Auto insurance predictions for 2022

No doubt, the way people get around has evolved over the last couple of years. With the pandemic and other economic factors. Mobility trends continue to shift as we change the way we live, work, travel, work out and entertain ourselves.

With this constant change, it may seem hard to predict driving trends that can shape digital insurance-related products. But with Arity data, advanced analytics and decades of transportation expertise, auto insurance businesses can make data-based decisions that solve real problems for real people.

Based on more than 700 billion miles of historical driving data, most recently from more than 32 million active mobile telematics connections and more than a decade of data directly from cars, we’ve predicted three major trends to keep an eye out for as we head into 2022 and beyond.

Let’s take a closer look:

1. Car insurance rates will rise due to major shifts in risky driving behavior since the COVID-19 pandemic.

Many drivers will pay more in 2022 for auto insurance as carriers begin to increase rates to cover rising claims costs, which are the highest in 20 years. This increase is partially due to an increase in driving mileage and also due to the pandemic-era trend of riskier driving and the resulting severity of accidents.

Data shows that during the height of the pandemic, when drivers reached speeds higher than 80 mph, they sustained those speeds for considerably longer than they had before. Although these instances of sustained high speeds have come down in 2021, time spent at speed for these trips remains about 10% higher than pre-pandemic levels in 2019. Today, almost one out of every 20 miles is still driven at speeds over 80 MPH. And this is with more traffic on the roads!

Arity analysts report that the number of miles driven returned to expected levels by January 2021, and based on more current driving behavior trends, December 2021 will experience a more than 18% growth in miles driven compared to December 2019.

2. Driving scores will be used to price new auto insurance for individuals, similar to how credit scores are used today.

Even though most of the major carriers leverage telematics today, policyholder driving data is typically only used in the renewal of a policy. This is because carriers don’t have driving data at the quote stage for new business. Instead, these carriers provide all customers the same discount at enrollment, generally between 5% and 10%, regardless of their actual driving risk. It’s not until after the monitoring period, at renewal, that they can re-assess a new price or discount based on the telematics-based driving behavior they have gathered. With the pressures of increased driving risks and rising claim costs, carriers need to have better telematics insights at new business to more effectively matching price to risk.

A personal driving score at the time of quote for auto insurance eliminates this lengthy delay to collect driving insights on a customer. And, now that this driving data is available, we predict more insurance companies will move to price with this data to help manage their goal to grow profitably. This is especially critical during this time of risky driving behavior and rising loss costs.

However, consumer sentiment for more fair and transparent pricing of auto insurance is another major force for using driving data.

3. Increased use of driving data by insurance companies will allow for more equitable and transparent pricing for consumers.

More insurance carriers are looking to leverage driving data to price auto insurance coverage based on individual driving behaviors, going beyond traditional demographics, location, and credit score. There are two big reasons for this: consumer awareness of and demand for individuals, relevant pricing is rising and insurance state regulators are scrutinizing traditional rating variables, including credit.

Consumer demand for more fair and transparent auto insurance pricing is on the rise. In the first half of 2021, Arity conducted a consumer survey of nearly 2,000 U.S. adults on how they feel about auto insurance and found that the majority of consumers want their insurance pricing tied more closely to how they drive rather than who they are or what they look like.

When we asked which factors should be most important to the price of their insurance, people pointed to:

What is their previous driving records How many miles do they drive How safely do they currently drive

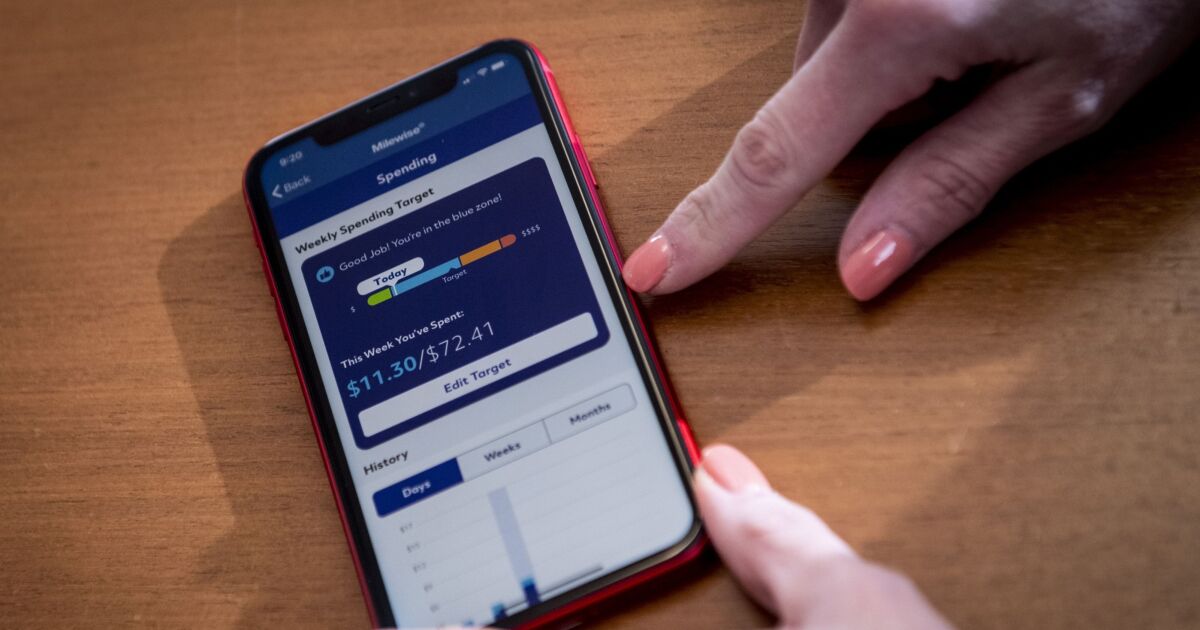

As a result, more and more carriers will offer telematics-based auto insurance (UBI, pay-per-mile) to attract new customers and keep the ones they have. And, with driving scores available at the time of quote, insurers will be able to provide auto premiums that are based on actual measures of risk, not proxies such as credit, income levels, or level of education. In 2022 and beyond, this will be a competitive imperative, especially as state DOIs re-evaluate the use of traditional rating factors.

How will auto insurance companies react to these three predictions?

As driving data and analytics are more available to insurers than ever before, even mid-sized and regional carriers will have the ability to leverage telematics to rate drivers. This will provide these insurance companies the ability to compete with the larger carriers who already have telematics programs in place.

But the advantage of telematics at new business will be enjoyed by those first-mover insurers – big or small – that capitalize on the availability of driving behavior data at the point of quote. This will better equip insurers to more effectively match price to risk and grow profitably, particularly during this period of increased risky driving behavior and rising claim costs. And, ultimately consumers will win too, with more equitable and transparent auto insurance pricing.