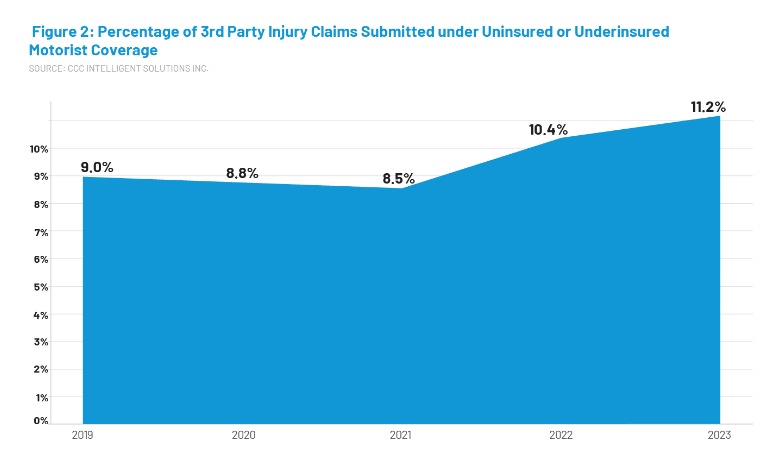

On the casualty side, we are seeing frequency increases in the percentage of 3rd party injury claims submitted under uninsured or underinsured motorist coverage (Figure 2), which is only utilized when an insured driver and/or passengers sustain injuries due to the negligence of an uninsured or underinsured driver.

Figure 2

Lastly, we also are seeing increases in the percentage of 1st party injury claims exhausting benefits (Figure 3), meaning the policyholder’s personal injury protection or med pay coverage is increasingly inadequate to cover medical bills incurred.

Figure 3

In conclusion, one can reasonably expect a larger financial burden to shift to the standard book of business and/or typically less risky policyholders as continued rate increases push more and more drivers to “uninsured” and “underinsured” status.

Information is power, which is why these points are raised for awareness, but what about mitigation and proactive measures? Opportunities abound to leverage technology to improve accuracy and efficiency across the claim cycle. For example, as we have previously reported, rapid medical billing inflation, aging population, and shifting treatment patterns have only strengthened the need for robust medical bill review engines, price benchmarking, and medical professional reviews to ensure injuries of questionable causation and/or treatment of questionable necessity are identified and addressed. Indemnity for unsupported injuries or treatment can quickly add up to hundreds of millions of dollars, ultimately harming consumers. These tools, when combined with automation and technology such as straight through processing, photo estimating, and integrated payments can improve loss adjustment expense and ensure faster, more accurate indemnity.

Along with improved, intelligent customer and adjuster experiences, the insurer can price competitively with reduced necessity for continued aggressive rate increases. As always, we will continue to analyze, track, and report on these developments as further information becomes available.

About CCC

CCC Intelligent Solutions Inc. (CCC), a subsidiary of CCC Intelligent Solutions Holdings Inc. (NYSE: CCCS), is a leading SaaS platform for the multi-trillion-dollar P&C insurance economy powering operations for insurers, repairers, automakers, part suppliers, lenders, and more. CCC cloud technology connects more than 35,000 businesses digitizing mission-critical workflows, commerce, and customer experiences. A trusted leader in AI, IoT, customer experience, network and workflow management, CCC delivers innovations that keep people’s lives moving forward when it matters most. Learn more about CCC at cccis.com.

Forward-Looking Statements

This press release contains forward-looking statements that are based on beliefs and assumptions and on information currently available. In some cases, you can identify forward-looking statements by the following words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. These statements involve risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Forward-looking statements in this press release include, but are not limited to, statements regarding future use and performance of CCC’s digital and AI solutions. Such differences may be material. We cannot assure you that the forward-looking statements in this press release will prove to be accurate. These forward looking statements are subject to a number of risks and uncertainties, including, among others, competition, including technological advances and new products marketed by competitors; changes to applicable laws and regulations and other risks and uncertainties, including those included under the header “Risk Factors” in the definitive proxy statement/prospectus filed by Dragoneer Growth Opportunities Corp. with the Securities and Exchange Commission (“SEC”) on July 6, 2021, which can be obtained, without charge, at the SEC’s website (www.sec.gov). The forward-looking statements in this press release represent our views as of the date of this press release. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this press release.

SOURCE: CCC Intelligent Solutions Inc.