AXA buys 25% more catastrophe reinsurance for 2024 at stable retentions

Global insurance and reinsurance giant AXA has significantly expanded its catastrophe reinsurance protection at the January 2024 renewal season, with much more limit purchased but all of its retentions kept stable year-on-year.

It’s a further example for how increased demand for reinsurance capacity is continuing to soak up any additional capital that flows into the market, with numerous large buyers having increased their limit purchases for 2024.

For 2024, AXA has purchased significantly more protection for its European exposures, where these have been rising fast, but has also increased its US wind and quake coverage as well, lifting the top of these reinsurance towers as well.

As we reported earlier today, fellow European re/insurance giant Zurich has also purchased more reinsurance protection for 2024, and lifted some of its towers.

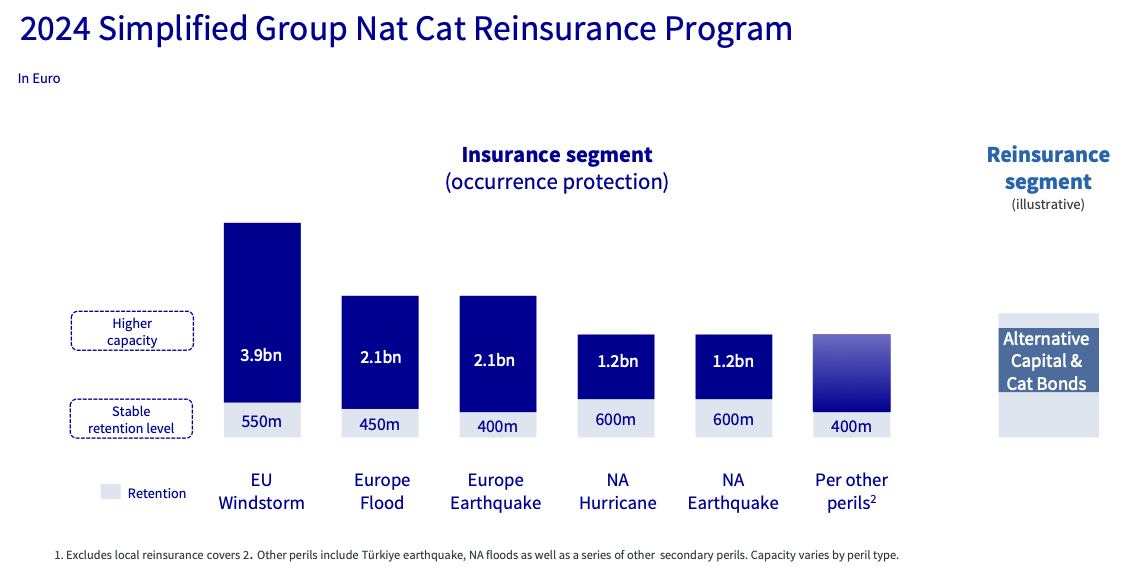

But, AXA has lifted the reinsurance limit purchased much more significantly this year, for example growing its European windstorm reinsurance by 40% to reach EUR 3.9 billion.

AXA’s European flood reinsurance tower has grown by 20% to reach EUR 2.1 billion, its European quake tower has grown 17% to EUR 2.1 billion, while its US hurricane and earthquake reinsurance towers are up by 20% each to EUR 1.2 billion.

All of this achieved with retentions flat, suggesting significantly more spend on reinsurance in 2024 to secure the much higher limits of protection.

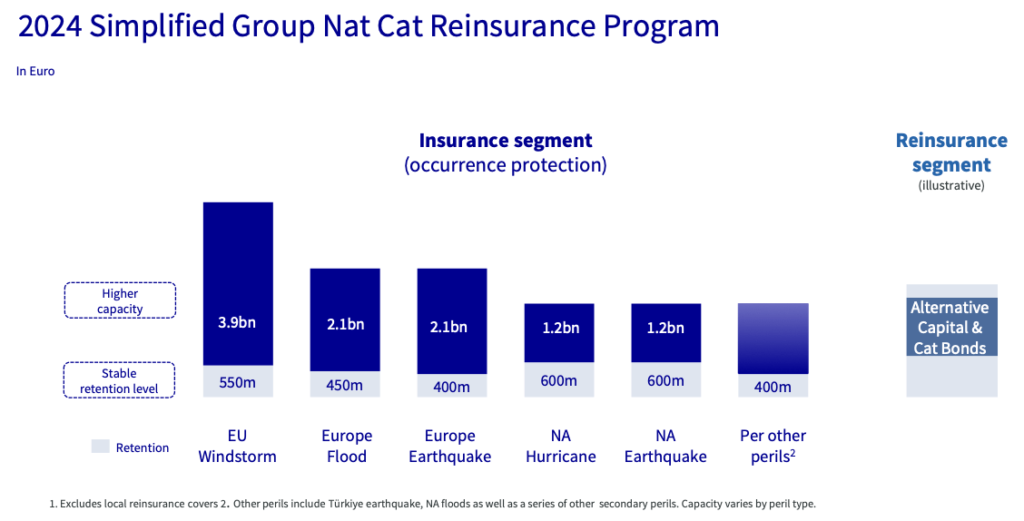

You can see AXA’s 2023 group catastrophe reinsurance program below, for comparison:

The renewed 2024 group catastrophe reinsurance program for AXA can be seen below, with the much higher limit purchased:

One of the drivers for the increased reinsurance buying for 2024 is AXA’s rising exposure levels, as the company has continued to expand its overall premiums written, even as it has pulled back on AXA XL Re’s cat exposure, as reported by our sister publication earlier today.

This growth has also driven an increase in AXA’s group average expected natural catastrophe charge budget, which has risen from last year’s EUR 2 billion to now be set at EUR 2.5 billion for 2024, net of reinsurance and pre-tax.

Within this higher nat cat budget for 2024, AXA has made an additional EUR 200 million allowance for losses from secondary perils.

Overall, AXA has purchased significantly more catastrophe reinsurance limit for 2024.

In fact, across all the towers AXA provides visibility of, the reinsurance purchase has risen from EUR 8.75 billion in 2023 to now EUR 10.9 billion for 2024, a roughly 25% increase.

As is typical, AXA does not provide visibility of its retrocession program, only saying it is largely from its alternative capital activities and catastrophe bonds.

Recall that AXA secured a new $375 million Galileo Re Ltd. (Series 2023-1) catastrophe bond back in December 2023, which had a US peril focus.

Given the re/insurers need for significantly more catastrophe reinsurance limit in Europe, it will be interesting to see whether the company has any appetite to tap the cat bond market for coverage there, in the coming years.