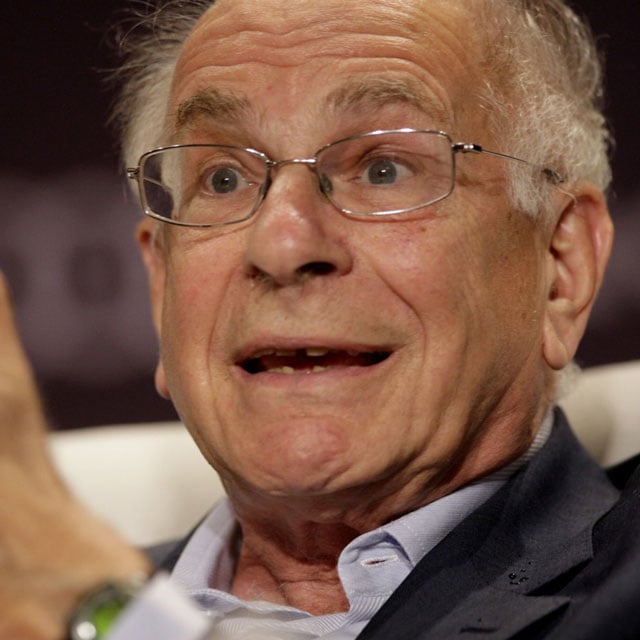

Behavioral Economics Pioneer Dies at 90

What You Need to Know

Psychologist Daniel Kahneman showed the logic behind puzzling behaviors, like why people refuse to sell stocks that have lost value.

He shared the 2002 Nobel Prize with Vernon Smith, another experimental economist.

In 2011, he published the bestselling

Daniel Kahneman, a psychologist whose work casting doubt on the rationality of decision-making helped spawn the field of behavioral economics and won him a Nobel Prize, has died. He was 90.

He died on Wednesday, the Washington Post reported, citing his stepdaughter, Deborah Treisman, the fiction editor for the New Yorker. No other details were available.

Kahneman upended assumptions about rationality that had dominated economics for decades.

He was able to show the logic behind a number of puzzling behaviors — why people refuse to sell stocks that have lost value, or why they will drive to a distant store to save money on a small item, but not to make the same saving on an expensive one.

Kahneman was “the world’s most influential living psychologist,” Harvard University professor Steven Pinker told the Guardian in 2014. “His work is really monumental in the history of thought.”

Working with psychologist Amos Tversky, Kahneman isolated biases that distort decision-making. These include aversion to loss and how the way a question is framed can affect the answer. For example, if a health program will save 200 lives and result in 400 deaths, whether it’s accepted may depend on whether its proponents highlight the lives saved or the lives lost.

Kahneman said that the brain reacts quickly and on the basis of incomplete information, often with unfortunate results. “People are designed to tell the best story possible,” he said in a 2012 interview with the American Psychological Association. “We don’t spend much time saying, ‘Well, there is much we don’t know.’ We make do with what we do know.”

Under the rubric “prospect theory,” Kahneman and Tversky sparked a revolution in psychology and then in economics, which had seldom been considered an experimental science.

The field of behavioral economics arose near the end of the 20th century as a group of young economists used their insights to challenge classical notions of “homo economicus,” the rational actor.

‘Cognitive Minefield’

In 2011, Kahneman published the bestselling “Thinking, Fast and Slow,” finding a wide audience for his ideas. The study presented a comprehensive view of the mind as containing two systems, one fast and intuitive, the other slow and more rational. It offered advice for making better decisions, starting with: “Recognize the signs that you are a cognitive minefield.”

Daniel Kahneman was born on March 5, 1934, in Tel Aviv, where his mother was visiting relatives. The family lived in France, having emigrating there from Lithuania. His father, a Jewish chemist, was arrested because of his religion during World War II, then released. After the war, the family moved to Palestine.