At $2.1bn, cat bonds will be TWIA’s biggest source of funding for 2024

For 2024, the funding tower of residual market insurer the Texas Windstorm Insurance Association (TWIA) will see catastrophe bonds as its largest component, providing 32% of the funding limit needed to meet the statutory 1-in-100 year probable maximum loss for the coming hurricane season.

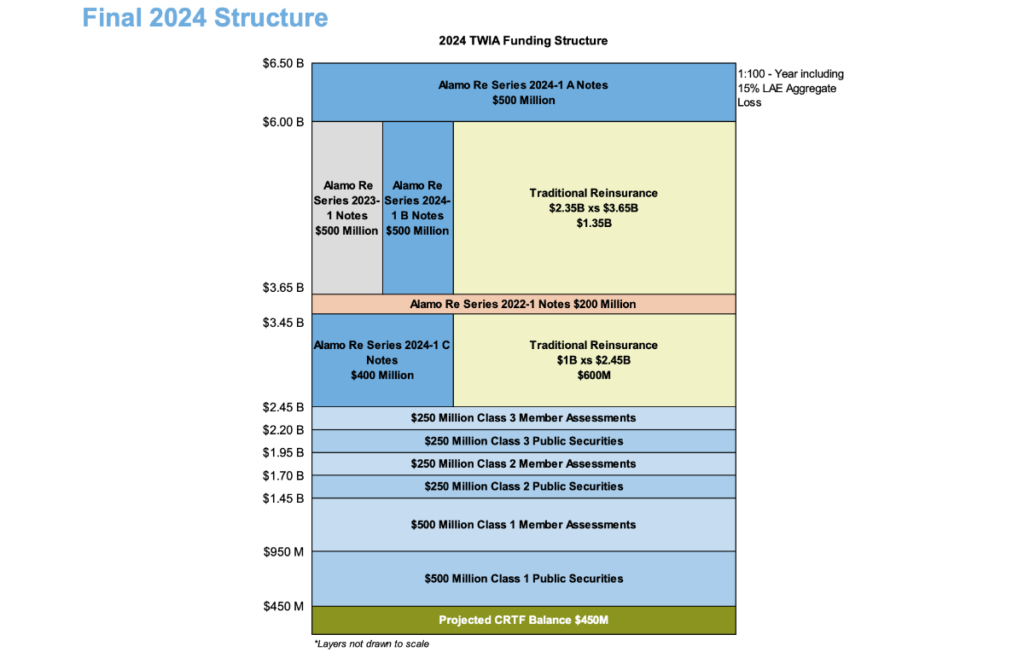

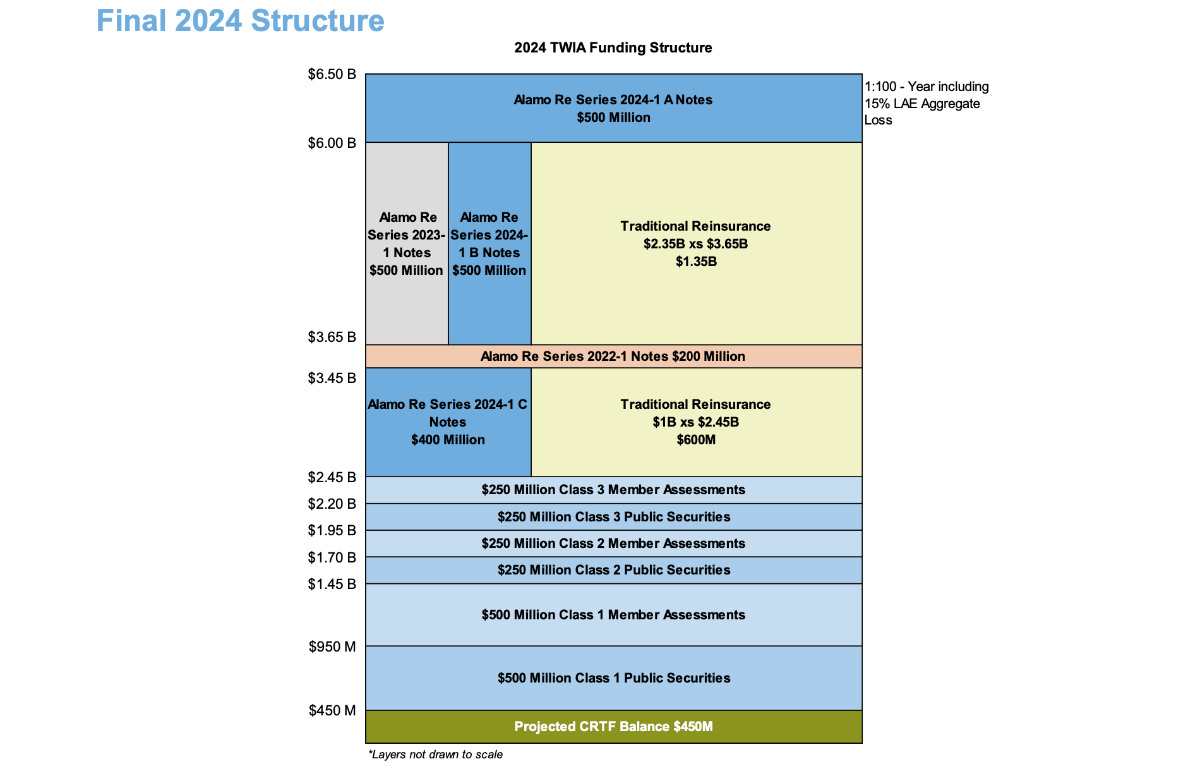

Recall that, back in February the Board of the Texas Windstorm Insurance Association (TWIA) approved a 1-in-100 year PML for 2024 funding purposes at a new high of $6.5 billion, meaning the insurer of last resort needs just over $4 billion in reinsurance limit for the 2024 wind season.

Already TWIA has been making rapid progress in securing that, helped enormously by the catastrophe bond market.

TWIA will have $700 million in catastrophe bond limit from prior year issues that rolls forwards to provide cover through the 2024 hurricane season.

These outstanding cat bonds have also been repositioned within TWIA’s funding tower for 2024, to make most efficient use of their coverage alongside newly placed cat bonds and reinsurance that will be bought.

The insurer added its largest cat bond yet to the funding tower, in the recently completed $1.4 billion Alamo Re Ltd. (Series 2024-1) catastrophe bond that we have been covering in recent weeks.

In addition to that $2.1 billion of cat bond protection, TWIA will be out in the traditional reinsurance market to secure $1.95 billion in cover as well, before June 1st.

It’s now come to light that TWIA had already placed $750 million of that traditional reinsurance limit before the end of April.

The expectation is that the rest of the needed limit will be secured well in advance of the end of May.

Once all the new reinsurance is secured, the $2.1 billion of catastrophe bonds will make up the largest component of TWIA’s funding for 2024, at 32% of the $6.5 billion.

After that, $2 billion of member assessments and public securities will contribute 31% of funding between them, then the $1.95 billion of traditional reinsurance (some of which could come from collateralized or fronted ILS market sources, we expect) will make up another 30% of funding, and lastly a 7% contribution from the CRTF (catastrophe reserve trust fund).

You can see TWIA’s funding and reinsurance tower for 2024 below, including the positioning of its catastrophe bonds and traditional reinsurance layers:

It’s testament to the appetite of the capital markets to support TWIA’s reinsurance needs that it is catastrophe bonds that now make up the largest share of its funding needs.

TWIA has been directly sponsoring catastrophe bonds since 2014 and now sits as one of the largest sponsors in our cat bond market sponsors leaderboard.

You can read about all of TWIA’s Alamo Re catastrophe bonds it has ever sponsored in the Artemis Deal Directory.