Assurant extends cat reinsurance at renewal despite higher retentions

US specialty insurance group Assurant has secured more catastrophe reinsurance protection for the year ahead at the mid-year renewal, with $1.28 billion of limit available for the United States, despite the fact its retentions have risen.

A year ago, Assurant’s US catastrophe reinsurance program provided it with $1.16 billion of reinsurance protection, above an $80 million first-event retention, with the tower extending to $1.34 billion.

That tower played a role for the insurer after hurricane Ian struck Florida last September, with Assurant making reinsurance recoveries as a result of its losses there.

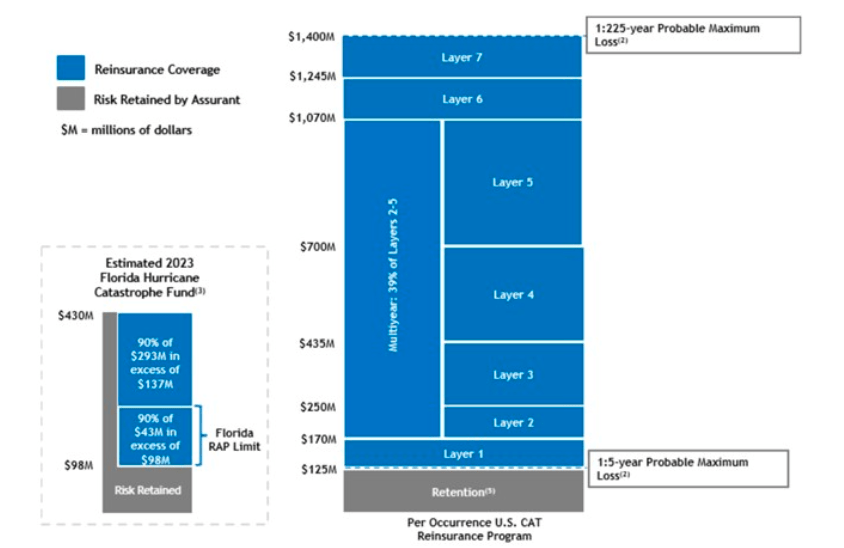

For 2023 into 2024, Assurant’s US catastrophe reinsurance tower extends to $1.4 billion at the top, with $1.28 billion of limit available to cover losses above a now $125 million first-event retention.

On a second and third-event basis, the retention is now set at $100 million for Assurant.

So, it’s clear more risk is being retained, as is typical of renewals for most carriers in 2023, but Assurant still has more catastrophe reinsurance limit available, so is well-protected against the major loss events this US tower is designed to cover.

Assurant’s nearly $1.3 billion in reinsurace coverage within its main US program was secured through signings with over 40 reinsurers, the company said.

Assurant said it also sought to mitigate higher reinsurance prices in a number of ways, including through the exit of international business, optimising its product structures and having some multiyear reinsurance coverage in place.

The tower addresses both frequency and severity, Assurant noted, protecting policyholders against severe weather and other natural hazard loss events.

Importantly, Assurants says the 2023 reinsurance tower covers it against a 1-in-225-year storm compared to a 1- in-174-year PML in 2022, a significant increase and helped by its own exposure reducing, it appears.

Combined with the Florida Hurricane Catastrophe Fund, Assurant’s US reinsurance tower now protects against gross Florida losses of up to approximately $1.58 billion, higher than the $1.34 billion of 2022.

This also included additional coverage in 2023 that Assurant has taken by opting to use the Reinsurance to Assist Policyholders (RAP) program.

Premiums for the 2023 reinsurance tower are estimated at $200 million, pre-tax, which is up on 2022’s $189 million pre-tax.