Barefoot Investor advises on how to save hundreds on health insurance – Daily Mail

Barefoot Investor reveals how you can save hundreds as health insurance rises 54 per cent in the past decade and are about to go up again

The cost of getting health insurance in Australia has long outstripped inflationHBF is raising its premiums on Friday, and the other suppliers will soon follow But there are ways to save, including thinking about the extras cover you pay

With HBF about to increase its premiums by 3.62 per cent – and other four major funds to follow – health insurance is rising for everyone.

Premiums have not just suddenly got expensive, they have long outpaced inflation and cost of living rises in Australia.

The consumer prices index rose 20 per cent in the past 10 years, but health insurers raised their premiums by 54 per cent in that time.

With all these cumulative price hikes, and more to come, Scott Pape, also known as the Barefoot Investor, has offered some timely advice on how people can save hundreds of dollars on their premiums.

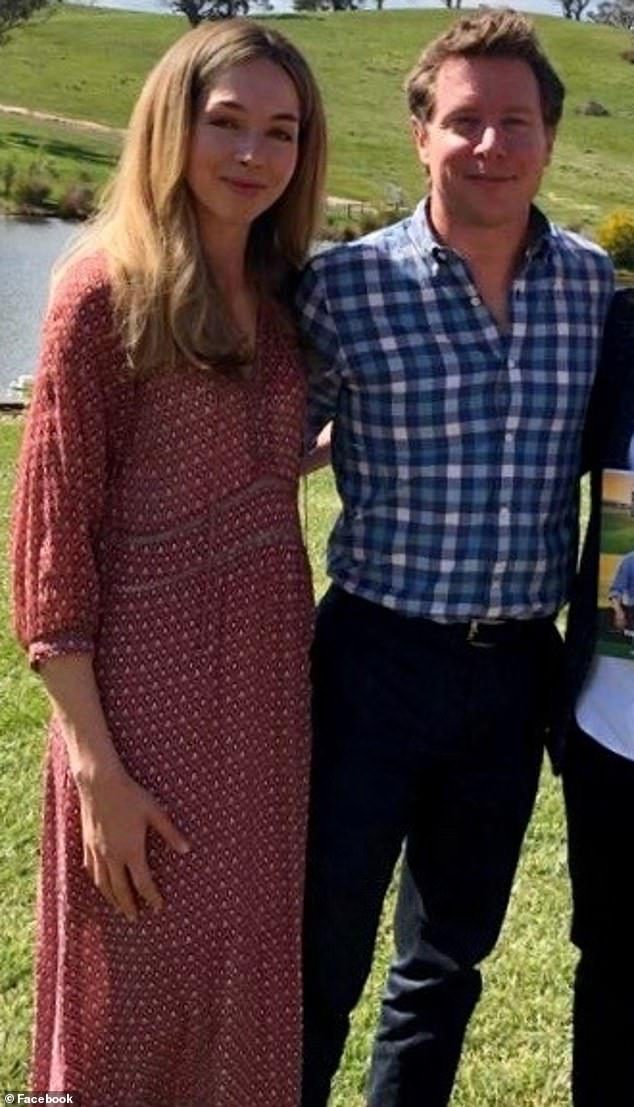

Scott Pape, also known as the Barefoot Investor, is pictured with his wife Liz. Pape has offered some advice on how to save on health insurance premiums

PRICE INCREASES BY MAJOR AUSTRALIAN HEALTH INSURERS

HBF – 3.62 per cent increase from April 1

NIB – 2.66 per cent increase from September 1

Medibank – 3.10 per cent increase from October 1

Bupa – 3.18 per cent increase from October 1

HCF – 2.72 per cent increase from November 1

Source: choice.com.au

Though HBF is raising its prices in days, the other members of the big five insurance providers – NIB, HCF, Medibank and BUPA – are holding off for at least five months, so there is still some time to plan ahead.

Pape’s first piece of advice is, ‘if you can afford it, most funds allow you to pre-pay your premium and lock in the old rate’.

So, for example, if you are with HBF, if you prepay by 31 March, you can lock in your current premium for up to 18 months.

That would amount to a hefty saving, but not many can afford to pay that much money upfront.

The Barefoot Investor also said people should consider if they really need health insurance.

‘If you’re under the age of 31, or you’re earning under $90,000 a year as an individual or $180,000 as a family, you may not need it,’ he said.

In his latest email to his followers, Pape explained what he does for his own family.

Firstly, he gets purchase top-level comprehensive private hospital insurance.

Secondly, he doesn’t get extras or combined healthcare cover: ‘Reason being, most extras policies cost you hundreds of bucks extra per year… whether you claim or not.

Health insurance premiums have risen by a massive 54 per cent in the last 10 years in Australia

‘Ring your fund and request an annual claim statement. Then ask, “If I switched to a comparable hospital-only policy, how much would I save each year?”‘

Thirdly, he I researches on privatehealth.gov.au, a government website which he said was ‘weirdly good’.

‘It allows you to compare your current policy against others. Most importantly, it compares every fund on offer – unlike those comparison sites which only list funds that pay kickbacks,’ he said.

‘This week it’s time to turn the tables on your fund… and show you how flexible they really are’.

Advertisement